The Strategic Petroleum Reserve is running empty, and your wallet feels pain. The Biden administration slammed the brakes on plans to restock America’s emergency oil supply, citing high crude prices.

This means the country’s oil ‘piggy bank’ will stay light just as tensions flare in the Middle East – and your gas and grocery bills will likely remain sky-high. Critics say the move leaves the U.S. vulnerable in a crisis and fails to deliver relief to struggling consumers.

Biden Administration Cancels Plans to Refill Strategic Petroleum Reserve

The Biden administration recently announced they were canceling plans to replenish America’s Strategic Petroleum Reserve (SPR) amid skyrocketing oil prices.

The Department of Energy (DOE) had planned to purchase 3 million barrels of oil for the SPR in August and September but decided to scrap those plans, citing the need to protect taxpayers.

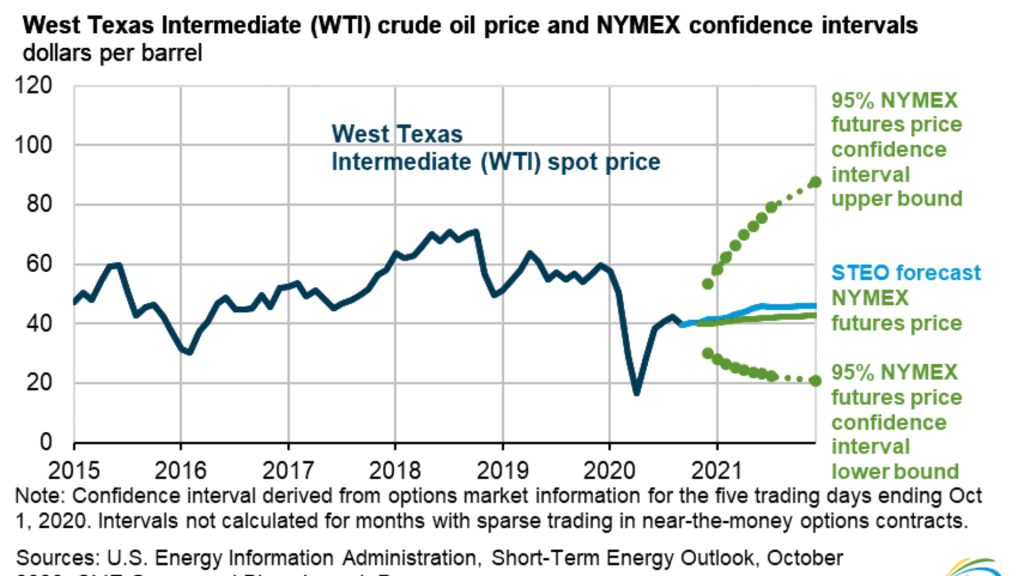

Surging Oil Prices Force Government’s Hand

Refilling the SPR would cost the government significantly more at those elevated prices than the $79 per barrel price tag officials had aimed for.

Rather than overpay, the DOE chose to pause refill efforts until the market stabilizes at a lower cost.

SPR at Lowest Level in Decades

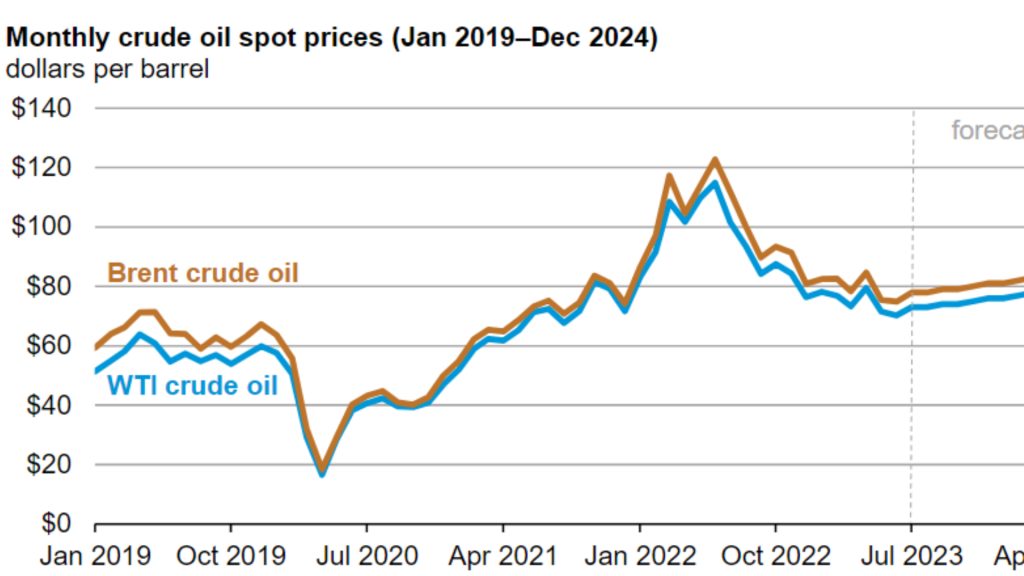

The Biden administration withdrew a record 180 million barrels earlier this year to help counter supply issues caused by Russia’s invasion of Ukraine.

While officials had planned to replenish the SPR by the end of the year, that may not be possible if oil prices remain high.

Impacts on Gas Prices and National Security

Halting refill efforts could mean higher gas prices for Americans if global supply falls or another crisis emerges.

Critics argue the depleted reserves put national security at risk and that the administration’s policies have hampered domestic oil production, contributing to higher costs across the board.

What Is the Strategic Petroleum Reserve and Why Was It Created?

The Strategic Petroleum Reserve (SPR) is an emergency stockpile of crude oil maintained by the U.S. Department of Energy. It was established in 1975 after oil supply disruptions caused by the 1973 oil crisis.

The SPR allows the U.S. to counteract future supply disruptions for reasons such as natural disasters, pipeline or refinery outages, or geopolitical events.

A Buffer Against Oil Scarcity

The SPR is stored in underground salt caverns at four major storage sites in Texas and Louisiana, holding millions of barrels of crude oil ready for use during supply emergencies.

It acts as a buffer against oil scarcity and allows the U.S. to maintain a steady supply of crude oil even when usual oil supplies are disrupted.

National Security Asset

The SPR is considered a national security asset, providing an insurance policy against potential oil supply shortages that could negatively impact the U.S. economy.

By releasing oil from the SPR, the government can offset temporary supply disruptions and stabilize oil markets.

A Release Valve During Oil Crises

The SPR has been used during several oil supply crises, including Operation Desert Storm in 1991, Hurricane Katrina in 2005, and the Libyan supply disruption in 2011.

Most recently, the Biden administration released a record 180 million barrels from the SPR in 2022 to counter supply issues created by Russia’s invasion of Ukraine.

Why Did the Biden Administration Withdraw From the Reserve in 2022?

The Biden administration withdrew a record amount of oil from the SPR in 2022 to help counter skyrocketing oil prices that hurt Americans at the pump.

When Russia invaded Ukraine, it caused global oil supply issues, and prices spiked. Releasing oil from America’s piggy bank helped keep costs down for a while.

Replenishing the Supply Hindered By Prices

The DOE announced plans in March to buy back 3 million barrels to start refilling the SPR. However, oil prices have continued climbing since then, currently sitting around $85 per barrel.

At those prices, refilling the SPR would cost taxpayers significantly more than the $79 per barrel the DOE said was its target. The administration decided it was not in the best interest of Americans to refill at such high prices.

Criticism Over Depleted Reserves

Some critics argue that the now nearly depleted SPR leaves the U.S. vulnerable in times of crisis. The reserves were meant to provide a cushion in case of disaster, war or other events that threaten the oil supply.

With only 363 million barrels remaining, about 40% less than at the start of 2022, the U.S. has less of a buffer. The reduced reserves could be problematic if prices remain high or supply falls dramatically.

What Was the Plan to Refill the Reserve This Year?

The Department of Energy had planned to refill the Strategic Petroleum Reserve throughout 2022 after heavy withdrawals last year reduced stockpiles to historic lows.

In March, the DOE announced it would purchase 3 million barrels of crude oil to store at the Bayou Choctaw site in Louisiana, one of four locations for the SPR.

What Could This Mean for Oil and Gas Prices Moving Forward?

Without a robust strategic reserve, the country is more exposed to potential price shocks from hurricanes, wars or OPEC supply cuts.

If a disruption reduces supply, oil companies and gas stations may raise prices to account for the limited availability and protect their profit margins.

What Are the Concerns Around Depleted Reserves During a Crisis?

Some experts worry that the country has become more vulnerable as a result. The SPR was designed to provide a safety net in times of crisis, but its stores are now at their lowest levels in decades.

If a natural disaster, conflict, or other unforeseen event severely constrained oil production or shipping channels, the U.S. could face major fuel shortages and price spikes without robust emergency reserves to draw from.