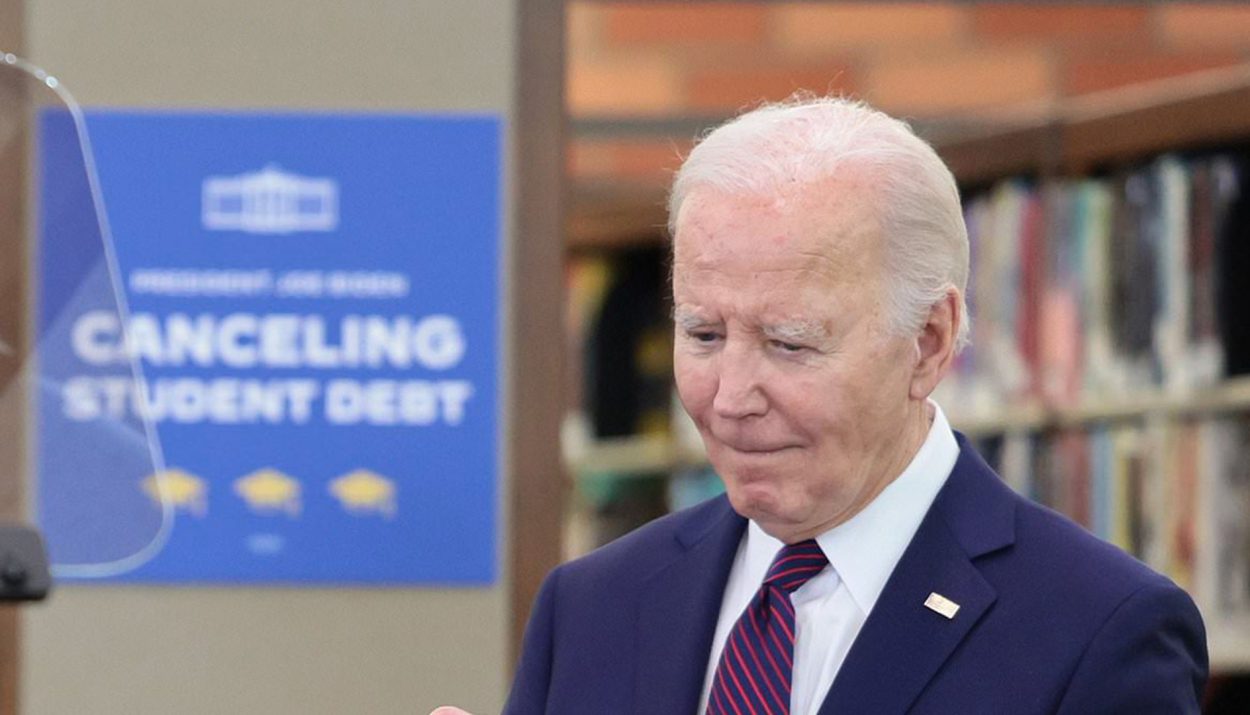

The Biden administration has disclosed its plans for the Next Wave of Aid for 277,000 student loan borrowers amid legal challenges from Republicans.

The latest round of relief wipes out $7.4 billion in student loans, thus bringing the total debt relief approved by the Biden administration to $153 billion, as reported by the White House.

Not Everyone Is Celebrating

But there’s no decision made in the White House that doesn’t come in for criticism and this one is no different. While some have celebrated the move and applauded the government’s efforts, many others are not celebrating it.

“You’re incentivizing people to not pay back student loans and at the same time penalizing and forcing people who did to subsidize those who didn’t,” Rep. John Moolenaar reportedly said during a hearing last week, where Education Secretary Miguel Cardona spoke on the Education Department’s budget request for 2025.

Education Secretary, Cardona Says Government Is Fixing What’s Broken

Cardona gave a counterargument to the criticisms. He mentioned that the aid is the government’s efforts to fix what’s broken.

“I don’t see it as unfair. I see it as we’re fixing something that’s broken,” Cardona responded. “We have better repayment plans now so we don’t have to be in the business of forgiving loans in the future.”

Biden Continues Peacemeal Student Loan Forgiveness Approach

Biden is not relenting in his Peacemeal approach to student loan forgiveness after the Supreme Court dismissed his initial strategies last year. On April 17, the administration announced its first draft of rules for forgiveness.

“We are once again sending a clear message to borrowers who had low balances: if you’ve been paying for a decade, you’ve done your part, and you deserve relief,” said U.S. Secretary of Education Miguel Cardona.

Who Is Eligible For Forgiveness?

A total of about 206,800 people who originally borrowed $12,000 or less and are also enrolled in the new SAVE plan will benefit from the majority of relief. An extra 65,000 that are enrolled in repayment plans will have the amount they owe reduced through “administrative adjustments.”

Another 4,600 borrowers will get their relief through changes to Public Service Loan Forgiveness (PSLF). You can read more on the SAVE plan in the latter part of this article.

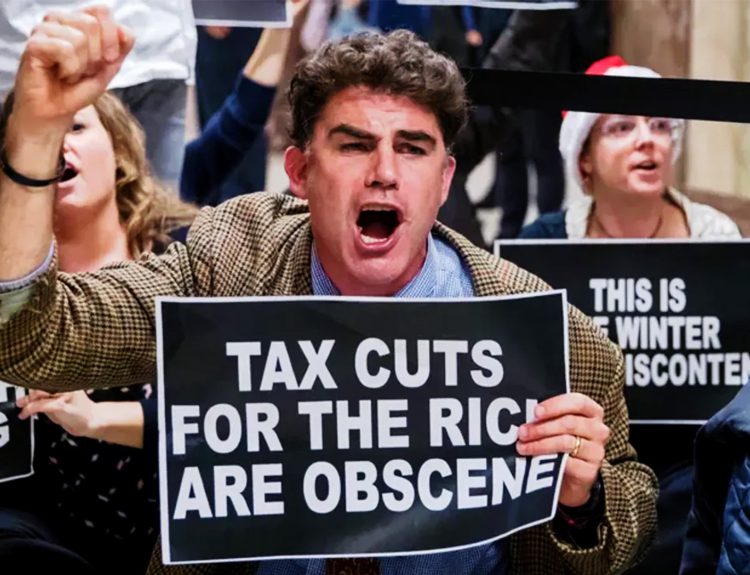

Biden’s Debt Relief Policy Faces Republican Opposition

According to CNBC, over half of House Republicans and 40 GOP senators (which includes Minority Leader Mitch McConnell) are not in support of the Biden administration’s debt relief policy.

In early February, they submitted briefs to the U.S. Supreme Court, contending that the forgiveness plan should be deemed “illegal.”

Biden’s Move A ‘Slap In The Face’, McConnell Says

McConnell trash-talked the move on X, formerly known as Twitter, calling it a “slap in the face” to those who had already settled their loans and made substantial professional and personal self-denials to evade student debt.

“President Biden’s inflation is crushing working families, and his answer is to give away even more government money to elites with higher salaries,” the GOP leader said in his statement.

The Administration Is Tone Deaf!

Some Republicans have reportedly labeled his latest plans to forgive student debt a political ruse to win the hearts of young voters ahead of this November’s election.

“The administration is tone-deaf. There’s no other way to put it,” said Education and the Workforce Committee chairwoman Virginia Foxx (R-NC) in a statement, dubbing Biden’s plans an “illegal loan scheme.” “What is absolutely maddening is that the administration is STILL not doing its job and instead focusing on its student loan shenanigans. “Enough is enough, Mr. President,” she added.

18 States File Lawsuits Against Biden Administration

Meanwhile, 18 states have filed two separate lawsuits against the Biden administration because of the SAVE program. They claim that it sabotages a separate cancellation scheme that helps careers in public service.

Yet again, the President is unilaterally trying to impose an extraordinarily expensive and controversial policy that he could not get through Congress,” reads the lawsuit filed Tuesday by attorneys general in Missouri, Arkansas, Florida, Georgia, North Dakota, Ohi, and Oklahoma.

Lawsuit Leaves Unanswered Questions

With that said, the lawsuits don’t say what will happen to people who already had their debts cleared by the SAVE program.

A court document filed by Kansas’ attorney general says it’s “unrealistic to think that any loan forgiveness that occurs during this litigation will ever be clawed back.”

How Does The Save Plan Work?

The SAVE plan seeks to assist borrowers who face more difficulty with repaying their loans. According to the Department of Education (DoE), most federal student loan borrowers in default initially borrowed $12,000 or less and that’s the criteria of eligibility for this wave of the SAVE plan relief.

For those who borrowed more than $12,000 through SAVE, they’ll get relief for every extra $1,000 borrowed after a year of payments.

Approx. 153,000 Set To Benefit With Immediate Effect

The Department of Education thinks this new round of relief will assist around 153,000 borrowers with almost immediate effect. Those who qualify for early relief but are not a part of the SAVE program yet will get a reminder from the Department of Education to sign up quickly.

It’s important because all SAVE plan participants are set to receive debt forgiveness after either 20 or 25 years, depending on whether or not they have graduate school loans.

Ongoing Fight For Debt Cancelation

The Biden administration has now ratified loan relief for almost 3.9 million borrowers — and according to Cardona: “Our historic fight to cancel student debt isn’t over yet.”

Washington’s recent $1.2 billion debt cancellation comes after a huge announcement on February 15 when President Biden proposed broadening student debt forgiveness to individuals experiencing financial “hardship.” This proposal would leave the responsibility of determining what qualifies as ‘hardship’ to the Department of Education.

Millions Of Students Counting On Biden Administration To Fix Flawed Student Loan System

In January, the administration wiped off $4.9 billion in student loan debt for 73,600 borrowers by making changes to the income-driven repayment (IDR) forgiveness and Public Service Loan Forgiveness (PSLF) programs.

The U.S. Secretary of Education, James Kvaal stated that millions of student loan borrowers are counting on the Biden administration to repair the flawed student loan system and provide the forgiveness they earned and have been waiting for.”