John Anthony Castro, who was recently charged with 33 counts of falsifying tax returns for dozens of clients, is accusing Supreme Court Justice Clarence Thomas of doing the same with a 2005 income tax return. Yes, I know it’s ironic, but you know what they say – it takes one to know one.

Who Is John Anthony Castro?

John Anthony Castro is a 40-year-old tax preparer who regularly runs for political office, but never comes close to winning. He has run as both a Democrat and Republican – though he currently identifies as the latter – and has regularly collided with Donald Trump and his adversaries.

He was always a heavy supporter of the George Bush Administration and even went as far as saying he wants to ‘return to the compassionate conservatism of the Bush era – he said that in 2021, the same year he called Trump a ‘false prophet.’ Now, he’s launching an attack against Justice Thomas.

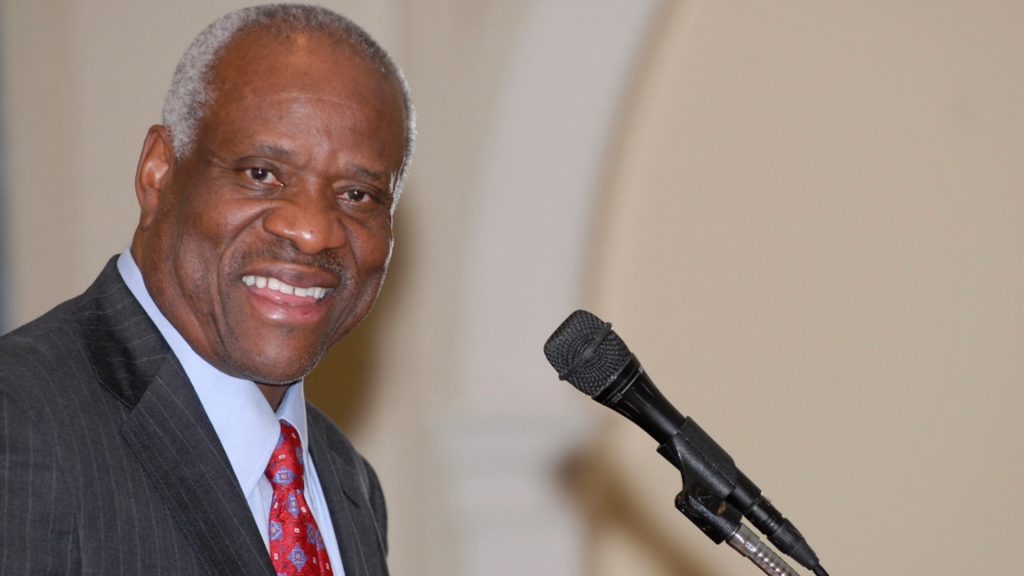

Castro Accuses Clarence Thomas Of A False Claim

On Feb. 2, Castro filed a lawsuit against Thomas in a Virginia court. The complaint wasn’t filed right away – he mailed it on a Friday, so it took a few days – but it has since been processed and filed. In the case, Thomas is being accused of violating the Virginia Fraud Against Taxpayers Act (VFATA).

“Clarence Thomas knowingly presented or caused to be presented a false and fraudulent claim (i.e., his 2005 Virginia State Income Tax Return) to the Virginia Department of Taxation on or about April 15, 2016, that failed to report income from discharge of indebtedness,” the complaint reads, according to Newsweek.

What Is The VFATA?

The VFATA was enacted in 2003 and was designed to mimic the federal federal False Claims Act (FCA) – which protects (and even rewards) whistleblowers. The primary difference between the VFATA and FCA is that the VFATA is a state law (in Virginia), while the FCA is a federal law.

For example, the VFATA provides protection for those who report activities of fraud against the state government – including tax returns. Those who violate the VFATA are liable to triple the damages, as well as other penalties, legal fees, and costs – and that’s true for each false claim.

Senate Finance Committee Questions Thomas’s Tax Compliance

In October 2023, a Senate Finance Committee released a shocking report regarding a $267,000 loan Justice Thomas received from a wealthy friend more than two decades ago. The loan was supposedly for an RV, and Thomas was to pay interest for the first five years – at which point the loan was due.

The problem? Thomas paid interest, but never paid off the rest of the loan. The Committee found that the loan was ‘forgiven,’ but Thomas never listed it on his tax return – which is required by law (a forgiven loan is considered income, which means it’s taxable).

Committee Demands Answers From Thomas

On Feb. 1, one day before Castro mailed his complaint, the Committee published a statement on the loan dilemma. They detailed their findings from the investigation, but were disappointed at the lack of cooperation they received from Justice Thomas and his legal team.

“Justice Thomas never reported a quarter-million in forgiven debt on his Financial Disclosure Report in 2008, the year his debt was forgiven,” the statement read. “Justice Thomas and his lawyers could put this whole affair to rest by providing copies of checks repaying this quarter-million-dollar loan. My guess is they can’t, because those payments never happened.”

Castro Alludes To Tax Code Section 108

In his complaint, John Anthony Castro alluded to Section 108 of the International Revenue Code. That section states that Thomas had a ‘legal obligation’ to report his $267,000 loan as taxable income. This is true in any instance ‘where debt is canceled, forgiven, or discharged for less than the amount owed.’

According to Castro, the tax on the loan would’ve been worth around $40,000 and $50,000 – which he noted was more than a third of Thomas’s annual salary. “And that’s when I was like, ‘There’s no way he reported that because that’d be financially disastrous for him.'”

Donald Trump Tries To Get In Castro’s Way

Castro’s lawsuit against Justice Thomas was originally supposed to be filed last year, but he ran into some personal issues – brought on by former President Donald Trump – that delayed his intentions. Those ‘personal issues’ resulted in Castro being charged with 33 counts of falsifying tax refunds.

According to Castro, the charges against him were nothing more than Trump collaborating with the IRS as a form of retaliation. “Right when I’m going to level these accusations against Clarence Thomas for filing false and fraudulent returns, what happens to me? I get accused of false and fraudulent returns,” he said.

Castro Says Legal Principles Are More Important Than Party Loyalty

Castro claims that Trump and his allies ‘devised this plan’ of accusing him of the same thing he was preparing to accuse Thomas of. Trump’s goal? To discredit Castro and damage his reputation – to the point that, even if Castro did submit a claim, no one would believe him.

Despite the negative press he was getting, Castro decided to send the complaint because he felt obligated to. “I’m a very, very stubbornly principled person and if I feel that somebody broke the law, I’m going to hold them accountable. Just like Trump for January 6 and Clarence Thomas for this sham loan,” he said.

Is Castro In The 2024 Presidential Race?

In 2022, John Anthony Castro announced his plan to run for President of the United States in the 2024 general election – though he would have to get through the Republican Primary first. Of course, that means defeating Donald Trump and Nikki Haley – which seems near impossible.

“I could spend the rest of my life building a business empire and even becoming a billionaire if I really set my mind to it, but that’s not who I am. I’ve proven I can do it. But that’s just not who I am. This is who I am. I was born to help people. I was born to serve my country. I was born to lead my country that I love so dearly,” he wrote on his official campaign website.