A TikToker recently stated that young people can’t afford homes, so they’re spending their cash in whatever way they can. Retail therapy is nothing like actual therapy, yet it’s an escape many of these young people have from the gloomy housing market. Let’s look closer at doom spending and what it could mean for us.

An Increase in Spending

It might be easy to think that people who throw money away on random stuff don’t care about the economy. The truth is that they do, but they don’t have the power to affect how it goes or how it impacts them.

The result? Most people have decided that they’re going to make the most of their time by buying the things they always wanted. Sure, they could save for a house, but since the property market is such a mess, why waste time and money on it?

Why Young People Are Buying Nice Things

One of the best explanations of the phenomenon comes from a TikToker, Maria (@firstgenliving). This TikToker says that many older people ask her why young people buy so many nice things they would never spend money on, even though they want them.

Maria tells them that it’s because they can’t afford anything else. Homeownership is out of reach for most young people, and since many of them aren’t having kids, they’re spending their money on things they want and will comfort them despite the harsh economic conditions.

Younger People Are At a Disadvantage

According to JP Morgan Chase, the prices of houses in November 2023 were the highest they’ve ever been. Even if they find a lovely home they want and save a bit of the downpayment, they’re still competing against people who can outbid them.

Statistically, the most significant demographic for homeowners is the Boomer generation. Thanks to working in a fast-growing economy and saving money while they progressed up the ladder, they now have a tremendous amount of money they can dedicate to outbidding younger people for a new home.

Despite a Budget Squeeze, Sales See Record Numbers

Spending over the holiday season in 2023 is uncharacteristically strong, given the state of inflation and the economy as a whole. Shoppers during the holiday season still came out in enormous numbers for Black Friday and Cyber Monday sales.

Most of these buyers were younger people who spent money they had been sitting on for a bit because it was clear things weren’t getting any better. Instead of waiting for the chance to buy a house that would never happen, they decided to enjoy that money and what it buys in the “now.”

Higher Prevalence Among Millennials and Gen Zs

Millennials still hoped to own a property, and many of them still hold onto long-term savings accounts. However, Gen Z is all for living in the moment. A Massive 73% of them state that they aren’t interested in planning for a future that might not be there.

This comes at a time when the US has a massive amount of people with less than $2,000 in their personal savings accounts. Many Millennials and Gen Zs don’t even have bank accounts since their trust in the economic system never recovered after the 2008 crash.

Is Doom Spending a Problem?

Most people just consider doom spending as buying nice things for themselves. Yet doom spending, much like doom scrolling, can have a negative impact on many people’s financial well-being while attempting to soothe their emotional well-being.

Doom spending sees Gen Zs and Millennials spend money without thinking about how they may need it in the future. They prefer living in the moment, and as Gen Z is the largest cohort of non-savers in the population, their approach to money differs from older generations.

What Causes Doom Spending?

The typical cycle of doom spending is similar to the cycle of bad news that makes its way across news feeds and social media reels worldwide. People hear about some atrocity in the world, affecting their emotional well-being.

To cope with this, they turn to retail therapy and buy something to make them forget about the ills of the world. Some of these are silly things, like a Stanley Cup for $40. Others can be excessive, like a three-night stay at Disney World, for the price of buying a new house.

It’s About Affordability

The crux of the matter is that doom spending sits at the crossroads between affordable housing and the state of the world as it is today. No one can change how global geopolitics plays out. The government seems like they aren’t concerned about the ballooning cost of housing either.

When faced with this, Millennials and Gen Z decide to do what they can afford. They can’t own a house, but they can afford the travel. Since the future is uncertain, they determine that living for today is the best approach to life.

A Fundamental Lack of Trust And Understanding

The 2008 global financial crisis did more than just cause banks to suffer. It undermined the public’s trust in its leadership and its ability to do anything to help regular people. This lack of confidence has carried over to today and explains why so many Gen Zs oppose saving money.

Lack of confidence in leadership coupled with the ever-worsening state of the world regarding conflicts and insurrections makes it difficult for young people to imagine a future, much less one they’d enjoy.

Temporary Happiness Beats Long-Term Disappointment

Young people have been betrayed by the institutions and people they’ve put in power to help them. Because of that, they are facing what’s probably the worst housing crisis the US has ever seen and leadership that seems directionless and powerless to help.

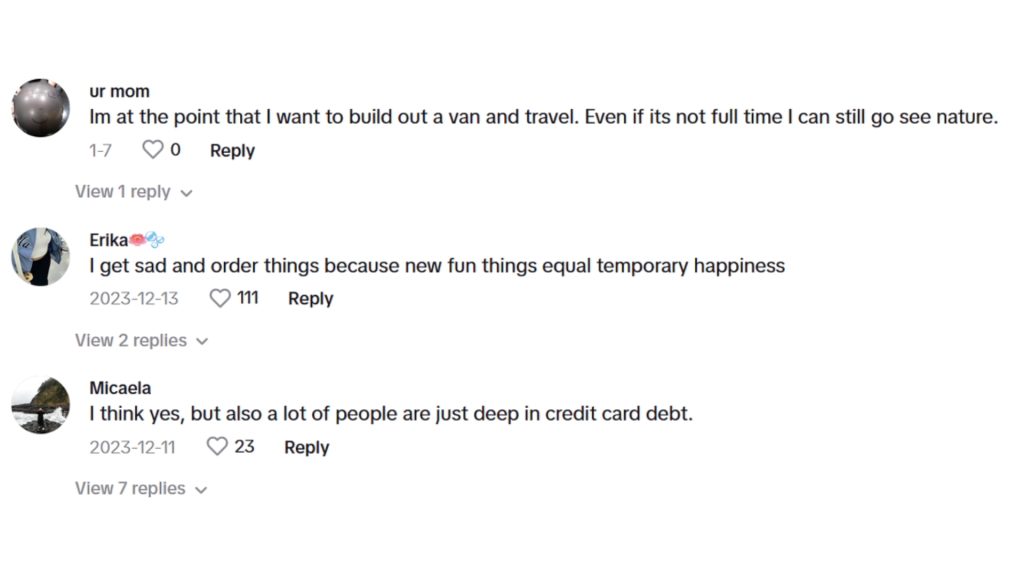

The 2024 elections will likely replay the previous one, and young voters will again face two “non-options.” In this case, a quote from one of Maria’s followers summarizes it best: “I get sad and order things because new fun things equal temporary happiness.”