Home insurance costs have skyrocketed in Florida over the last few years as more and more insurers are leaving the state. As part of the government’s support for homeowners, it has leaned heavily on the Citizen Property Insurance governmental organization. Let’s see how this affects Floridians.

Floridians Have Less Insurance Coverage Now

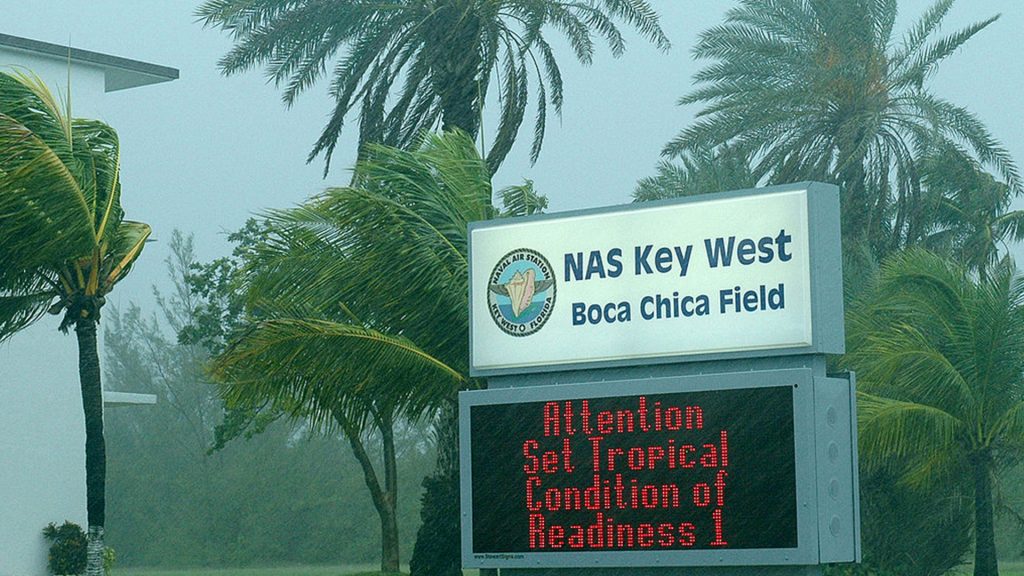

Over the past few years, natural disaster strength has increased several times over. Whether climate change or something else, insurers have been struggling with it in Florida. Thanks to these increased payouts for disaster insurance, a few companies have just left.

According to the law of supply and demand, as the supply decreases and demand remains the same, the price of the commodity will go up. That’s as true as ever in Florida, as average home insurance costs have hit a nationwide high of $6,000 annually.

Government Should Do Something

With the departure of a few insurance companies, residents of Florida have been calling on the governor, Ron DeSantis, to do something about the rising costs of home ownership. In a surprising move, DeSantis has decided to look at a more socialist model for home insurance.

Citizen Property Insurance is the solution DeSantis is leaning on to solve his burgeoning cost of home ownership problem. This not-for-profit government agency specializes in offering coverage for homes that no other insurer will cover. Yes, it’s a last-resort insurer that may rescue the Floridians.

Not A Decision Taken Lightly

Anyone who knows Republicans knows that they hate socialism more than almost anything else. This knowledge reveals that DeSantis, a Republican governor, is considering it a solution to the state’s problem.

Yet this road is not one DeSantis walks down lightly. The governor has already put several pieces of legislation in place to help homeowners deal with the rising insurance costs. However, these solutions will take time to show any tangible returns.

Other Measures Taken By The Governor

In December, DeSantis introduced a revised budget based on cutting property taxes. The idea was to ease the burden on homeowners and give them more money to dedicate toward the rising costs of homeowners insurance.

However, he’s still hampered by certain elements. The slow pace of legislature debate in Florida means that some of the governor’s policies may take a while to come into effect, by which time the cost of insurance may have doubled again.

How Bad Is the Situation in Florida?

Owning a home in Florida seems like a good idea. The state has a 0% income tax and encourages both businesses and individuals to move there. However, one of the hidden costs of living in Florida is paying homeowner insurance.

Estimates suggest that the premium for homes has increased by as much as 102% over the last three years. This is partially due to so many companies leaving the state because they can no longer justify the loss of money due to unforeseen circumstances. It’s actually cheaper to rent over the long term than to own a home in some areas.

The Legislature Is Ready to Take Drastic Action

The soaring cost of homeownership in Florida is threatening its influx of new migrants. While DeSantis seems to at least be on the fence about turning Florida into a socialist welfare state, the legislature has other ideas.

Many of the proposed solutions they have for managing the cost of homeowner insurance are decidedly socialist in nature. One of the most prominent ones is using the Citizens Property Insurance body to cover more homeowners. They also want to lower reinsurance costs and offer direct subsidies to policyholders.

Helping Some But Not All

Most people in Florida are covered under private insurance company policies. However, as more and more of these companies leave the state, it leaves these homeowners without coverage. In a disaster-prone area like Florida, this could be a death sentence for their investment.

The Citizens Property Insurance could potentially fill in for some insurance companies that fled the state. However, there’s a limit on the value of properties that the Citizens Property Insurance would cover. Currently, it covers around 1.3 million homeowners in the state.

Previous Pushes Have Been Met With A Stone Wall

These measures are not new to Florida and have been introduced several times before. Most of the introductions were done by Democrats, hoping to relieve the burden on individual homeowners in the state, but were almost always shut down by the Republicans.

What makes this introduction different is that the backing parties are Representative Jim Mooney and Senator Ana Maria Rodriguez. Both of these are Republicans, making it more likely for the bill to pass into law since both sides may support it.

To Cover More People, The Cap Must Be Raised

As mentioned, Citizen Property Insurance can only cover homes below a specific value. The current value only applies to properties that fall into the value bracket of less than $1 million. This cap eliminates whatever help this would give to many middle-income families.

Some lawmakers suggest raising the cap to $1.5 million to cover more homes. However, this by itself may not prevent burgeoning costs, so further measures like capping the rate increase to 10% per year may also need to be considered.

Unfair Rates Don’t Make For a Free Market

One of the core tenets of American free-market capitalism is that the market should find its level. Time and time again, the government has tried to meddle in the market, either directly or indirectly, leading to unforeseen circumstances as a result. No one can control or advise the invisible hand of the market, after all.

By forcing Citizen Property Insurance to cover more homes, it creates an imbalance in the supply and demand forces. Private insurance companies may have to sell insurance at even lower rates, which might have the effect of seeing even more insurers flee the state.

Inadvertently Creating a Government Monopoly

Some economists point out that it’s nearly impossible for private businesses to compete against the state as an insurer. What company could ever compete against free insurance? Little by little, the state would start subsuming the role of insurer until it covers the entire population.

The pushback argument is that Citizen Property Insurance has a cap on the price of homes it can cover. But as more and more insurers leave, that ceiling will have to rise unless it wants to leave its high-value homeowners without insurance.

Adding Liabilities To The State

Homeowners might not really feel too terrible about paying nothing for homeowners insurance. However, the state has to find a way to pay for this increased burden, and the best way to do so would be to tax citizens. After reducing their tax recently, this could be seen as a betrayal by the voting public.

Yet until such a tax increase goes into effect, the state will have to somehow manage the payment for property damage due to ever-increasingly violent disasters. Economists urge legislators to give some of the previous moves a chance to see if they will help with the increasing value of homeowners insurance.

Can The State Afford a Serious Natural Disaster?

Citizen Property Insurance can manage damages to the currently covered homes, but how many more homes need to be added before it becomes unsustainable? The US Senate Budget Committee isn’t even sure it can cover its current obligations to homeowners.

The Senate Budget Committee recently launched an investigation to see how robust the coverage that the Citizen Property Insurance body offers is. If the body becomes insolvent, other policyholders will have to pay more, even if another private insurance company covers them.

The Problem With This Socialist Solution

While there are many problems with socialist solutions, this particular one has a huge red flag. If the Citizen Property Insurance body goes bankrupt, the debt of helping homeowners recover will rest on the shoulders of other homeowners.

These homeowners will be required to pay into the Citizen Property Insurance body to rescue their fellow homeowners but will never see a cent of the relief they pay for. Instead, their private homeowner policy will go up since the company was required to pay them a settlement. That’s not a fair settlement for any homeowner.

The Federal Government May Need to Step In

If Citizens Property Insurance goes belly-up, it could be more than just a problem for Florida. It could extend to cover the entire country. Taxes may need to be allocated to help Florida’s homeowners in an indirect bailout to the Citizen Property Insurance policyholders. For the rest of the country, this could mean a cut in federal funding for other things.

Where does that leave Florida? At this point, Florida needs to figure out how it’s going to manage its Citizens Property Insurance to benefit homeowners while not penalizing others. It’s a fine line to walk. Economists hope that the legislature will rethink their drastic measures, since it could spell disaster for more than just Florida.