The stock market’s volatility since the Great Recession has fueled anxieties about economic stability-dramatic swings and crashes reported in the media worry Americans, even those without direct investments.

Americans remain uneasy about the economy due to various factors like stagnant wages, declining opportunity, and financial precarity. Policy solutions that address income inequality, access to education and healthcare, job insecurity, and other issues could help relieve anxieties and promote a shared sense of economic progress.

Lingering Concerns About Job Growth and Wage Stagnation

While the unemployment rate in the United States remains low, serious concerns persist regarding job growth and wage stagnation. A sizable portion of workers feel significant anxiety about job security and vulnerability in an age of increasing automation, outsourcing, and the rise of the gig economy.

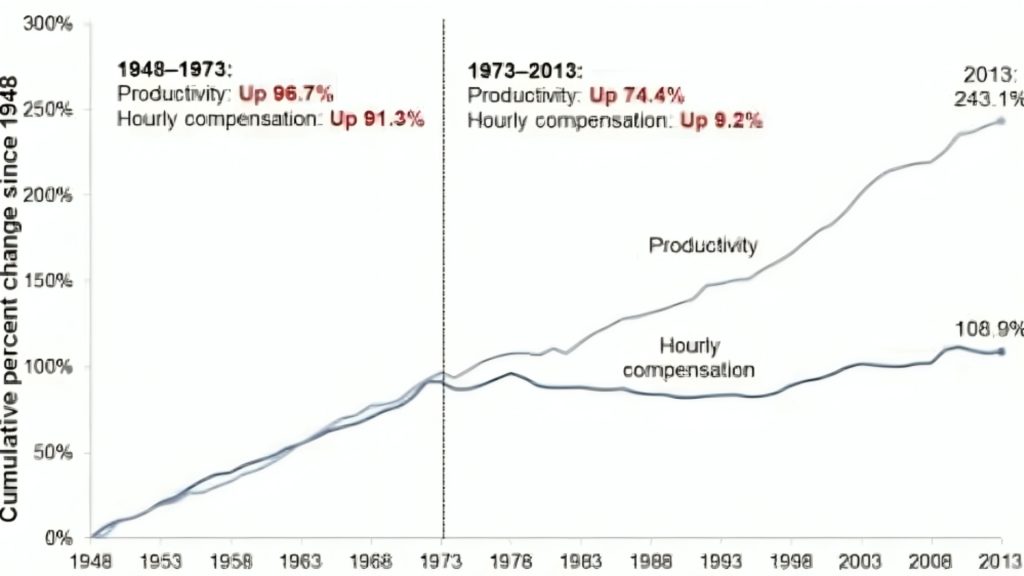

Compounding these worries is the fact that wage growth has remained stubbornly slow for average workers. After accounting for inflation, real wages have barely budged in decades. According to recent data, nearly two-thirds of Americans report living paycheck to paycheck, with little financial security.

The Shrinking Middle Class and Rising Income Inequality

The middle class, traditionally the backbone of the American economy, has been shrinking. According to the Pew Research Center, the size of the middle class decreased from 61% of adults in 1971 to 52% in 2021.

The cost of living and wage stagnation have squeezed the middle class. While inflation has risen, real wages have remained largely flat, eroding people’s purchasing power. At the same time, the costs of necessities like housing, healthcare, and education have climbed dramatically. These economic pressures have made it increasingly difficult for many middle-class families to maintain their standard of living.

Why the Housing Market Recovery Has Been Uneven

The housing market is a key indicator of economic health, and its recovery since the Great Recession has been uneven. According to research from the Joint Center for Housing Studies of Harvard University, homeownership rates have declined for younger households while rising for older age groups.

For Millennials, in particular, homebuying has been difficult. Burdened with student loan debt and lacking wage growth, many in this generation have struggled to save for down payments and afford mortgage payments. Without access to home equity, Millennials have limited wealth accumulation opportunities compared to previous generations at the same age.

Healthcare Costs and Access

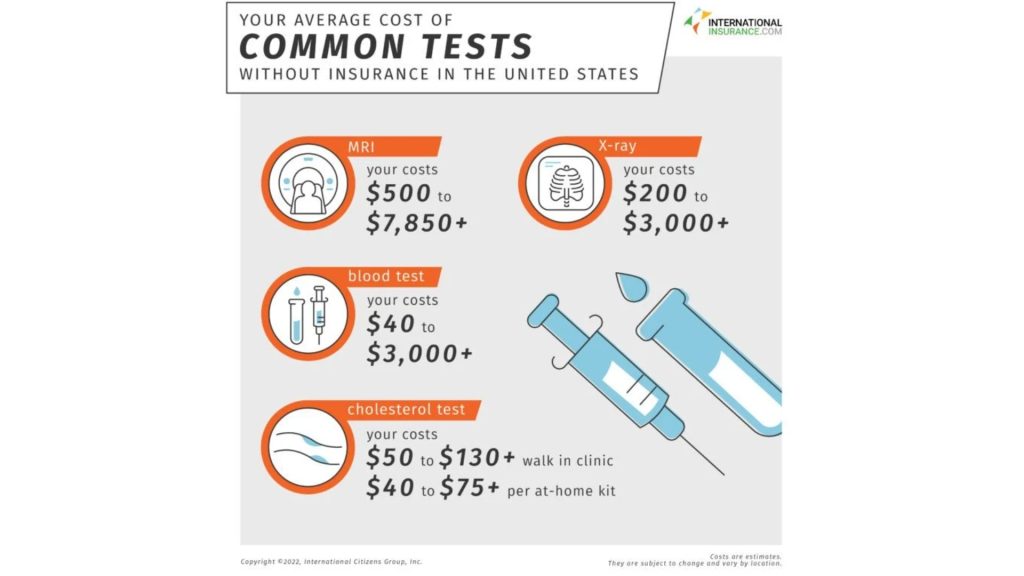

The cost of healthcare in America remains astronomically high. Even with laws like the Affordable Care Act, medical bills are a leading cause of bankruptcy. Insurance premiums, copays, and prescription drug prices continue to rise faster than wages, leaving many unable to afford basic care. This harsh reality fuels anxieties about health issues potentially spiraling out of control and leading to financial ruin.

For the uninsured, the situation is even more dire. Lacking coverage means preventative care and treatment are often out of reach. Many are forced to choose between necessities like food or rent and seeing a doctor.

Consumer Debt and Savings Levels Remain Problematic

Consumer debt levels in the U.S. remain elevated, hindering economic progress. According to the Federal Reserve, household debt reached $14.96 trillion in the second quarter of 2020, with large mortgage, auto, and student loan debt increases. These high debt burdens reduce individuals’ ability to save and spend, slowing consumption and weakening recovery.

Elevated household debt levels pose a significant threat to America’s economic recovery and long-term financial well-being. Reducing interest rates provides some relief, but ultimately, structural changes around college affordability, predatory lending, and financial literacy education are needed to shift these problematic trends.

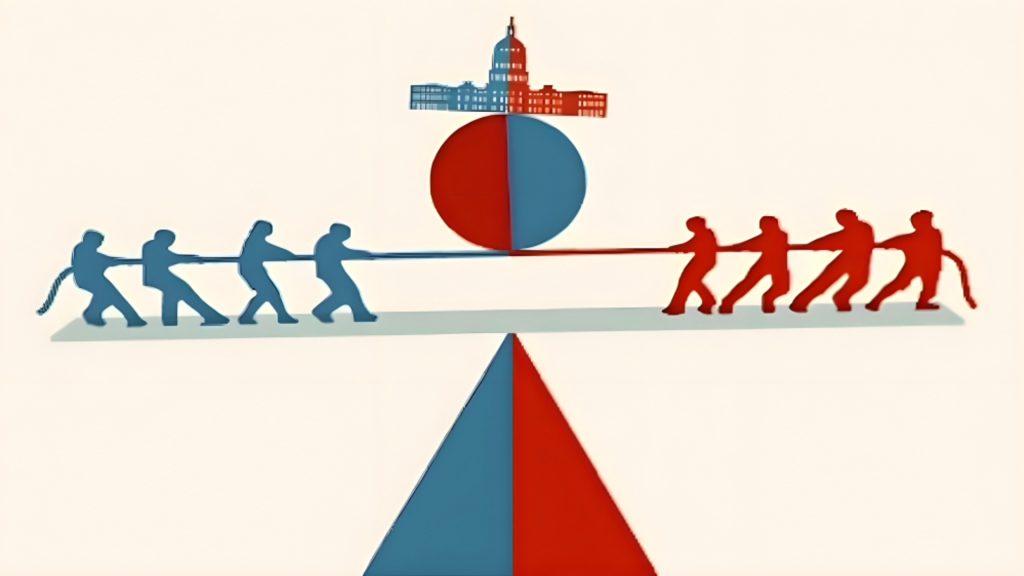

Political Gridlock and Policy Uncertainty Are Hurting Growth Prospects

The economic debate in America is often mired in partisan gridlock, hindering progress and leaving citizens feeling unheard and ignored. This lack of bipartisanship and meaningful solutions exacerbates anxieties and deteriorates trust in the system.

The government’s inability to pass meaningful legislation has significant consequences. Uncertainty surrounding policies like tax rates, healthcare, immigration, and environmental regulation makes it difficult for businesses and individuals to plan. This doubt threatens investment, hiring, and consumer confidence.

Can Infrastructure Investment Boost the Recovery?

Infrastructure spending has historically been an effective way to boost economic growth during a recession. When the government funds infrastructure projects like improving roads and bridges, it creates new jobs in the construction and supply chain industries.

This increased employment and economic activity, in turn, generated additional tax revenue for the government. Some economists argue infrastructure investment has a “multiplier effect” on the overall economy.

The Mental Health Toll of Economic Stress and Anxiety

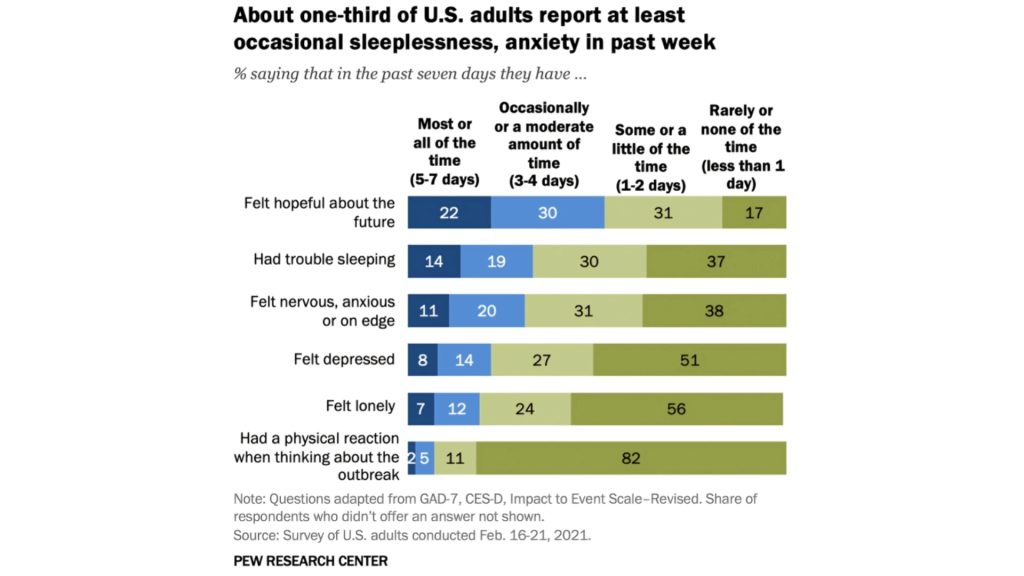

The constant anxiety and stress of struggling financially take a massive toll on mental health. When you’re worried about affording necessities or feel hopeless about improving your situation, it’s easy to become depressed or anxious.

The challenges of making ends meet in today’s economy can feel insurmountable, sapping your motivation and resilience. You may feel like no matter how hard you work, you’re treading water in a sea of bills and debt. This lack of control and optimism breeds anxiety and helplessness.

The Fed’s Role in Supporting the Recovery

The Federal Reserve plays a critical role in stabilizing the U.S. economy during times of crisis. When the COVID-19 pandemic struck, the Fed took unprecedented action by slashing interest rates to near zero and launching massive asset purchase programs to inject liquidity into the financial system. These measures aimed to support market functioning and facilitate lending to households and businesses.

According to the Federal Open Market Committee, the Fed’s policy-making body, rates are expected to remain low until labor market conditions have improved substantially. The Fed has pledged to maintain an accommodative stance for as long as needed to promote maximum employment and price stability. While necessary to prop up the economy, extended periods of low rates can fuel asset bubbles and increase inequality.

There is Time For Change, But It’s Not Coming Fast Enough

While the U.S. economy has rebounded significantly since the Great Recession, many Americans still feel uneasy about the recovery. Lingering impacts like stagnant wages and rising living costs contribute to this unease despite positive GDP and unemployment trends.

Moving forward, policymakers face the challenge of implementing solutions to translate national economic gains into direct, tangible improvements in everyday Americans’ financial situations. Achieving this broader-based prosperity that citizens can actually feel in their daily lives will be key to restoring confidence and easing the disquiet that persists below the surface of today’s economy.