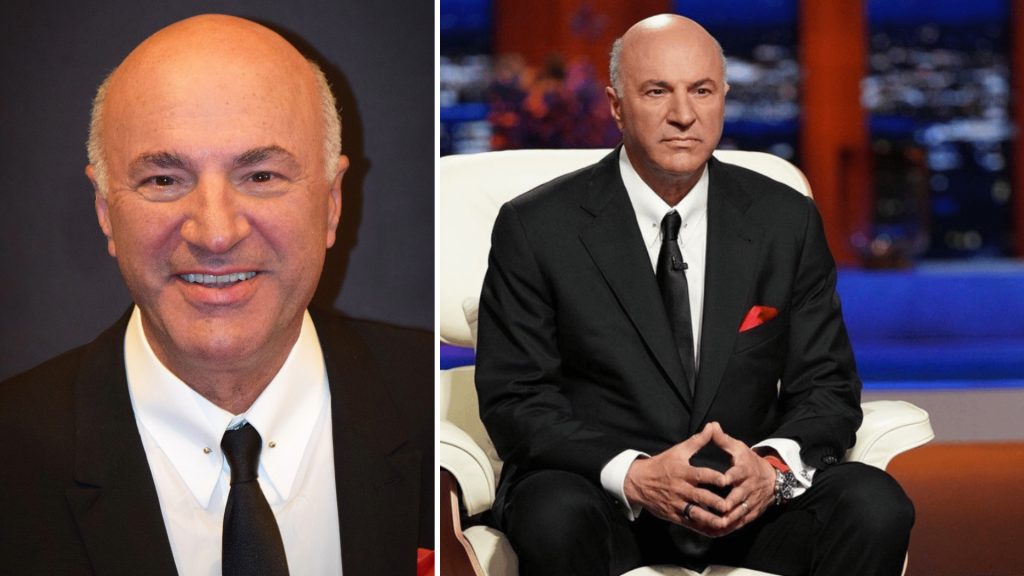

“Shark Tank” star Kevin O’Leary slams Canada for its mismanagement of their natural resources. Though controversial, his comments highlight valuable Canadian industries. Here are 3 top natural resource stocks poised to profit from a potential comeback.

O’Leary: Canada Has Everything The World Wants But It’s “Poorly Managed“

Kevin O’Leary is a prominent Canadian businessman with deep roots across the country. However, he openly criticizes Canada’s management despite its vast natural bounty, stating: “It’s a very, very wealthy country, but it’s poorly managed.” His comments in a popular YouTube video have drawn over 1.3 million views.

While controversial, O’Leary’s sentiments about mismanagement may resonate with many Canadians. A recent poll found 63% are dissatisfied with PM Justin Trudeau’s leadership. Canada also ranks just 23rd on the World Bank’s Ease of Doing Business index.

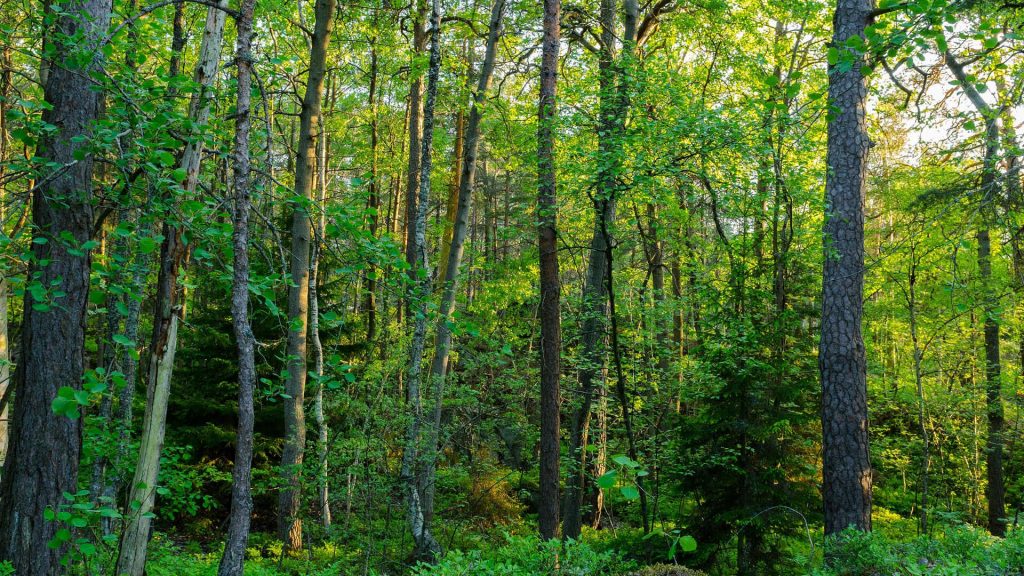

Canada’s Natural Riches: Forests, Oil Sands, Minerals, More

Regardless of political views, Canada possesses prodigiously abundant natural resources interwoven through its vast landscapes, from the endless evergreen forests of British Columbia to Alberta’s massive oil sands reserves to mineral troves yet untapped. These resources comprise a major segment of Canada’s benchmark stock index.

But some investors feel discontent: While Canada’s S and P/TSX main index gained a modest 37% over the past 5 years, the US S and P 500 index zoomed 82% higher in the same period as Canada missed out significantly. Still, natural resources should thrive amid inflationary times, presenting lucrative chances to profit.

Canadian Natural Resources: Oil and Gas Giant Focused on Efficient Operations

Canadian Natural Resources (CNQ) is a leading Canadian oil and gas behemoth known for running highly cost-effective operations, especially in oil sand mining. This has provided resilience amid volatile commodity prices. Efficiency focus helps counterbalance Canada’s regulatory burdens.

In Q3, CNQ achieved an all-time high quarterly production of 1.39 million BOE/day. It also raised its dividend by 11%, now offering a 4.5% yield for shareholders. Given strong operations and dividends, analysts see a 46% upside potential for the stock as oil and gas enjoy tailwinds.

West Fraser Timber: Major Lumber Supplier Expanding Despite Market Dips

West Fraser Timber (WFG) runs an empire of lumber mills, pulp plants, and other wood product facilities across North America. Lumber is among the most widely utilized building materials globally. Despite tough recent markets, WFG continues expanding through acquisitions to gain market share.

WFG generated strong Q3 sales of $1.7 billion. Its new CEO Sean McLaren aims to continue growth amid analyst expectations of a 28% upside, eyeing factors like a potential housing market rebound. The stock pays a dividend of over 1% too.

Barrick Gold: Betting on the Safe Haven of Gold Amid Market Turmoil

Toronto-based Barrick Gold operates gold mines globally, making it one of the largest gold miners worldwide. As a scarce and lustrous metal, gold often functions as a stable asset and inflation hedge, maintaining purchasing power over long periods due to inherent scarcity. While gold prices have dipped slightly year-to-date, the precious metal tends to shine during economic uncertainty.

Though facing production declines, analysts remain bullish on Barrick over the long run with a 40% upside seen from current levels. Barrick offers geographic diversification and pays a small dividend.

Canadian Stocks Outpaced By US – But Natural Resource Sectors Could Lead Turnaround

While top Canadian large-cap stocks have generally lagged the raging US stock market bull run over the past decade, Canadian natural resource companies seem poised to help catalyze a reversal. If global economic turbulence like inflation persists amid geopolitical tensions, demand typically rises for commodities-from oil and gas to lumber to precious metals. They become more precious in times of instability.

Stocks like CNQ, WFG, and GOLD could lead the way as investors bet more heavily on Canadian natural resource exports. All 3 trade on both Canadian and US big board exchanges, granting investors scalable and diversified exposure to underlying physical commodities. Upside forecasts show Wall Street betting on further gains.

O’Leary Still Bleeds Maple Syrup As a Patriotic Canadian

Though O’Leary appears deeply frustrated with Canada’s governance and economy, his passion reveals a profound patriotism for his native land. With citizenship conferred in multiple countries, he hasn’t abandoned his Canadian roots.

Back in 2017 O’Leary vigorously pursued running for Canadian PM under the Conservative Party banner against Justin Trudeau before ultimately dropping out of the leadership race. Clearly, despite barbed remarks, part of him still bleeds maple syrup at heart.

Canada Boasts Abundant Natural Resources – But Faces Challenges

Canada’s sprawling boreal forests, towering mountain ranges, pristine waterways, and rich oil reserves mean it boasts an embarrassment of natural resource riches. However, governance issues, excessive bureaucratic red tape, and market access problems have hampered the country from reaching its full economic potential.

With better policy making to reduce barriers, Canada could potentially catapult itself much higher in international economic competitiveness rankings – offering more profit opportunities for companies and shareholders alike while boosting standards of living.

3 Stock Picks to Hedge Bets on Canadian Comeback

For investors seeking upside exposure to Canadian natural resource companies along with a chance to profit from a potential Canadian streamlining and comeback, stocks like CNQ, WFG, and GOLD present 3 compelling picks. Savvy analysts are betting on substantial further gains.

Upside forecasts of 28-46% show Wall Street betting these Canadian commodity giants could rally strongly if Canada cuts red tape to simplify business operations. Their global presence also helps mitigate risk.

Canada’s Wealth Is Still Undeniable – Controversy Aside

The data doesn’t lie – Canada ranks among the wealthiest countries globally in terms of natural resources, landscape value, education levels, quality of life measurements, and more. Future governance decisions will determine if it reaches its full potential.

But for investors, ample opportunities remain today across resource stocks like CNQ, WFG, and GOLD as Canada continues working towards maximizing its rich blessings.