A recent development in the climate change arena has seen two major financial institutions, JPMorgan Chase and BlackRock, withdraw from the UN-convened Net Zero Banking Alliance over reported concerns about the prescriptiveness of some of the alliance’s policies.

With sustainability and climate change mitigation efforts being taken more seriously by the finance industry, this move indicates potential tensions between cooperative international frameworks and maintaining competitiveness and autonomy when it comes to strategy.

JPMorgan and BlackRock Exit Net Zero Asset Managers Initiative

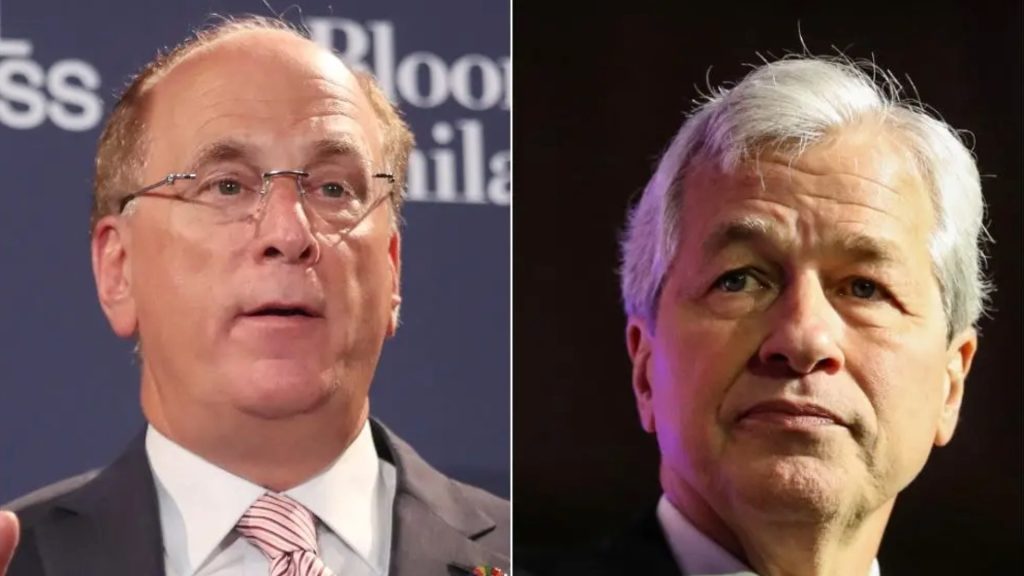

JPMorgan Chase and BlackRock, two of the world’s largest asset managers, recently announced their departure from the Net Zero Asset Managers initiative. According to a statement by JPMorgan Chase, the exit is due to the growth of its internal sustainability team and risk framework over the years.

Source: The TRADE

“The firm has built a team of 40 dedicated sustainable investing professionals, including investment stewardship specialists who also leverage one of the largest buy-side research teams in the industry,” JPMorgan Chase said in a statement. “Given these strengths and the evolution of its stewardship capabilities, JPMAM has determined that it will no longer participate in Climate Action 100+ engagements.”

BlackRock Scales Back Involvement and State StreetGlobal Advisors is Out

BlackRock, the world’s largest asset manager, announced it would scale back involvement in the Net Zero Asset Managers initiative. BlackRock withdrew its U.S. business from the initiative but will continue participation through its smaller international entity, where the majority of clients are pursuing decarbonization goals.

State Street Global Advisors, another major asset manager, announced its complete exit from the Net Zero Asset Managers initiative. According to State Street, the initiative’s “phase 2” commitments conflicted with the firm’s internal investing policies.

Background on the Net Zero Asset Managers Initiative

The Net Zero Asset Managers initiative is a group of international asset managers committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5 Celsius. Launched in December 2020, the initiative aims to accelerate the transition to net zero emissions by engaging with portfolio companies and policymakers.

As of June 2022, the Net Zero Asset Managers initiative has 128 signatories with over $43 trillion in assets under management. Membership has grown rapidly, highlighting the increasing commitment of large asset managers to tackling climate change.

Commitments, Strategies, and Criticism

Members of the Net Zero Asset Managers initiative commit to transitioning their investment portfolios to net zero greenhouse gas emissions by 2050. This includes engaging with portfolio companies to encourage them to set emissions reduction targets, improving climate-related financial disclosures, and allocating capital to climate solutions.

The Net Zero Asset Managers initiative has faced criticism from Republican lawmakers and attorneys general who argue that the group’s activities may undermine government policymaking. They have warned that the initiative could negatively impact domestic energy companies and raise consumer prices.

Reasons for JPMorgan and BlackRock’s Departure

JPMorgan Chase and BlackRock recently announced their departure from the Climate Action 100+ alliance, citing conflicting priorities with the group’s objectives. According to documents, JPMorgan Chase stated that the expansion of its internal sustainability team and establishment of climate risk frameworks led the firm to conclude it would no longer participate in the alliance’s engagements.

Similarly, BlackRock withdrew its U.S. business from the alliance, shifting involvement to its smaller international entity, where clients are pursuing decarbonization goals. In addition to conflicting priorities, JPMorgan Chase, BlackRock and State Street Global Advisors expressed concern over potential legal issues from the alliance’s climate initiatives.

Implications of the Exits for the Climate Initiative

The withdrawal of major financial institutions like JPMorgan Chase, BlackRock, and State Street Global Advisors is a blow to Climate Action 100+. It signifies a loss of key members and investor confidence in the initiative. Together, these firms manage trillions of dollars in assets and were instrumental in establishing and growing the climate alliance.

Their sudden departure casts doubt on the initiative’s effectiveness and questions whether it can achieve its objectives without strong backing from major players in the financial sector. The exits also highlight the legal and policy issues confronting climate alliances like Climate Action 100+.

Conflicts With Business Interests

For some companies like State Street, membership in Climate Action 100+ conflicted with their own business interests and investment policies. As the initiative enters its second phase with more demanding commitments from signatories, it may require firms to take actions that do not align with their fiduciary responsibilities to clients or shareholders.

Rather than face such conflicts, major financial institutions may prefer to pursue climate goals independently or work with partners whose objectives are more compatible. While the initiative still has hundreds of members and significant assets under management, its influence and ability to drive meaningful change may be diminished without the participation of leading global financial firms.

Investors Express Disappointment But Understanding

Investors expressed disappointment at the news that major firms were scaling back or exiting the Climate Action 100+ initiative. However, some investors also acknowledged the companies’ legal and policy pressures regarding their environmental, social and governance priorities.

“It’s unfortunate to see key players like JPMorgan and BlackRock step back from Climate Action 100+ just as the initiative is ramping up its asks of companies,” said Mindy Lubber, CEO of Ceres. This sustainability nonprofit helps manage the climate alliance. “But we understand the complex pressures they’re under and appreciate their continued support of our mission.”

Climate Activists Call Moves ‘Shortsighted’ and ‘Irresponsible’

Climate activists were sharply critical of the moves by JPMorgan, BlackRock and State Street, calling them “shortsighted,” “irresponsible” and “a betrayal.” They argue the firms have a moral obligation to use their influence to push companies toward decarbonization and a transition to renewable energy.

“By abandoning Climate Action 100+, these huge asset managers are signaling they don’t really care about climate change or the catastrophic effects it will have,” said Richard Brooks, climate campaign coordinator for Stand.earth, an environmental advocacy organization.

Policymakers Welcome the News, Call for Further Action

Republican policymakers, who have warned that climate alliances like Climate Action 100+ infringe on government authority and harm domestic energy companies, welcomed the news. However, some called on the firms to take further action to curb “collusive” environmental, social and governance (ESG) investing activities.

“This is a good first step, but more is needed,” said Rep. Jim Jordan (R-Ohio), ranking member of the House Judiciary Committee. “These massive asset managers must completely abandon their collusive ESG actions, which distort the free market and impose a left-wing agenda on American companies and consumers. We will continue to closely oversee these firms to make sure they are acting legally and in the best interests of their clients.”