Recently, the IRS has announced to roll out a pilot program that allows taxpayers to file taxes free and directly. This program is available in 13 participating states to a limited number of eligible individuals and could potentially end a multibillion-dollar tax preparation business overnight.

Why Is The IRS Introducing This Program?

The United States is one of the few wealthy countries which does not have a free and direct government system to file taxes. Tax filing service is a $11 billion industry run by some very controversial companies that we discuss later. The IRS faced heavy criticism regarding this, and it was finally addressed in The Inflation Reduction Act.

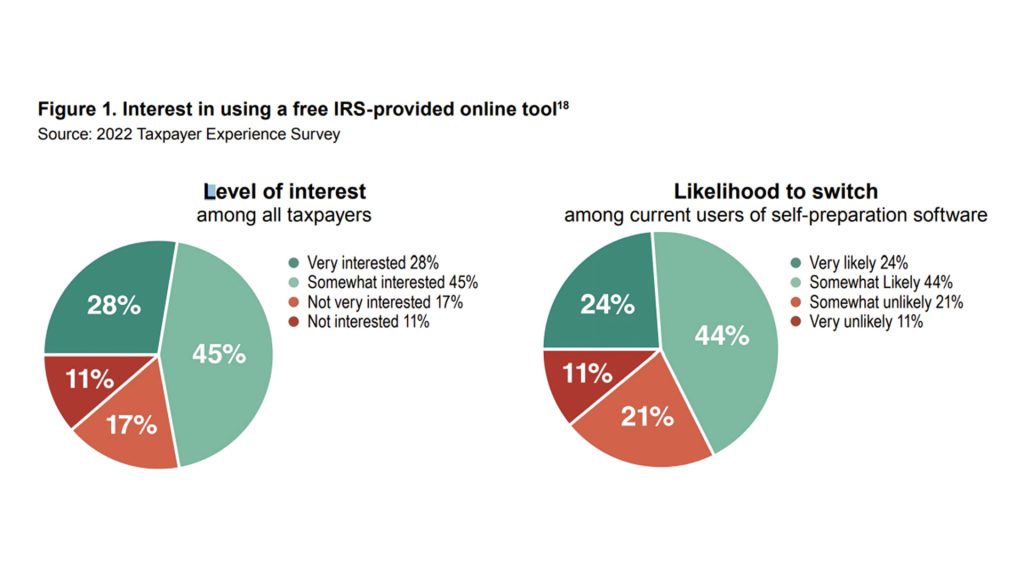

The act, which Joe Biden backed, finally directed the IRS to conduct a feasibility study and public opinion of an IRS-run e-filing system. The study concluded that 73% of Americans were interested in using a free IRS-provided online tool to file their taxes.

Do You Qualify For The Program?

The IRS is currently running this as a limited-scope pilot program for 2024. It is available to eligible taxpayers in 13 states. Basically, eligible means taxpayers who have the simplest tax situations. Your income must be from employment filing W-2 wage forms, social security benefits, or unemployment benefits to be eligible.

Your interest income also shouldn’t exceed $1,500. You must also only claim basic credits like Earned Income Tax Credit, Child Tax Credit, and Credit for Other Dependents. The 13 states currently involved include Arizona, California, the District of Columbia, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington, and Wyoming.

How Will This Affect Tax Filing Services Like Turbotax?

Currently, the direct filing has a very limited scope and includes only 13 participating states. Very few people will be able to file taxes using it. So, it is not an immediate threat to companies like Turbotax. However, the IRS has made its intention to include more states and complex tax filings clear.

IRS Commissioner Danny Werfel said,” This is a critical step forward for this innovative effort that will test the feasibility of providing taxpayers a new option to file their returns for free directly with the IRS,”. If this program starts to cater to more complex tax situations and expands its reach, it could significantly affect services like TurboTax.

How Have These Companies Lobbied Against This Until Now?

There is big money in the tax prep industry, and two companies dominate it. Intuit, which owns TurboTax and H&R Block. TurboTax alone made an operating profit of $1.6 billion in 2020. So, these companies have lobbied the government for decades to prevent the IRS from building its filing program. In total, they have spent $90 million since 2003.

In 2003, the IRS reached an agreement with tax filing companies called “Free File Alliance”. According to the agreement, the companies would provide free filing services to taxpayers earning less than $73,000 annually. In return, the IRS would not build its filing system. But this is where the problem starts.

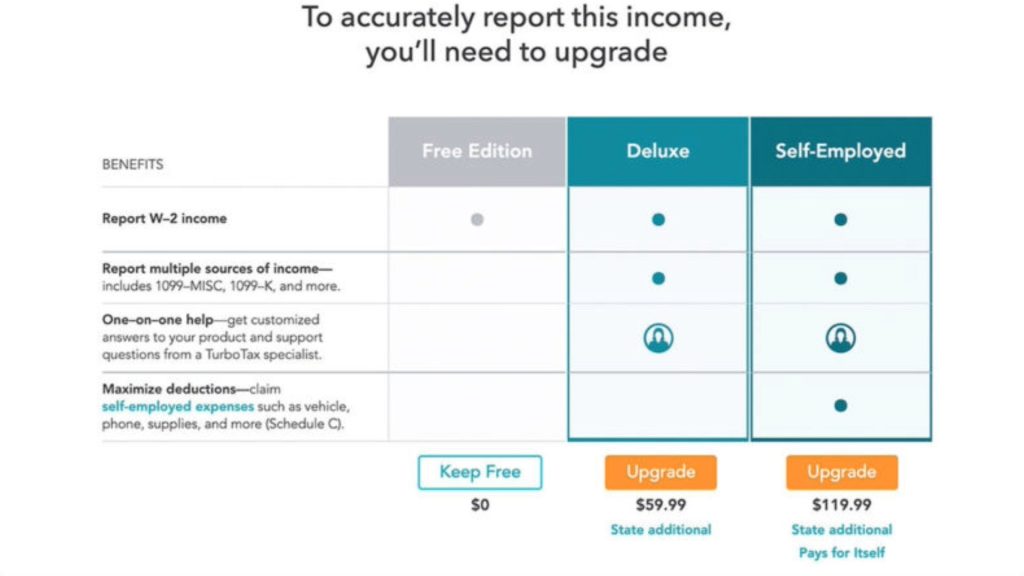

Making The Free Version Intentionally Hard To Find

The agreement looked like a win-win situation at first. The IRS would not have to use taxpayers’ money to fund a filing system, and low-income individuals could file their taxes for free. However, these companies have found loopholes to make customers pay. For instance, TurboTax intentionally made it difficult to find its free version by hiding it from search engine results.

According to ProPublica’s research, the free version you find on Google isn’t free for most people. TurboTax directs you to its paid version if you have even slight complexities like student loan interest or insurance. It has an actual free version for anyone making under $73,000. However, it has made it difficult to find by hiding it from search engines. So, two-thirds of eligible taxpayers end up paying.

The Inuit Lawsuit

TurboTax has a long history of shady and deceptive business tactics. According to its agreement with the IRS, it can’t charge anything for filing taxes for low-income Americans. But by making its free version intentionally difficult to find, it made millions of Americans file taxes with its paid version advertised as free.

An investigation led by New York Attorney General Letitia James found that TurboTax deceived 4.4 million low-income Americans between 2016 and 2018 into paying for its services when it should have been free. Intuit, TurboTax’s parent company, agreed to settle for $141 million and pay customers back the fee.

How Much Will It Cost, And Who Will Fund It?

No matter how good a program looks, the economics needs to make sense. So, who is funding the direct filing program? The Inflation Reduction Act. The act has allocated an additional $80 billion to the IRS over 10 years and one of its objectives is to improve taxpayers service.

The IRS estimates running this program will cost anywhere from $64 million to $246 million annually. On average, an American spends $140 and 8 hours filing taxes annually, and the IRS justified the expense with this benefit. However, the IRS has stated the actual benefit of this program is facing criticisms for this as we discuss later.

When Will The Irs Roll It Out Everywhere?

It is clear Americans want a free and direct way to pay taxes. So, when can we expect it to roll out everywhere? It might be sooner than you think. The IRS is already planning to add more states and complex situations in 2024.

According to the IRS, “Direct File will first be introduced to a small group of eligible taxpayers in filing season 2024. As the filing season progresses, more and more eligible taxpayers can access the service to file their 2023 tax returns.” However, the IRS hasn’t given a clear timeline for when the program will be available for mass rollout.

Reaction Of Intuit

As you can imagine, Intuit and the tax prep industry as a whole are not happy with this program. They have made tens of billions in the last few decades and spent almost $100m on lobbying against an IRS filing system.

Intuit spokesperson Rick Heineman said the program “will cost taxpayers billions of dollars for something already free of charge and with potentially disastrous effects on the finances of millions of Americans.” He also criticized the IRS for not having clarity on how much this program will save American taxpayers.

Irs Clarifies Intentions Behind Direct File Launch

Addressing some criticisms, the IRS has clarified that it does not intend to compete with private companies. “Projects like Direct File represent a goal of the IRS Strategic Operating Plan to give taxpayers choices in how they interact with the tax agency,” the IRS revealed in a statement.

“This includes choices in how they prepare and file their taxes, whether it’s through a tax professional, commercial tax software or free filing options. Direct File is one more potential option from which qualifying taxpayers will be able to choose to file a 2023 federal tax return during the 2024 filing season.”

Politicians’ Opinions On The Direct Filing

Politicians, especially Democrats, are not big fans of tax prep companies like TurboTax, and they have been very vocal about it. According to Bloomberg, the company has received $106 million in federal research and experimentation credits. Politicians argue this alone could help fund the IRS’s direct system.

In a letter written to the executives of Intuit and H&R Block, lawmakers stated, “Your company’s disclosure reveals that Intuit’s research tax break from 2022 alone could have been enough to fund a year of a free e-File program for millions of Americans.” These lawmakers include Bernie Sanders and Elizabeth Warren.

Public Opinion Of The Program

There is a large public support for this program. According to a study conducted by the IRS, 73% of Americans are interested in using a free tool provided by the IRS and 68% trust the IRS with their information.

Individuals who self-prepare are also much more likely to use the program, with 82% reporting interest in the program. So, there clearly is interest in a free tax filing software directly offered by the IRS.

Direct Filing: Is It A Step In The Right Direction?

Most wealthy countries already have a direct and free filing system provided by the government. This system is a result of decades of lobbying by companies, which has proven to be ineffective and expensive for the taxpayers. While it has faced some criticisms, providing a free tax filing system is definitely a move in the right direction