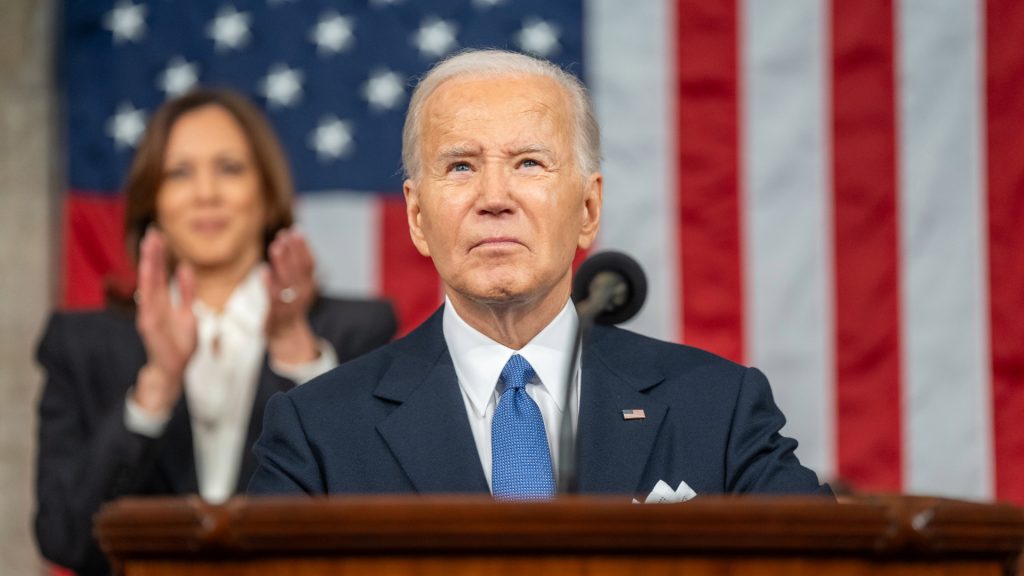

President Biden apparently angered a lot of billionaires with a reference to tax proposals in his State of the Union address. According to a statement issued by the White House, the new tax reform would require billionaires to pay a minimum of 25 percent of income in taxes.

Biden Wants To Target Giant Loopholes, Tax Preferences For The Wealthy

Billionaires are typically taxed at lower rates than what the average taxpayer that makes an ordinary wage income would pay. There are even certain tax preferences and loopholes that allow some wealthy individuals to not be taxed at all.

Studies have shown that these Americans can pay an average income tax of 8% of their incomes – which is a much lower rate than even teachers and firefighters pay. President Biden wants to modify this particular system to make it fairer for all taxpayers.

Biden Proposed 25 Percent Minimum Tax On Wealthiest 0.01 Percent

President Biden proposed levying a 25% minimum tax on the wealthiest 0.01 percent of American citizens. According to the White House, this specifically means the taxpayers that retain a wealth of over $100 million.

This is something that Biden has essentially fought for since he first took over the Oval Office as Commander in Chief. The objective is to create a system that mandates all Americans to enjoy a level playing field regarding the taxes owed.

Biden: “We All Do Well’ When ‘The Middle Class Does Well’

Biden referenced his childhood years of growing up in a home where “trickle-down economics didn’t put much on my dad’s kitchen table.” President Biden explained that was why he is focused on turning things around.

According to Biden, when the “middle class does well,” the wealthy “still do very well.” More importantly, though, “we all do well.”

Real Estate Billionaire Disagrees With ‘Singling Out People’ Based On Net Worth

Jeff Greene, a real estate billionaire, told the Daily Beast that he does not agree with the tax proposals discussed in Biden’s State of the Union address. More specifically, he does not agree “with the idea of just singling out people because of how much they have or don’t have.”

Greene admitted that he does under “the progressive income tax.” However, according to Greene, there is a need to “leave incentives for people” that create the jobs for the ones trying to “climb the ladder.” Greene is reportedly worth an estimated $7.5 billion.

Grocery Billionaire Claims Biden ‘Doesn’t Want A Capitalist Government’

John Catsimatidis, a grocery billionaire, told The Daily Beast that “President Biden doesn’t want a capitalist government.” On the contrary, according to Catsimatidis, Biden “wants a government for socialism” – a system that “doesn’t work.”

Catsimatidis echoed Greene’s feelings when he said that Biden is essentially “trying to take away the incentives for people to work hard.” He admittedly does not mind trying to support the poor within the United States. However, he claims that “you can’t support the whole world.”

IRS Has Funding Needed To Target Tax Cheats Used By Wealthy Taxpayers

President Biden reportedly worked hard to secure the funding needed for the Internal Revenue Services (IRS) to target the tax cheats used by big businesses and the wealthy. As a result, over $500 million in unpaid taxes have been collected by less than 2,000 delinquent millionaires.

The funding provided has also allowed the IRS to take enforcement action against over 25,000 millionaires that had not filed a single tax return since 2017. It reportedly assisted in the analysis of deductions used for the personal usage of corporate jets as well.

The Wealthy Would Also Have To Pay A ‘Fair Share’ Toward Medicare

Biden also expressed the need to extend Medicare solvency and protect the Medicare benefit for future generations to enjoy. In his opinion, the most effective method to accomplish this goal is to make the wealthy pay a fair share instead of increasing costs for beneficiaries or reducing their applicable benefits.

Biden would increase the Medicare tax rate for any taxpayer that makes above $400,000 each year. This would also seal any existing loopholes within the Medicare tax spectrum that makes it possible for wealthy business owners and high-earning professionals to avoid this tax.

Biden Proposes To Expand Child Tax Credit, Will Impact 66 Million Children

President Biden currently plans to expand the Child Tax Credit to support 2 million children that are currently living with a 60-year-old caregiver and older. This would provide ample funds for daily expenses by allowing qualifying families to receive monthly payments as their tax credit.

The expansion would also reportedly move 3 million children above the poverty line. It would also cut taxes by at least $2,600 for 39 million families within the low-income and middle-income tax brackets. That equals out to an impact for over 66 million children.

Lower Health Insurance Premiums Would Be Made Permanent

Studies have shown that the enrollment in affordable health coverage is currently at an all-time high. President Biden made his commitment clear regarding ramping up the success of the Affordable Care Act (ACA) program.

The goal is to make the premium tax credit applied to premiums permanent. This credit is currently saving a lot of people an average of $800 annually in health insurance premiums.

Over 19 Million Americans From Working Class Would Receive Tax Cuts

President Biden also plans to cut taxes by $800 per year for approximately 19 million working couples or individuals that are not currently raising a child in their home. This includes the workers age 65 and up (2 million people) along with the individuals ages 18-24 (5 million).

This change would be the direct result of a stronger Earned Income Tax Credit program that specifically targets low-paid workers that either are no longer raising or have never raised children.

Reporter Claims State Of Union Address Felt More Like ‘Campaign Speech’

Kimberly Halkett, a reporter that was present for the State of the Union address on Thursday, stated that “it was really more of a campaign speech.” Halkett stated that Biden referenced Donald Trump at least 10 different times throughout the speech.

Even though Biden did not name Trump directly, he referred to him repeatedly as “my predecessor” throughout his address. Halkett says that Biden mentioned him “throughout the speech with each topic that was mentioned.”

Biden Refuses To ‘Bury The Truth About January 6’, Offers ‘Simple Truth’

One of the times that Biden took a subtle jab towards his “predecessor,” Donald Trump, was regarding the January 6 attacks. Biden mentioned that some in attendance along with his “predecessor” wanted to “bury the truth about January 6.”

Biden made it clear that he would “not do that.” He added that the “simple truth” was that “you can’t love your country only when you win.”

Biden Wants To ‘Restore Roe v Wade As The Law Of The Land Again’

President Biden strategically used his State of the Union address to separate himself and the Democratic Party from the conservatives that were excited by the 2022 Supreme Court decision to overturn Roe v Wade. Biden promised on Thursday night to defend abortion access on a national level.

He stated that if the American people sent him “a Congress that supports the right to choose,” he would “restore Roe v Wade as the law of the land again.” Biden made it clear that the “electoral power” possessed by women would help the Democratic party to win votes this November.

Mark Cuban Not Bothered By Biden’s Proposal, Still Plans To Vote For Him

Mark Cuban told The Daily Beast that he had no plans to watch the State of the Union address on Thursday. He admitted that he would instead choose to watch his Dallas Mavericks team battle the Miami Heat on the basketball court.

However, he remains insistent on supporting Joe Biden as the next U.S. President. When asked about Biden’s advanced age, Cuban made it clear that does not matter to him. The Cost Plus Drugs cofounder stated that he would still vote for Joe Biden even if “he was being given last rites.”