It’s nice to know you have friends you can count on until you can’t count on them. Former President Donald J. Trump doesn’t have a bond less than a week before he has to pay the fine for his New York City fraud case because Chubb won’t cover it. Let’s explore what led to this situation.

Trump’s Go-To for Bonds Says No

Having been found guilty in the E. Jean Carroll case, Trump sought Chubb as the company to help him pay the bond so he could take it to appeal. They gladly footed his bill then.

Unfortunately, the company declined to do the same for Trump’s upcoming fine deadline for his New York City fraud case. And they picked an inopportune moment to let him know.

Less Than a Week Remains

Chubb told Trump, “No, thanks,” about funding his bond from NYC less than a week before the former president had to pay his fine. The value? No less than $456 million as a penalty.

Declining to cover Trump is a bold move from Chubb’s CEO, Evan Greenberg. The company’s choice to cover his previous bond for the E. Jean Carroll case got it some bad press.

Greenberg Is a Good Friend

Trump is no stranger to handing out favors to the people he likes. Many people got into power because of the former President, who made sweeping political appointments all over.

One of those appointments saw Greenberg take a seat on a critical trade advisory committee. Greenberg held that position until 2023 when his tenure expired.

Leaving Personal Feelings Aside

The press asked Greenberg to comment on his denial, and the CEO stated that they did so because they felt that it was the best option as far as the law was concerned, leaving feelings aside.

He also touched on how polarizing and emotional this case was to the public, but failed to mention if the previous pressure put on the company because of the last bond figured in the decision.

Understanding Reputational Damage

One critical factor that insurance underwriters consider before taking on a bond is reputational damage. Companies need to be aware of their client’s public image.

Given the nature of the case and the individual, Chubb’s underwriting of Trump’s appeal could be seen as a faux pas. However, they’re unlikely to make the same mistake twice.

At Least One Billion Dollars Needed

The bond amount is usually based on a cash surety. If Trump wanted to secure the bond for this $435 million, he would be required to fork out no less than $1 billion.

However, it’s not clear whether Chubb had asked Trump to have $1 billion free for the bond or whether the former president could afford to set aside that much money on the campaign trail.

At Least 110% – 120% Surety

As a rule of thumb, most insurance carriers require an amount equal to 110% to 120% of the bond before they consider underwriting it. This limits their risk while maximizing rewards.

The amount the lawyers stated is far more than that value, and many commentators noted that it was a bit high. However, this amount is simply a suggestion, not a hard and fast rule.

A Severe Blow To The Appeal

Trump has been shopping around for insurance underwriters to cover his bond, but most of them have been wary about taking on a client of that stature with so much baggage on him.

Chubb was the closest to saying yes among the thirty firms that Trump had been considering, but they quickly changed their decision into a no.

An Unprecedented Solution

Trump was obviously short of liquid funds to fund his surety. Chubb devised a unique twist on funding his surety that appealed to the real estate magnate.

Chubb had also been willing to let Trump post real estate as part of his surety before changing its mind. The initial decision showed how far Chubb would go to land Trump’s business.

Real Estate Is Usually a No-Go

Most insurance carriers will not accept real estate as a surety because it is not liquid enough. If the client’s appeal is lost, the bill comes due immediately and must be paid.

Real estate is notorious for being a difficult asset to liquidate. Not only does it require finding a buyer and working out the details of the purchase, but it may also have several fees associated with the sale.

Trump’s Trying to Use Real Estate for His Fines

Most of Trump’s assets are real estate holdings, and he’s been trying to peddle them as much as possible to get the most value out of them. He’s even offered them as surety to New York City.

The Attorneys are having none of it and have stated that Trump has shown he’s not to be trusted in financial matters and holding real estate as a promise of repayment is not in NYC’s best interests.

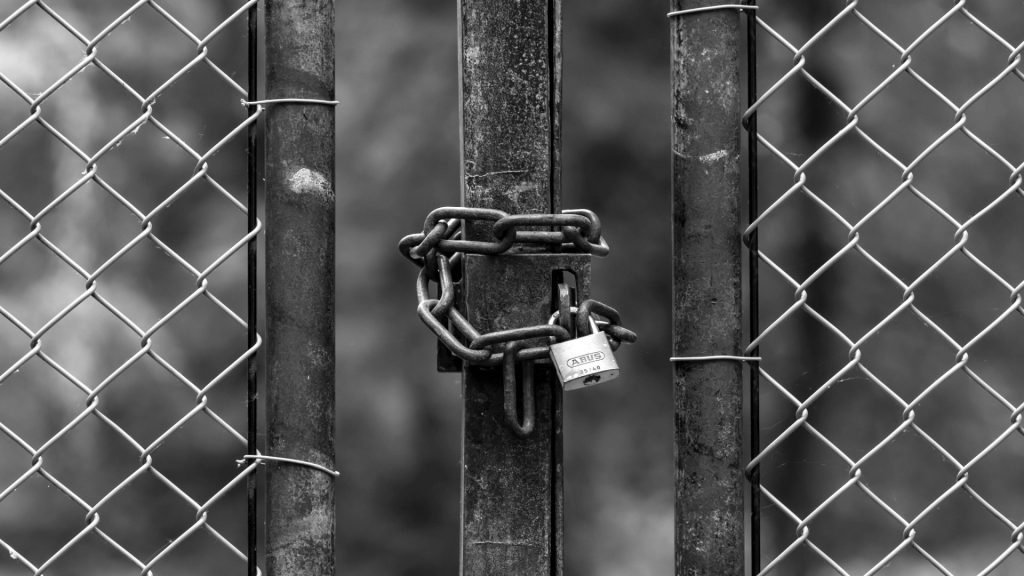

A Threat of Seizure

Trump is in a very desperate situation at present. He has many non-liquid assets on hand that he needs to liquidate to pay his fines to New York, and they aren’t willing to accept the properties as surety for payment.

Yet, New York is ready and willing to seize his property if he can’t pay. This could be bad for the former president.

Isn’t the State Still Taking His Property?

It seems counterproductive that the state would seize his property after denying it as a surety of payment, but there’s a distinct difference when the state takes the property in lieu of payment.

As a surety, they can only liquidate the property if the appeals fail. When assets are seized, they could go up on the auction block or the open market as early as the next day.

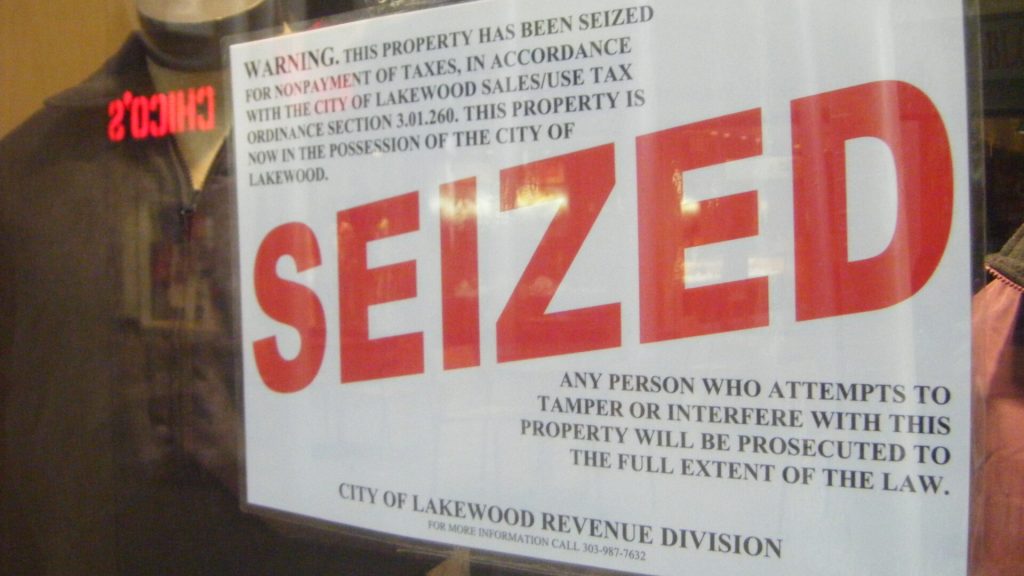

What Would Happen If He Can’t Pay?

If Trump can’t pay the bill for his surety, he will have to pay the fine. If he can’t pay the fine, the state will start seizing and liquidating his assets to make up the difference.

Trump is in an unenviable position of not having the money he needs and assets the state can seize from him. Whether the state takes his property or he sells it, he’ll still lose.