California suffers an awful fiscal hit for its repeated wild spending over the years. With a budget double that of the past decade and a flourishing tax system admittedly sucking up its rich, the state remains heavily debt-stricken.

Blame it on inflation and the massive population upshoots. However, the current report on California’s finances is no good news for its wealthy few. This is quite an uneasy take from a system that already has them by the neck.

The Staggering Multibillion Dollar Debt

California has a projected $68 billion debt this fiscal year. This is understandably shocking for a seemingly progressive economy with successful complementary initiatives. Yet it appears to be an epic financial turnout in the state’s history.

Among the U.S. states, California has one of the most elegant tax systems that add to the enormous revenues generated annually. But as it stands, this return might not suffice to offset its standing financial deficit.

An Aftermath Of The Savior-Complex

The Golden State isn’t in this challenging position today because of its frivolous spending. At least, that’s what the government wants to believe. However, the system has taken a couple of fiscal missteps while performing the savior act.

Imagine a state with unfunded liabilities for retirees’ health insurance in the billions sorting illegal immigrants’ health coverage. Like that isn’t enough, the said indebted state also found it advisable to pay for gender transition surgeries on a platter.

California’s Revenue Drop

The genesis of California’s unprecedented financial jab is its recent revenue shortfall. The clumsy 2022 stock market resulted in a steep outcome contrary to a projected capital tax that’s dependent on its rich one percent.

We can ascribe the issue as an institutional fault. More than half of California’s tax comes from its well-off. In the face of troubled economic patterns, there is almost nothing else to expect with such a system.

A Possible Next Action?

Often, when states are in a difficult financial position, only one move remains. It’s that period to implement a wealth tax on residents. Similarly, California has no choice but to subscribe to this next action step.

For those still wondering, the move is already taking form. A bill has been proposed and is awaiting enactment. Soon, the wealthy with net worths above $1 billion could be slammed with an excise tax. Of course, that’s great news for tax appraisals!

Debated Repercussions Of This Expected Next Move

Taxing the wealthy has ignited concerns among financial experts and residents alike. And there is a common fear. Soon, California might be bidding farewell to its well-off in mass. At this point, this is probably unavoidable.

Again, questions are arising on the Golden State’s fiscal and economic priorities. Why? The consequences of tax go far beyond merely amassing revenue. It’s now left to the state’s policymakers to decide between the actual economy boomers or their annual remittance.

California’s Sweeping Measure

With the impending California tax law, there is no exception. The policy is forecasted as a sweeping measure that’ll bind part-time and full-time residents. It’s an attestation to the obvious. The state is keen on gaining huge revenues to trade off its cash deficit.

California will levy a 1.5% excise tax on $1 billion and above net worth to this effect. The aim is that by 2026, the net tax will extend to individuals with financial proceeds over $50 million at a 1% yearly rate. And another 0.5% on assets over $1 billion.

The Imminent Investment Shift

There are speculations that California’s top one percent could start investing more in real estate to escape the latest tax reality. With the bill exempting personally owned real estate, Sacramento Democrats heave a sigh of relief at their exorbitant landed properties.

As the Wall Journal Street puts it, this is an indirect flag-off for the rich to maximize the luxurious real estate market. Also, the enactment could be a deliberate damage-minimizing stunt prioritizing major-player cities like Los Angeles and San Francisco.

Attributive Factors Of The Financial Mess

Scrutinized elements leading to California’s upheaval are said to be encapsulated in the tax policy. These include COVID uproars, hampered revenue, and existing high tax rates.

Although arguable, it’s obvious that the government sees it as fair to tax its top folks more, especially for its economic survival. For the wealthy, it’s a stack of taxes needing to be paid already. The mantra now in California is “Get more and remit more.”

Governor Newsom’s Disagreeing Position

California’s Gov. Gavin Newsom relays publicly how much his state owes. He says the amount is only within the realm of $38 billion. However, most estimates tipped the price to twice that.

In 2022, Gavin Newson predicted a massive budget deficit for California. However, the reality is worse according to analysis. Some say his policies are driving middle-class Americans out of their indigenous homes.

A Lesson Yet Unlearned?

While California highlights the origins of its fiscal mess, it doesn’t appear that the state is ready to forgo the burdening commitments. As it stands, the Golden State is still keen on supporting undocumented immigrants.

The Medicaid budget allotment is bound to extend to these cohorts as well as other expenses. Perhaps it’s odd to think the government would stick to these responsibilities despite their repercussions. Nevertheless, these already-known factors are what prompted the wealthy tax idea.

The Role Of Inflation And Population Growth

In the past ten years, California’s budget has doubled due to the nationwide rise in commodity prices and population upswing. Meanwhile, now, people crossing the border are getting health benefits, and gender transition surgeries, among other supposed necessities.

As strange as that may sound, it’s California’s present reality. And the implication of that is harsh on residents. Working individuals in the state regardless of social class will have to do more to pay additional fees for health insurance.

The Wealthy’s Deduction From This Situation

Right! The California government projects rich taxation as the way to sort its fiscal woes. Whereas, this is a disincentive to the affluent potentiating a looming clapback. One that could have a detrimental long-term effect on the state’s economy.

High-income residents might have no option but to flee California permanently. Suppose this occurs, the implication will be quite telling with the drastic drop in job creation. In the end, the bill paradoxically puts the state’s industrious reputation on the line to solve its debt.

Beyond Wealth Tax Resort

California’s array of possible solutions goes beyond taxing the rich. In fact, this enactment automatically gives way to other tax hikes. Among residents, this translates only to more worry.

The state’s top tax rate was formerly 13.3%. Now, that has increased by 1.1%. The impending law might blow off the usual $146,000 wage benchmark for a 1.1% tax. In other words, it’s a more hostile situation for workers and businesses.

Beneficiaries Of The New Bill

Bet you didn’t see this one coming. But the potential winners of this new bill are trial lawyers. This is because of the rare empowerment the California law gives them. They have a bounty to scrutinize wealth records and statements under the False Claims Act.

You can picture a horde of attorneys trooping to California to target high-net-worth individuals. Not minding the headache that might accompany the valuation of their assets, it’s still a fulfillment for the tax crusaders among them.

A Remedy Or More Fiscal Troubles?

The wealth-tax proposal exemplifies the typical nature of California tax-and-spend policies. And the potential of this pending statute to worsen existing fiscal issues can’t be overlooked. The most telling is the risk of chasing away the economy’s growth enhancers.

Similarly, another concern is the possible exacerbation of recurrent legal battles with the affluent. The question of the long-term effect of this desperate solution keeps arising. Even though Newsom says he doesn’t support the tax proposal, the final decision isn’t his to make.

A High-Stakes Gamble

California’s wealth tax bill has been tagged a risky bet by many. At that, it could come with extensive repercussions. While the state keeps combating its fiscal deficit, it can’t afford to lose out on a promising economic upside with the new law.

It’s hard to tell how feasible it is for the state to balance out tax revenue increase, economic incentives, and a possible trigger of its private financial pillars. However, one thing is for sure: upsetting the already dented economic outlook is no way to go.

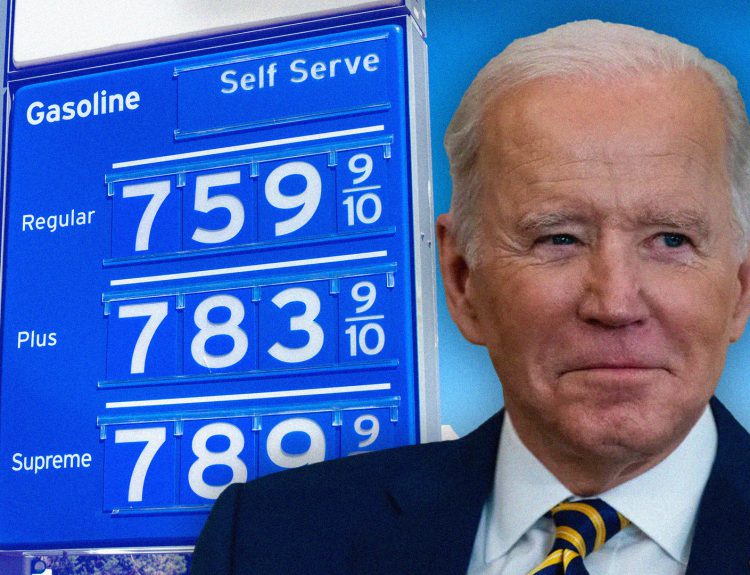

Unlikely Political Priorities Amidst Rising Cost

As wages rise and government salaries increase, costs keep going up. Meanwhile, the political class, especially the Democrats in Sacramento, seem more interested in pleasing their donors and preferred groups than looking out for regular working people.

It appears that the government has a priority and everyday workers are sidelined in this reality. While the tussle with financial challenges continues, concerns about the purported desperate next step lingers.