Do you ever wonder how most millionaires become millionaires? Do they inherit their wealth, start a successful company, or have extremely high-paying jobs? Well, according to a recent study of 10,000 millionaires, most of them have quite normal jobs. In fact, only 31% of millionaires ever made more than $100,000 per year in their career. Today, we will discuss what these “regular” millionaires do in their 20s that you can follow to become wealthy in your 30s.

1. Start Investing Immediately

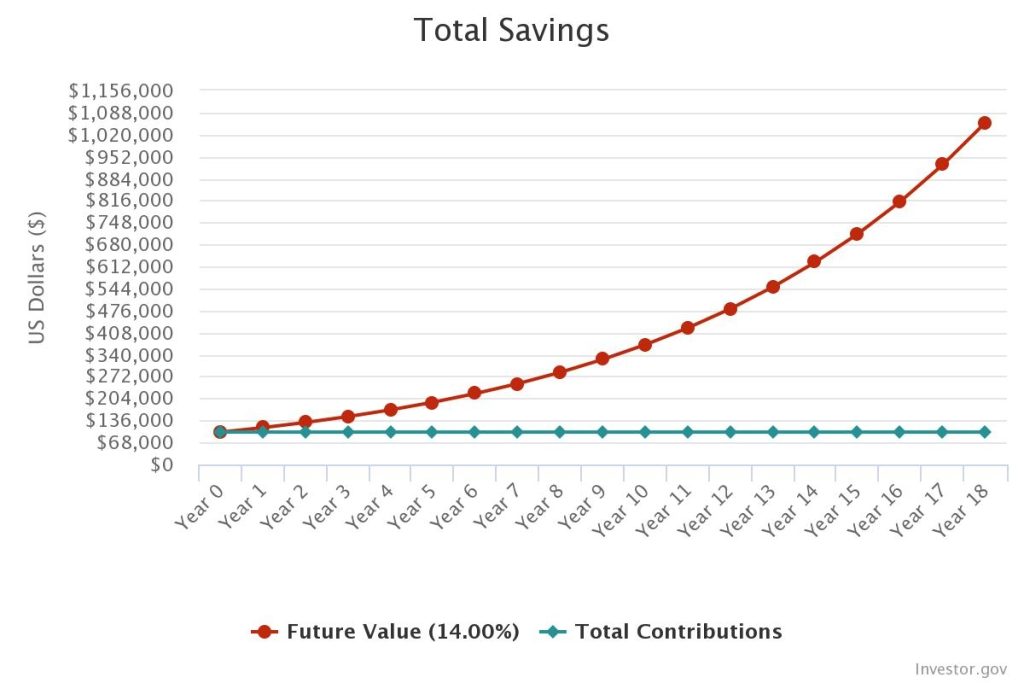

Most millionaires understand the power of compounding and know the importance of starting investing early. In fact, 75% of the millionaires attribute their success to investing consistently over a long time. Here is an example that will blow your mind away. Let’s say you started investing $1,000 into a broad index fund every month after you turned 20. You will have just over $559,000 by the time you are 39.

Guess how much will you have if you start 10 years later at 30 years old? $158,000! That’s almost a 4x difference. This doesn’t even account for increased investments as you get older. The number could be much higher depending on how much you can invest. So, the equation is simple. The earlier you start investing, the wealthier you will be. But if you really want to maximize your wealth, this next advice is the key.

2. Live Like You Are Broke

Your 20s are the best time to build wealth because of compounding. The more you can invest, the wealthier you can get in your 30s. And one of the easiest ways to invest more is by saving more. For instance, if you save and invest an extra $300 per month from age 20, it will grow to $186,000 by age 39.

You also don’t have many responsibilities, so you can save a large chunk of your income. This doesn’t mean you can’t enjoy life. But you can certainly avoid spending on things that you don’t need and save money wherever you can. The study of 10,000 millionaires revealed that 92% of them regularly used coupons while shopping and spent less than $200 per month on restaurants. If you want to become a millionaire, canceling those subscriptions you rarely use and eating out less often might be a good start.

3. Invest For Long-Term In Index Funds

Now that you understand the importance of investing early and saving, you need to understand how to invest. There is a famous quote by Warren Buffet. “Time in the market beats timing the market.” You can invest in individual stocks, but we are bad at picking stocks. In fact, according to CNBC, more than 80% of such investors lose money. There is a much better way to invest.

Index funds invest in a basket of companies that meet certain criteria. For instance, the S&P 500 index fund invests in the 500 largest companies in the US. So, you are effectively investing in the US stock market and betting on its overall growth. But you are not highly exposed to the risks of a single company. This strategy works well if you invest for the long run and buy and hold without panicking in market downturns.

4. Start A Business

The best way to be wealthy in your 30s is probably to start a business in your 20s. A successful business will almost always make more money than your investments in your 20s. Now, starting a business doesn’t mean you have to leave your job. It can be a side hustle at first.

20 years ago, if you wanted to start a T-shirt business, you would have to deal with suppliers, buy inventory, find storage for it, and deal with a lot of other hurdles. But today, you can start a small T-shirt business from anywhere in the world with less than $1,000 and a few hours every day. If it is successful, you can give it more time later on. If not, you can move on. There are no big risks.

5. Build Multiple Income Sources

No millionaire has gotten there with just a single income source. According to Forbes, an average millionaire has 5 separate income sources. Most millionaires understand this and start investing in these sources from very early on. Their 20s are spent building the foundation, and it slowly starts to pay off.

So, what are the most popular income sources? The first one is earned income or salary. This becomes the foundation for most millionaires to build other sources. Other sources include rental income, dividends, capital gains, and interest income. You need to start working on building income sources very early on. And our next advice is the most popular source millionaires use.

6. Invest In Real Estate (Rental Properties)

Here is a crazy fact. According to Wealth Engine, more than 30% of American millionaires attribute their wealth entirely to real estate, and a whopping 90% attribute it partly to real estate. And there is a very good reason why. Real estate is one of the few safe investments available to an average person, and banks easily finance with a low downpayment. You can even get a home loan for a down payment of less than 3%.

One of the popular ways to invest in real estate these days is something called house hacking, where you buy a multiple-unit property and live in one unit while renting out the other units. The idea is to cover your mortgage with rent and effectively live rent-free. Considering you can take out a fixed-rate mortgage in the US, people have successfully done this in a stable way.

Bringing It Home

Most millionaires get rich by staying very disciplined in terms of saving and investing. Whether it be in the stock market or real estate, they spend their 20s strategically building a foundation for the future. And if you follow the advice we have discussed in this article, you can become a millionaire too.