Despite recent economic growth, Federal Reserve Chair Jerome Powell cautioned during his semiannual monetary policy testimony before Congress that the United States remains on an unsustainable fiscal path in the long run.

Powell warned that rising deficits and debt levels could restrain growth and destabilize financial markets if left unaddressed. While the economy appears strong, Powell advised policymakers to enact reforms to curb entitlement spending and increase revenues. Failure to do so could jeopardize the nation’s future prosperity, according to the Fed Chair.

Current Economic Growth

The U.S. economy has experienced strong and steady growth recently. According to the Bureau of Economic Analysis, the GDP grew at an annual rate of 3.3% in the fourth quarter of 2023. This marks the sixth consecutive quarter of GDP growth over 2%. Consumer spending, which accounts for roughly 70% of the total economy, drove this growth.

However, Federal Reserve Chair Jerome Powell has warned that despite the current economic growth, the U.S. fiscal path is unsustainable in the long run. The total U.S. national debt recently surpassed $34 trillion, continuing its upward trend. The debt is growing faster than the economy, which Powell asserts is unsustainable.

Reviewing the Current State of the Economy

The U.S. economy has experienced steady growth over the past year. According to the Bureau of Economic Analysis, the gross domestic product expanded at an annual rate of 3.3% in the fourth quarter of 2023. This marks the sixth consecutive quarter of GDP growth above 2% and indicates the economy’s resilience and momentum.

Consumer spending, which accounts for roughly 70% of economic activity, rose by 2.8% in the fourth quarter. Consumers spent more on various goods and services, including recreational vehicles, clothing, hotels, and restaurants.

Declining Inflation

Inflationary pressures have eased notably over the past year. The consumer price index rose 1.7% year over year in the fourth quarter, down from 2.6% in the third quarter and well below the recent peak of 9% in summer 2022.

Falling inflation will reassure the Federal Reserve, which raised interest rates aggressively throughout 2022 and 2023 to curb rising prices. With inflation stabilizing around the Fed’s 2% target, the central bank has signaled its intention to cut rates in 2024 to support continued economic expansion.

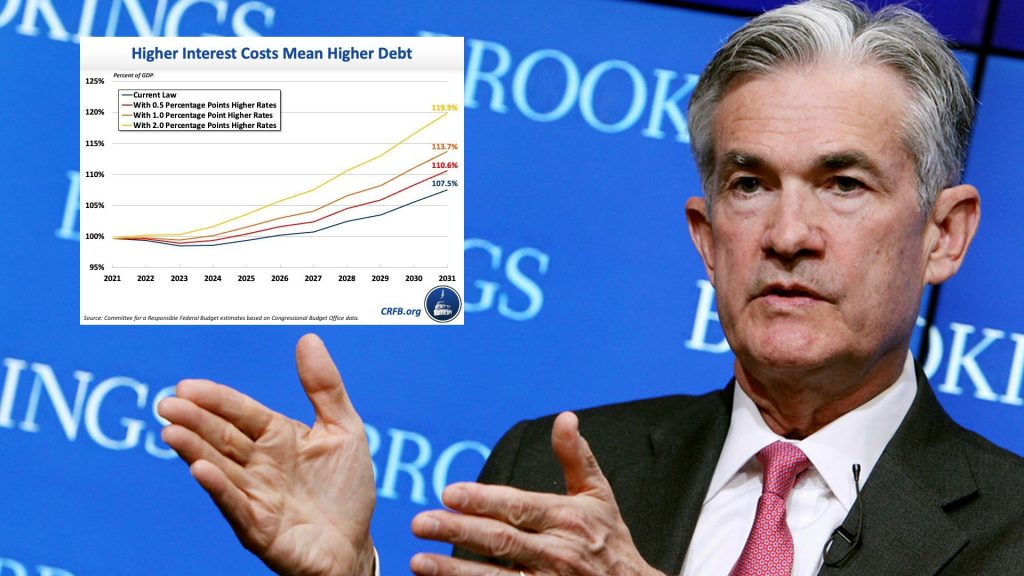

Higher Interest Rates on Government Borrowing

If investors become concerned about the government’s ability to pay its debt, they will demand higher interest rates to compensate for the risk. The government would then have to pay more in interest costs, diverting resources away from other priorities like national defense, healthcare, education, and infrastructure. This could slow economic growth over the long run and reduce living standards.

While Powell believes the economy is currently in a good place, the Fed chair has cautioned that policymakers need to make progress on addressing the structural drivers of the growing budget deficit and national debt. Fiscal reforms are necessary to ensure that the economy remains on a stable long-term trajectory.

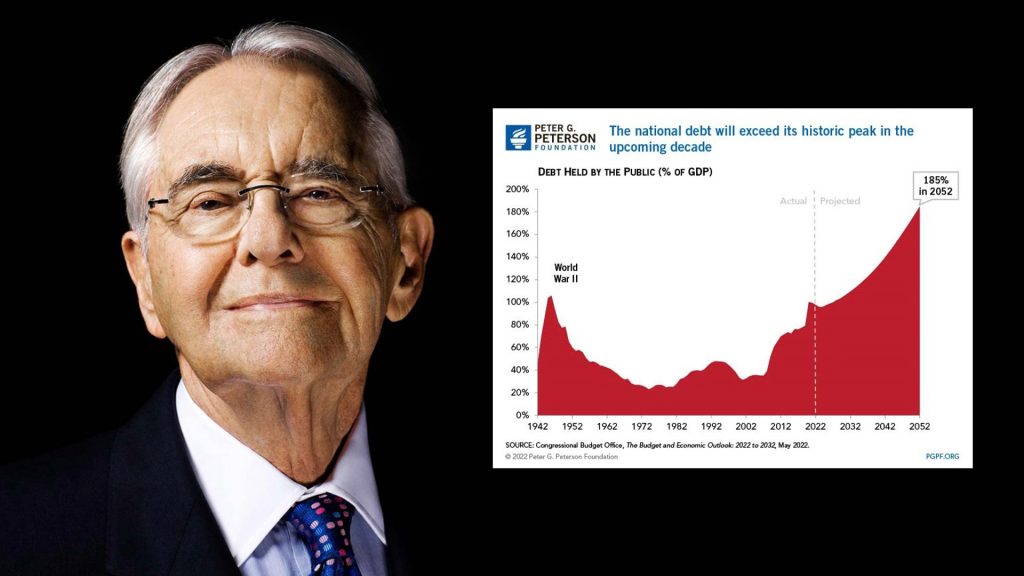

America’s Rising Debt Burden – Causes and Consequences

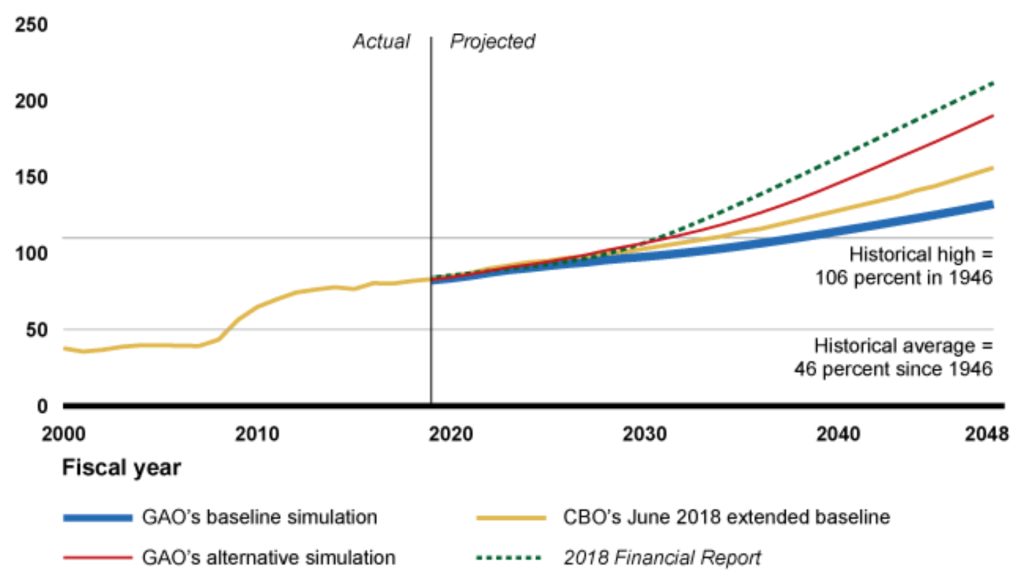

The growing national debt is primarily the result of sustained budget deficits, where government spending exceeds tax revenues. According to the Congressional Budget Office (CBO), the federal budget deficit was $984 billion in F.Y. 2019, and it is projected to average $1.2 trillion between 2020 and 2029.

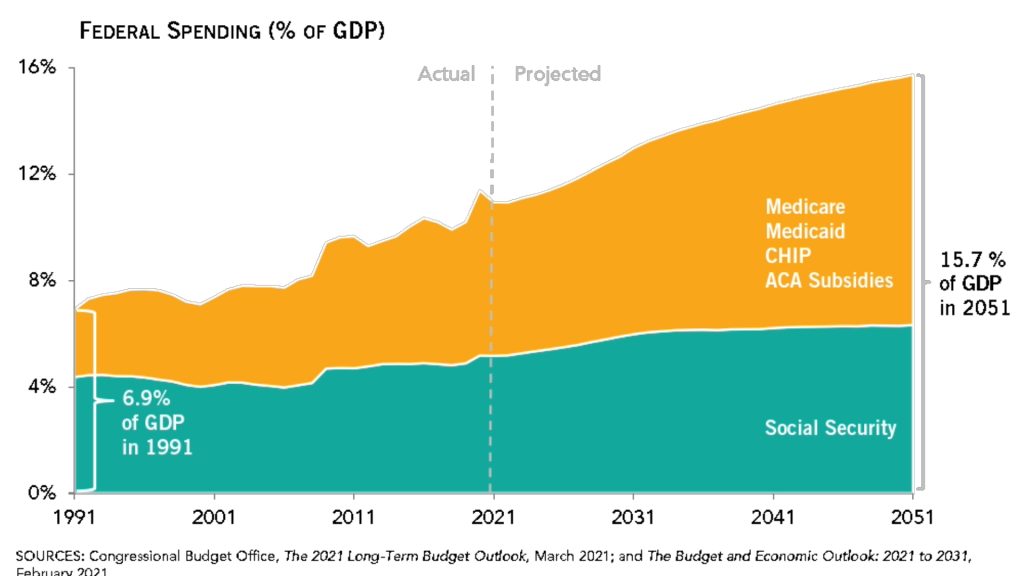

Despite a strong economy, tax cuts and spending increases have widened the deficit. The CBO warns that such high deficits will slow economic growth over the long run. A major driver of increasing deficits is the rapid growth of mandatory spending on entitlement programs like Social Security and Medicare. As the population ages, spending on these programs is projected to rise substantially.

Slowing the Growth of Entitlement Spending

The two largest mandatory spending programs, Social Security and Medicare, face serious long-term financing issues. The aging population in the U.S. is straining the resources of these programs. The number of beneficiaries continues to grow while the number of workers paying into the system declines.

Reforms to slow the growth of these programs could include measures like raising the retirement age, reducing benefits for higher-income individuals, and increasing Medicare premiums. Some proposals suggest transitioning Social Security to a system of private retirement accounts. Workers would invest a portion of their payroll taxes in the stock market through individual accounts.

Means-Testing Benefits

Means-testing benefits would reduce or eliminate payments for higher-income individuals. For example, raising the threshold for Social Security benefits or increasing Medicare premiums for those with higher incomes.

While means-testing could generate budget savings, critics argue it may undermine public support for these programs if they are perceived as welfare rather than social insurance. There are also concerns that it may discourage saving for retirement.

Policy Options to Improve Fiscal Sustainability

One approach is to cut government spending by reducing funding for federal programs and agencies. However, reducing spending on essential services and benefits could negatively impact vulnerable populations.

Another strategy is to invest in programs and infrastructure that boost long-term economic growth. For instance, increased investments in education, job training programs, and infrastructure could strengthen the economy and raise tax revenues to offset debt. However, it may take time for these investments to generate returns.

Political Challenges in Addressing the Debt Crisis

The increasing national debt poses severe challenges that require bipartisan cooperation to address. However, political polarization and partisanship have stymied efforts to develop viable solutions. Congress narrowly avoided defaulting on the national debt in 2023 after a standoff between President Biden and House Republicans.

The partisan brinkmanship led Fitch Ratings to downgrade the U.S. credit rating, citing “a steady deterioration in standards of governance.” The repeated failure of political leaders to responsibly address debt levels poses real risks.

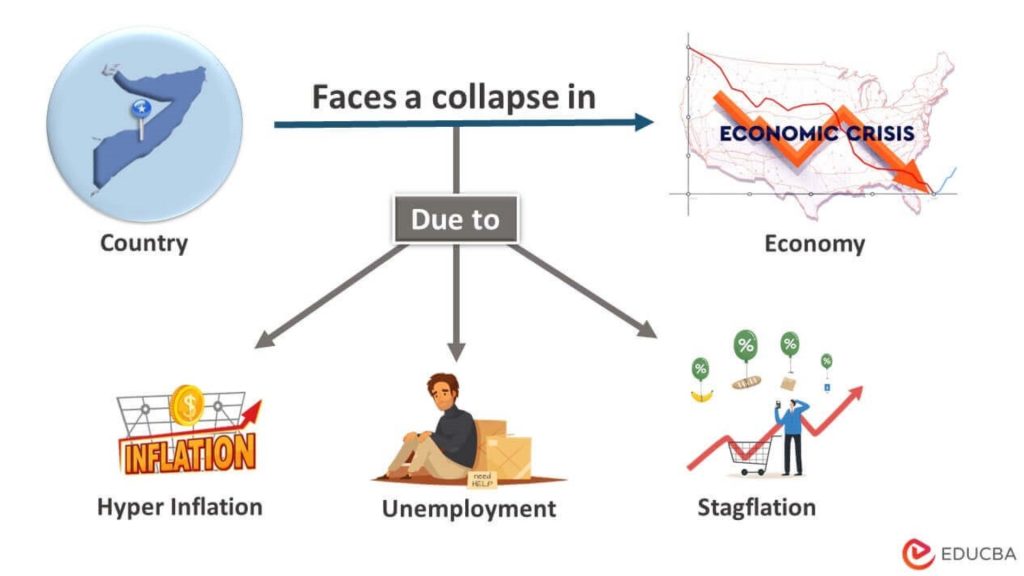

What a Fiscal Crisis Could Mean for the Economy

If the U.S. were to experience a fiscal crisis due to its unsustainable debt levels, the implications for the economy could be severe. As Federal Reserve Chairman Jerome Powell warned, the growing national debt is on an “unsustainable path” if it continues to outpace economic growth. Should investor confidence in U.S. treasuries weaken, interest rates could rise substantially.

Higher interest rates would slow growth by making it more expensive for businesses and consumers to borrow money. According to Fitch Ratings, downgrades to the U.S. credit rating could also weaken the dollar and raise costs for the government to issue new debt. Such a scenario may lead to a vicious cycle of rising rates and slowing growth that policymakers struggle to escape.