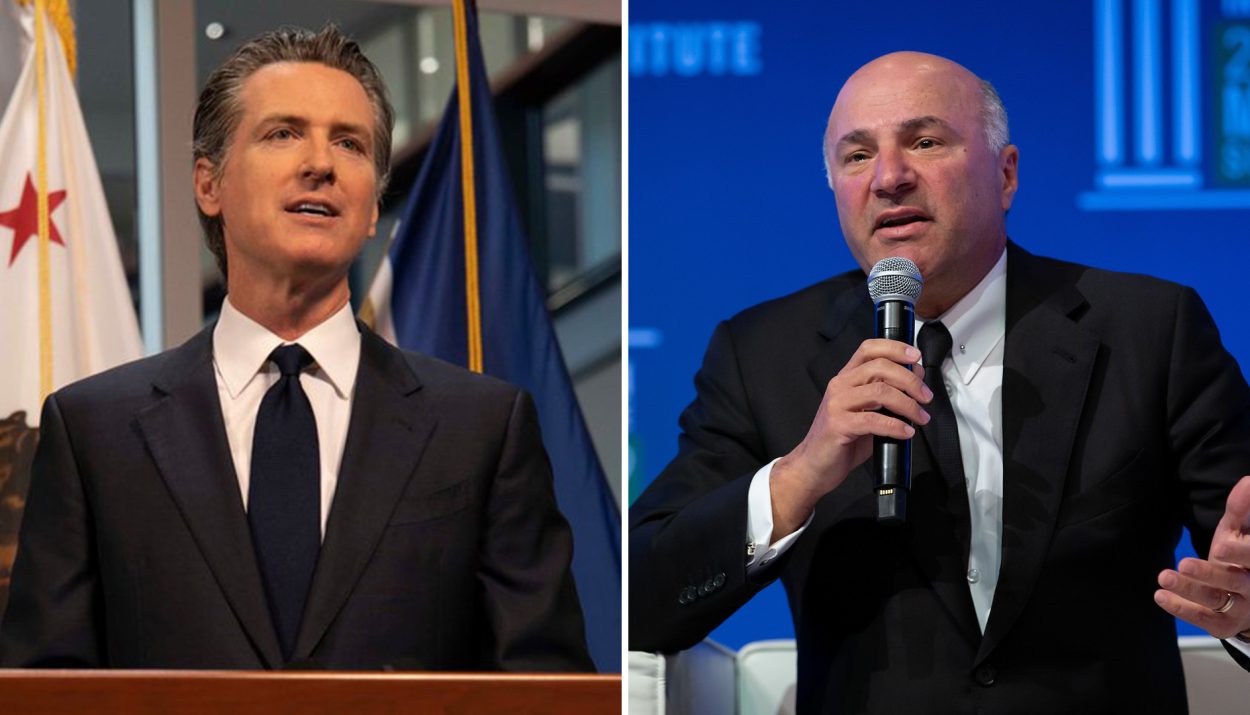

It’s not uncommon for governors to be hit with criticism from all sides. Running a state is a difficult job. There are tons of moving parts and nobody’s perfect. California Governor Gavin Newsom takes a lot of heat as the leader of the country’s most populous state. But is the criticism deserved? One Shark Tank investor thinks it is.

Who Is Gavin Newsome?

Gavin Newsom is the liberal and outspoken governor of California, the biggest state in the country by population. California has as many residents as the 21 least-populous states combined. It may be for that reason that Governor Newsome is often a target of harsh criticism, particularly from people in the highest tax brackets and prominent Republicans.

As of 2022, California had the fifth largest economy in the world, putting it ahead of most countries. Managing such a large economy is undeniably challenging. Newsome was elected governor in 2019 and is the state’s 40th governor. He’s known for his progressive policies and support of social programs to benefit the poor. He’s criticized as an enemy of business.

The Golden State and Climate Change

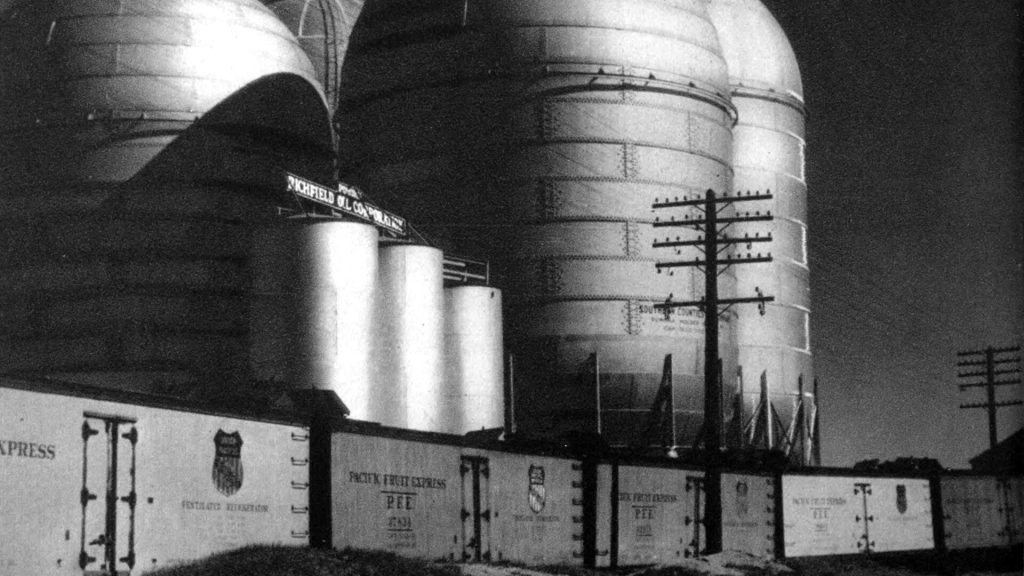

One area where Governor Newsome has faced particularly harsh criticism is related to California’s policies around climate change. The state has imposed restrictive regulations that have impacted the ability of energy companies to earn a profit there. Chevron is one of the companies that’s spoken out about the impact of California energy policies on their bottom line.

In a statement filed on January 2nd, Chevron revealed that the company has lost approximately $4 billion in profits due to the Golden State’s regulations. They went on to say that state regulations “have resulted in lower anticipated future investment levels.” Their statement and the financial hit taken by the company calls into question its future in the state.

Shark Tank’s Kevin O’Leary On Gavin Newsom

We all know Kevin O’Leary as Shark Tank’s Mr. Wonderful. His direct approach with the entrepreneurs on the show has made him a fan favorite. Estimates are that he has a personal net worth of close to $500 million. It’s not uncommon for wealthy people to criticize financial policies that they believe are bad for business, including energy regulations.

In a recent interview on Fox Business, O’Leary had harsh words for Gavin Newsome. “Wake up and smell the hydrocarbons,” he said. He went on to criticize California’s “uncompetitive” energy policies and referred to California’s management under Governor Newsom as “the worst of every state in the union.” Those words aren’t what Newsom wants to hear.

Clueless To The Competition

There’s no denying that O’Leary came out aggressively against California’s energy policies. He went on to say that Newsom is “clueless to the competition” in the energy market between states. The implication is that energy companies may be inclined to leave California in the rear view mirror as they depart in search of a more favorable business climate.

O’Leary said that California is “a very bad place to do business” for both energy companies and their investors. He’s not the first to criticize California’s business policies, which also feature higher-than-average expenses to start a business. In fact, California’s business tax rate is the third-worst in the nation according to the Tax Foundation, a non-profit that analyzes taxes.

Unfit To Manage A Candy Store?

Kevin O’Leary has said that he liked Gavin Newsom when he met him in person. However, he refused to let his initial impression get in the way of what he feels is justified criticism in Newsom’s handling of energy companies and their investment in the state. He said of Newsom that he “wouldn’t let him manage a candy store.”

Given the size of California’s economy, that has to be tough criticism for Newsom to take. The choice of a candy store is one that feels demeaning and dismissive of Newsom’s executive abilities. The perception of him as a bad executive is one that’s likely to hurt him if he decides to run for President in 2028, which seems likely.

Newsom And Big Oil

At the end of 2022, Newsom stepped out to announce California’s new climate action plan. Its goal, he said, was to slash greenhouse gas emissions by 85% and reduce gas consumption in the state by 94% by 2045. That’s undeniably an ambitious plan given how much Californians love their cars-and how limited public transportation is in some areas of the state.

Newsom said that Big Oil companies had made $200 billion in profits in 2022. He accused these companies of “fleecing Californians at the pump” and “lying” about climate change. A bill in front of the state legislature proposes capping oil profits to protect taxpayers. In September, Newsom said he was “sick and tired” of Big Oil playing Americans “for fools.”

Big Oil Lawsuit

In the same week that Governor Newsom said he was “sick and tired” of the oil companies’ lies about climate change, his state filed a civil lawsuit against five of the biggest energy companies in the country. The lawsuit accuses them of misleading the public and downplaying the role of fossil fuels in the ongoing climate change crisis.

The five companies named in the lawsuit are BP, Chevron, ConocoPhillips, Exxon Mobil, and Shell. It’s a sure thing that these giant corporations won’t take California’s lawsuit lying down. They’re likely to fight back. Chevron’s CEO told Bloomberg, “Climate change is a global issue. It calls for a coordinated global policy response, not piecemeal litigation that benefits attorneys and politicians.”

Will Energy Companies Still Invest in California?

The biggest question in light of O’Leary’s remarks is whether California’s treatment of Big Oil companies will impact their willingness to invest in the state. The answer seems to be yes. Andy Walz, the president of Chevron’s Americas Products business, wrote that “California’s policies have made it a difficult place to invest so we have rejected capital projects in the state.”

It seems clear that where Chevron leads, other fuel and energy companies will follow. The combination of strict regulations and high business taxes make the Golden State increasingly unattractive for businesses. How long will it be before California becomes something like an energy desert, leaving Big Oil profits and revenue to states with more favorable business environments?

Where O’Leary Is Putting His Money Instead

There’s no shortage of states where investors like O’Leary and companies like Chevron can invest their money. O’Leary was just as vocal about the states that he sees as having the most favorable business environments. He singled out North Dakota, Oklahoma, Texas, and Virginia as four states that he said were competing for his money.

He said that these states have more relaxed regulatory environments that boost energy security and give energy companies the opportunity to employ more people. He went on to say, “Who would give a dime to California to invest in energy when the regulatory environment is so punitive you can’t make money? That’s what Chevron’s telling everybody.”

What Comes Next For California?

It’s unlikely that Newsom will change his policies in response to O’Leary’s criticisms. He’s considered one of the most liberal governors in the country. California is one of the most liberal states. Many of the state’s residents worry about climate change and support restrictive policies about carbon emissions and other issues that may impact the planet.

California is the state with the most registered electric vehicles. The next closest state is Florida. The numbers indicate that there’s a willingness on the part of Californians to support strict regulations if they’ll lower temperatures, reduce the risk of wildfires, and slow climate change. California still has plenty of tax revenue from businesses, including the film and tech industries.

What’s The Latest on Climate Change?

The issue of climate change is hotly debated despite there being near-unanimous agreement in the scientific community about its dangers. As of 2024, there are predictions that Earth will have a temperature that’s, on average, 1.5C above pre-industrial levels. The countries that signed the Paris Agreement acknowledged that allowing the average to rise more would indicate a catastrophic event.

Other warning signs include a huge reduction in the volume of sea ice. Most experts say that sea water temperature is the key to tracking overall global warming, since the ocean stores heat. Melting ice could be a harbinger of dangers to come.

Will California Become A Business Desert?

Perhaps the biggest question raised by O’Leary’s and Chevron’s comments is what impact they will have on the Golden State over time. Will California continue to prosper? Or will departing businesses have a catastrophic impact on the state’s economy and residents?

California’s economic future is still in question. It may be that other industries, including tech, will pick up the slack if Big Oil companies move out of state, taking their revenues with them. Or, it may be that California will become a business desert and Gavin Newsom may wish he was managing a candy store instead of a state.