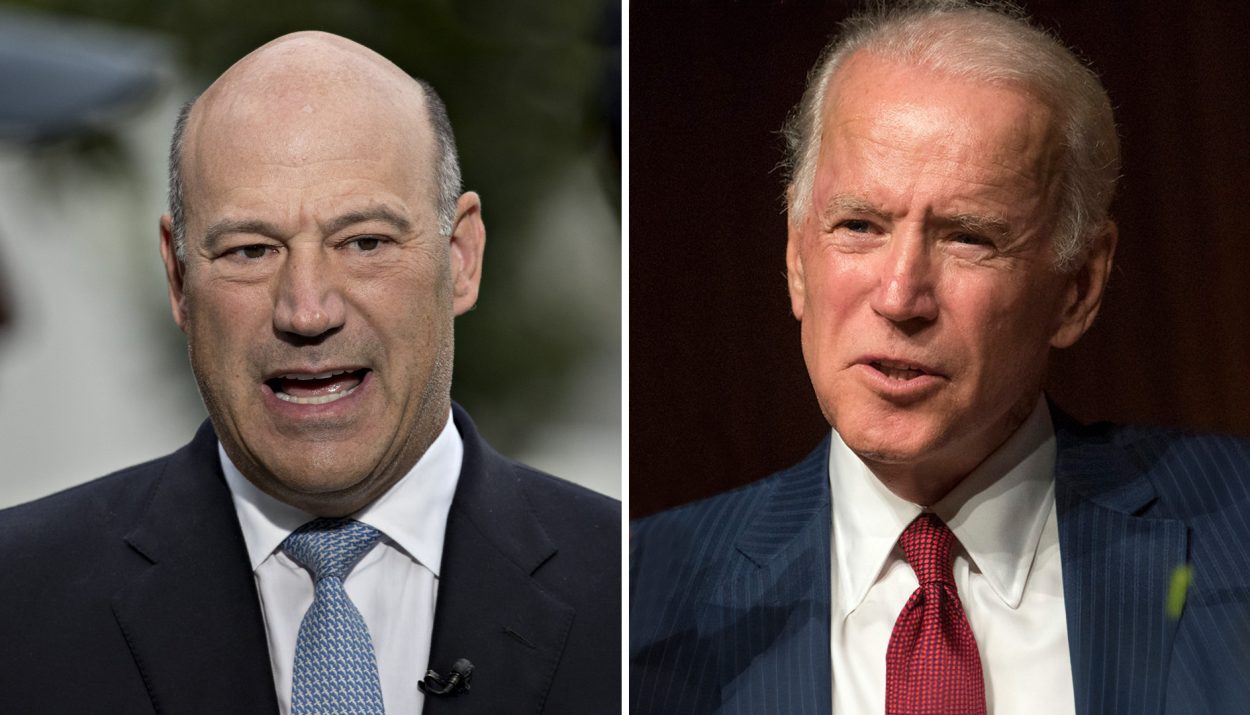

In a shocking revelation, Gary Cohn, IBM vice chair and former Trump economic adviser, has called out President Biden’s recent claim about billionaires not paying their fair share of taxes. Cohn’s statements on CBS’s “Face the Nation” have sparked a heated debate about the U.S. tax system and the role of the wealthy in contributing to the nation’s coffers.

Biden’s Jab at Billionaires Falls Flat

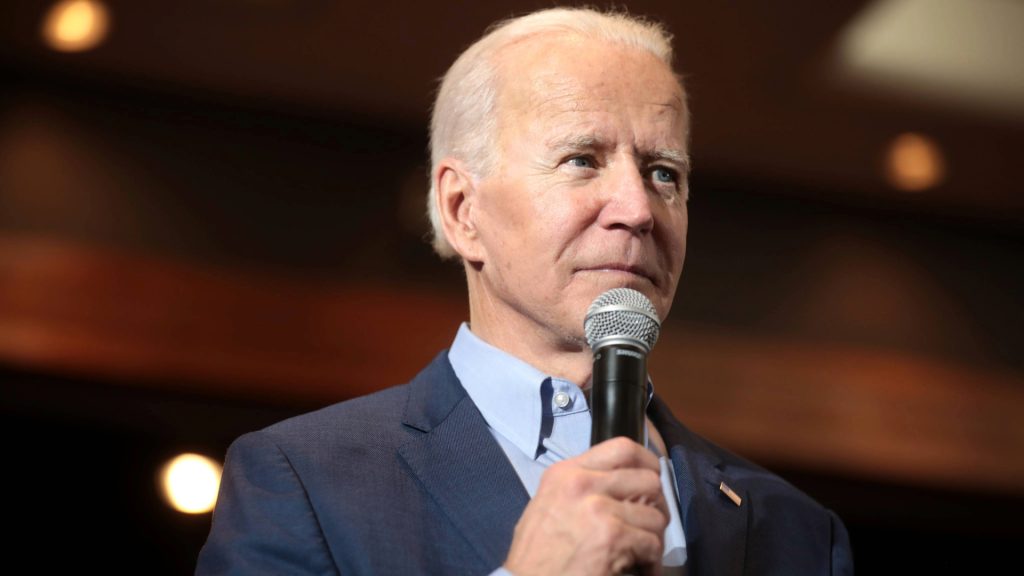

During his State of the Union address last week, President Biden tried to tap into the perception that the wealthy have greater advantages than the “little guy.” He claimed that billionaires pay a lower tax rate than teachers and proposed a minimum 25% tax on billionaires.

However, Gary Cohn, IBM vice chair and former Trump economic adviser, has called out the flaw in Biden’s argument. Cohn pointed out that billionaires with income in the U.S. pay at least 20% in taxes, thanks in large part to the Trump administration’s 2017 tax code changes.

The Numbers Tell a Different Story

Cohn presented eye-opening statistics about who pays taxes in the United States. According to him, the bottom 50% of earners pay a mere 2.3% of the total tax collected, while the top 10% contributes over 70% of the tax collected in the country.

These numbers paint a very different picture than the one presented by Biden. Cohn’s revelation suggests that the wealthy are already contributing a significant portion of the nation’s tax revenue and that targeting billionaires may not be the solution to the country’s fiscal challenges.

Billionaire Status Does Not Equal Taxable Income

Cohn identified a key problem with Biden’s talking point about billionaires. He noted that being a billionaire is a measure of net worth, not a description of one’s taxable income. In other words, someone can be a billionaire but have no taxable income at all.

This is because some people may be sitting on assets, both liquid and illiquid, that do not generate taxable income. Cohn emphasized that the U.S. does a very good job of taxing income, with no income escaping a minimum 20% tax, barring tax-free bonds.

Trump’s 2017 Tax Code Changes Explained

The Trump administration’s 2017 tax code overhaul played a significant role in ensuring that billionaires pay their fair share of taxes. The changes streamlined the tax system, closed loopholes, and ensured that high-income earners, including billionaires with taxable income, pay at least a 20% tax rate.

Cohn, who served as the chief economic adviser during the Trump administration, played a crucial role in shaping these tax reforms. He believes that the current tax system is effective in taxing income and that Biden’s proposed changes could be counterproductive.

The Perception vs. Reality of Wealth Inequality

President Biden’s claims about billionaires not paying their fair share of taxes tap into a broader perception of wealth inequality in the United States. Many Americans believe that the wealthy have unfair advantages and do not contribute enough to the country’s welfare.

However, Cohn’s revelations challenge this perception. The data suggests that the wealthy, particularly the top 10% of earners, are already contributing a disproportionately large share of the nation’s tax revenue. This raises questions about the effectiveness of targeting billionaires as a solution to wealth inequality.

The Complexities of Taxing Wealth

While income taxation is relatively straightforward, taxing wealth is a much more complex issue. Wealth often consists of assets, such as real estate, stocks, and other investments, which may not generate regular taxable income. This makes it challenging to design a fair and effective wealth tax system.

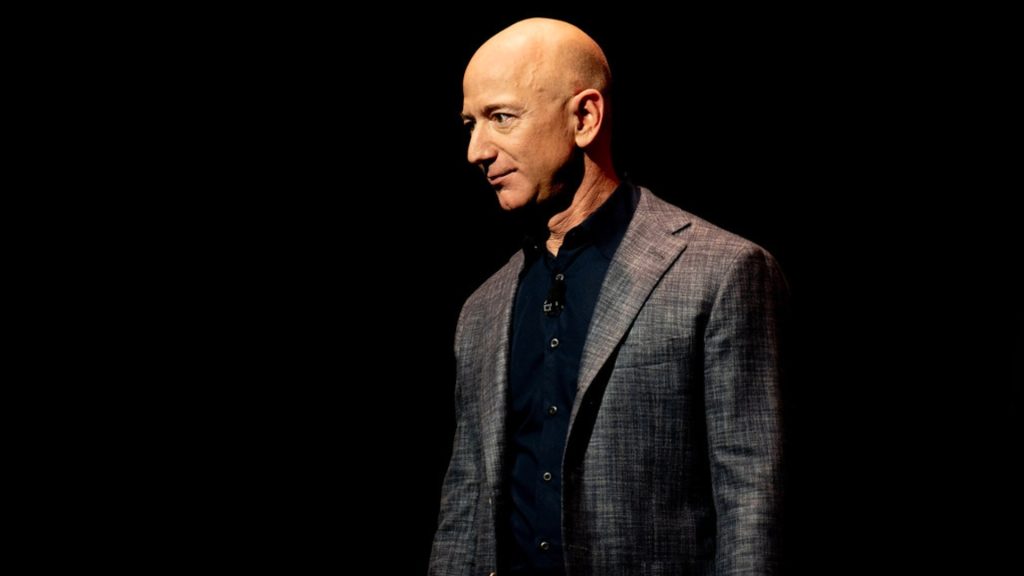

Moreover, some argue that taxing wealth could discourage investment, entrepreneurship, and economic growth. If the wealthy are penalized for accumulating assets, they may be less likely to invest in businesses, create jobs, and drive innovation. This could ultimately harm the very people the wealth tax aims to help.

The Role of Billionaires in the U.S. Economy

Billionaires play a significant role in the U.S. economy, often driving innovation, creating jobs, and contributing to charitable causes. Many of the country’s most successful companies, such as Amazon, Tesla, and Microsoft, were founded by billionaires who took risks and invested heavily in their vision.

While it is important to ensure that everyone, including billionaires, pays their fair share of taxes, it is equally crucial to recognize the positive contributions they make to the economy. Policies that disincentivize wealth creation and investment could have unintended consequences for the nation’s economic growth.

The Debate Over Biden’s Corporate Tax Hike Plans

In addition to targeting billionaires, President Biden has also proposed raising the corporate tax rate from 21% to 28% and increasing the 15% corporate minimum tax on companies reporting over $1 billion in profit to 21%, as per the 2022 Inflation Reduction Act.

These proposed changes have sparked a heated debate among business leaders, economists, and policymakers. Supporters argue that higher corporate taxes will help fund essential government programs and reduce the deficit, while critics warn that they could stifle economic growth, deter investment, and ultimately hurt American workers and consumers.

The Impact of Corporate Taxes on American Businesses

Corporate taxes have a direct impact on the competitiveness and profitability of American businesses. Higher tax rates can make it more difficult for companies to invest in research and development, expand their operations, and create new jobs. This is particularly challenging in an increasingly globalized economy, where businesses can easily relocate to countries with more favorable tax policies.

Moreover, many argue that the burden of corporate taxes ultimately falls on workers and consumers, rather than shareholders. When companies face higher tax bills, they may be forced to cut wages, reduce benefits, or raise prices, which can negatively impact the very people the tax hikes are intended to help.

Finding a Balance in the Tax System

Creating a fair and effective tax system is a delicate balancing act. On one hand, it is essential to ensure that everyone, including the wealthy and corporations, pays their fair share and contributes to the nation’s well-being. On the other hand, overtaxing can have unintended consequences that harm economic growth and job creation.

Policymakers must carefully consider the trade-offs and unintended consequences of any proposed tax changes. This requires a nuanced understanding of the complex interplay between taxation, economic incentives, and human behavior. Ultimately, the goal should be to create a tax system that is equitable, efficient, and conducive to long-term economic prosperity for all Americans.

The Need for a Comprehensive Tax Reform

The debate over billionaire taxes and corporate tax hikes highlights the need for a comprehensive reform of the U.S. tax system. Rather than focusing on piecemeal changes targeting specific groups, policymakers should aim to simplify the tax code, close loopholes, and create a more transparent and predictable system that encourages compliance and minimizes distortions.

A well-designed tax system should strike a balance between fairness, efficiency, and simplicity. It should provide sufficient revenue to fund essential government services and programs while minimizing the burden on taxpayers and businesses. Achieving this balance requires a thoughtful, evidence-based approach that goes beyond partisan rhetoric and political posturing.

The Global Context of Taxation

The debate over taxation in the United States must also be viewed in the context of an increasingly interconnected global economy. As businesses and individuals become more mobile, countries compete to attract investment and talent through favorable tax policies. This has led to concerns about a “race to the bottom” in corporate tax rates and the erosion of national tax bases.

To address these challenges, there have been calls for greater international cooperation and coordination on tax matters. Initiatives such as the OECD’s Base Erosion and Profit Shifting (BEPS) project aim to combat tax avoidance and ensure that profits are taxed where economic activities occur and value is created.

The Role of Public Discourse and Civic Engagement

The debate over billionaire taxes and corporate tax hikes underscores the importance of public discourse and civic engagement in shaping tax policy. In a democratic society, citizens must have access to accurate information and participate in informed discussions about the trade-offs and implications of different tax proposals.

Media outlets think tanks, and educational institutions play a crucial role in fostering a constructive dialogue on tax policy. By providing objective analysis, fact-checking claims, and facilitating open debates, they can help elevate the quality of public discourse and promote evidence-based policymaking.

Charting a Path Forward

As the United States grapples with the challenges of creating a fair and effective tax system, it is clear that there are no easy answers. The debate over billionaire taxes and corporate tax hikes is just one facet of a much larger conversation about the role of taxation in society.

Moving forward, policymakers, experts, and citizens must work together to chart a path that balances competing priorities and promotes the long-term well-being of the nation. This requires a commitment to evidence-based policymaking, civil discourse, and a willingness to find common ground in pursuit of the greater good. Only by working together can we build a tax system that works for all Americans.