Gun laws across the country are a tricky conversation to have, because gun rights and gun control are two subjects where everyone has an opinion, one way or the other. Some believe that the Second Amendment right that we are granted to own guns is eternal and unlimited, and some believe that there should be reasonable restrictions in place, the way there are with all rights. A new law out of Georgia has riled up both pro- and anti- gun rights activists, with the potential of more conflict ahead.

A Law to Buy Guns Tax Free

A proposed adjustment to the tax code in the state of Georgia would provide a tax break for gun owners, allowing them to purchase guns and ammo completely tax free starting in October of this year. The bill passed by a 30-22 vote on February 6.

The bill was proposed by Republican Senator Jason Anavitarte, and does have a caveat. The bill does not grant carte blanche ability to buy firearms and ammunition tax free from the time the bill goes into effect until eternity. The time window to buy these items tax free is limited, for only five days per year starting the second Friday in October every year.

Encouraging Hunting in the Region

Anavitarte, when discussing the bill, stated that it was designed to “encourage hunting, conservation and tourism” in the southern state. By allowing for gun owners to have a small break from their tax obligations for this hobby, Anavitarte hopes to increase the base of hunters in Georgia.

He also went on to argue that the bill was a good thing for conservation purposes. In the region, deer do not have any natural predators, and hunting is the primary way of keeping down the wild population.

Generous Hunting Laws

Georgia, like many Republican-led states, has fairly generous laws around hunting. There are multiple listed seasons for different types of game, with alligators and white-tailed deer being animals with some of the highest limits of game restriction.

For deer, each hunter is allowed to claim up to 10 white-tailed does and 2 antlered bucks per season. As mentioned in the new tax reform bill statement, this is to help curb the natural population where there are few natural predators.

Limitations and Education

Georgia does require that hunters take a hunting education course ahead of acquiring their license for the season. In-person classes are provided by the Georgia Department of Natural Resources at no cost to prospective hunters, and there are also online options for those who prefer digital education, though those may come with fees.

Hunting in Georgia brings in a not-insignificant amount of tax funds, and provides for more than 20,000 jobs across the state. Total, the hunting industry in Georgia brings in more than $100 million in state and local taxes, and $145 million in federal tax revenue.

Reasonable Expectations

Given these numbers, it does make sense that lawmakers would be interested in expanding this lucrative state business. For many, the barrier to hunting comes from the cost of buying a gun and ammo, given that the education and license itself in the state are fairly inexpensive.

Reducing that potential barrier to entry could allow for more individuals to enter the hunting scene, as well as continue to provide the necessary mitigating effect against runaway wildlife proliferation. In this way, the new tax break could be a very good thing for the state of Georgia and the hunting industry therein.

Quick Reactions from the Public

There are many that don’t see the issue that way, though. After the new tax bill was announced, there were many who were quick to speak up, voicing their displeasure over the idea of potentially getting guns into the hands of even more people.

Additionally, Democratic Senator Jason Esteves released a statement which voiced his suspicions that the tax break was structured in such a way to favor gun manufacturers, rather than Georgia residents. If residents are able to buy more guns at a lower price, the manufacturers benefit in a big way.

A Political Ploy for Gun Manufacturers

When speaking to reporters, Esteves explained, “Instead of looking out for children and families, we’re looking out for gun manufacturers. [Republicans] want to pander to politics that, at the end of the day, do not help everyday Georgians.”

While there are some hardliners regarding gun rights in the liberal conference of the Georgia state legislature, many have tried to meet Republicans halfway when it comes to reasonable gun restrictions. A proposal has been raised that would give a $300 tax break on gun safety devices and training, which is a measure that has been backed by some Republicans.

Heartbreaking Statements

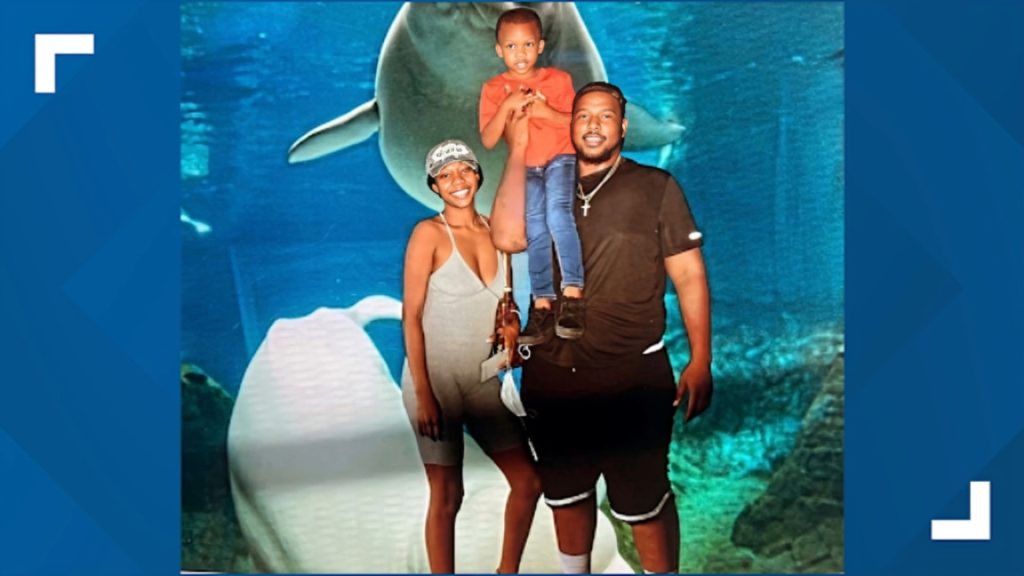

Citizens who had lost family members and other loved ones to gun violence were also quick to speak up against the new bill. Aaliyah Strong, who lost her husband in 2022 after being shot, released a statement that said, “[The proposal is] a slap in the face to people like myself, to all the other families who’ve lost someone to gun violence.”

Anavitarte was quick to respond, explaining that the bill was not intended to make it easier for criminals to get their hands on guns. He then went on to explain that if a criminal was going to be getting their hands on a gun, the tax breaks were the least of their concern, and he didn’t believe that they would be shopping for a gun in Georgia, anyway.

Heading to the House for the Vote

The bill is currently in the pipeline to go to the House for another vote, now that it’s passed the initial committee vote to be approved. If it passes both chambers, it will be sent to the state governor to be signed into law.

Whether the reactions of anti-gun advocates will result in changes to the proposal remains to be seen. It’s entirely possible that further limitations or modifications could be made during the debate and voting process, and the ultimate results of passing more lenient gun laws remain to be seen.