The housing market is as intertwined with politics as the stock market is. The rising cost of both home ownership and rent, as well as high interest rates on mortgages make the idea of home ownership out of reach for thousands of Americans. The Biden administration has proposed a bill that would theoretically make home ownership more achievable for many Americans, but the concept is not without its problems.

What is the NHIA?

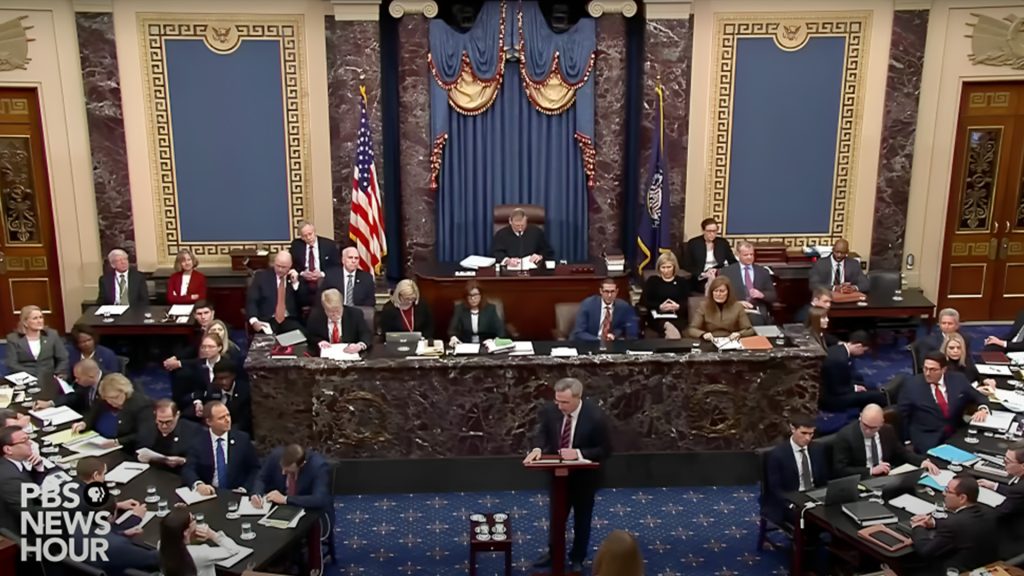

The Neighborhood Homes Investment Act is a bipartisan piece of legislation that was introduced in the senate in 2023 by Senators Ben Cardin (D-MD) and Todd Young (R-IN). This is not the first time that the measure has been introduced; a similar bill was introduced in Congress both in 2021 and 2022, and failed to make it for a vote both times.

The substance of the bill seeks to make housing more affordable by providing tax credits to developers in order to incentivize them to build or rehabilitate 500,000 homes for moderate and middle-income homeowners over the next 10 years.

Flawed at the Start of It

Immediately, we can see an issue in the intent of the bill. The NHIA seeks to make housing more affordable by providing tax credits to developers, who claim that they cannot sell homes for the amount it costs to build them in these lower income areas. This difference in the cost of building versus the profit of selling them is called the value gap.

While the intent of closing the value gap with the funding of the NHIA is admirable, the clear flaw remains: with the rising cost of materials and inflation, the value gap between the cost to build a home and the value it can be sold for is only going to increase.

Where Does the Money Come From?

The funding for the NHIA seeks more than $26 billion for building homes and a program to provide down-payment assistance for young borrowers. With the rising costs of housing, the funding would be gone long before 10 years is up.

There’s also the question of where the money to fund this initiative would come from. The answer, like for everything else, resides in taxes and the national deficit. Subsidizing the higher cost of housing means nothing if ordinary citizens have to take a hit on their tax bill at the end of every year in order to pay for it.

This Bill Likely Won’t Become Law

The bill hasn’t passed either chamber of Congress, and likely for good reason. There are many other issues that could be addressed that would affect the affordability of housing, and none of them have to do with taxing citizens in order to line developer’s pockets.

More importantly, the cost of housing is far too high to be trying to subsidize the cost. There are other steps that could be taken to make housing more affordable using federal legislation. One such bill would disallow hedge funds from owning single-family homes and require companies to sell off their stock, injecting the housing market with a much-needed swath of inventory.

A Predictable Divide

The backlash to the announcement of this bill has been swift, and predictably falls along both generational and party lines. Younger citizens think that any measure to reduce the cost of housing is a good thing, without thinking about the bigger implications of a bill like this one.

Wiser individuals, though, immediately see the flaws in this proposed legislation. Many people are more concerned with being able to afford gas and groceries than they are about building thousands of homes over the next ten years, and are even less interested in having more of their already inadequate paychecks taken in order to fund it.

More Legislation in the Works

Other legislations have been proposed that could address the affordability of housing, though many of them face the same issues as the NHIA. Some bills seek to fund programs that would provide down payment assistance for low income borrowers, and others would provide a refundable tax credit to first-time borrowers.

As noble as many of these initiatives are, none of them truly address the root issue, which is the affordability of housing. Other measures including rent ceilings and raising the minimum wage would go farther to increase the affordability of housing, but the primary intent of a housing bill has to be the citizens it’s meant to help, not the developers making money off the backs of said citizens.

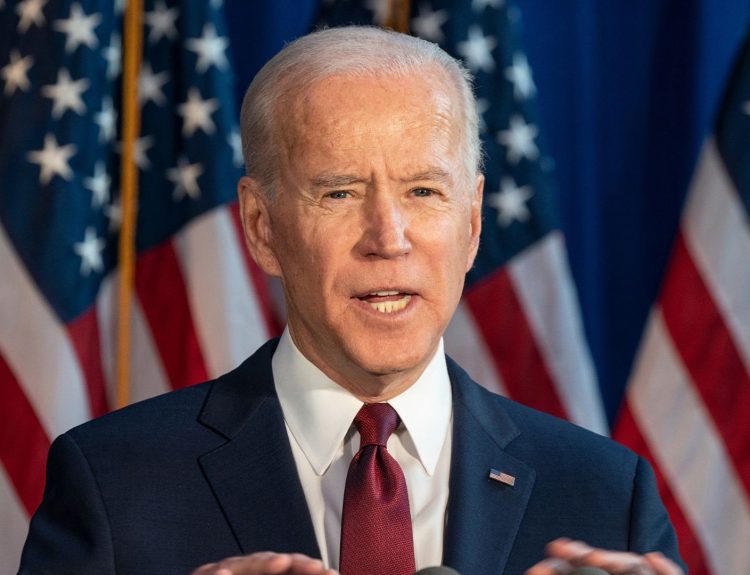

Biden’s Stance is Clear

While Biden hasn’t directly addressed the NHIA in any formal speech or comments, the administration’s stance on housing is clear. The White House website has several pages addressing the administration’s stance, where they state that Biden’s intent is to make housing more affordable by incentivizing building, rather than actually addressing the high cost of housing.

Again, while this is an admirable stance, it misses the crux of the problem and places a higher burden on Americans by misappropriating tax funds that would be better suited elsewhere. The administration would be better off supporting legislation that would immediately lower the cost of housing, rather than attempting to make housing somewhat more affordable in the nebulous long-term.

A Problem Still to be Solved

Though it’s likely that the NHIA won’t make it out of committee to even be discussed by Congress, the fact that it was a bill introduced at all is a cause for concern. The high American deficit and taxes that increase year over year is something that weighs on every American’s mind, and bills like this would only make things worse, providing handouts for corporations and individuals alike.

Unfortunately, bills like the NHIA don’t do anything to address the affordability of living, no matter how noble the intent. Though meant to help the lower class of Americans, bills like the NHIA would ultimately only burden every American with a higher tax bill, and do nothing meaningful to address the issue that it was meant to fix.