In an idealized world, social and economic classes wouldn’t exist. Everyone would know their neighbor, and it wouldn’t matter what you did for work or who your family was. Unfortunately, we don’t live in an idealized world, and information is coming to light that highlights exactly how stark the class and wealth differences are in the United States.

The Wealth Gap Looms

The United States’ unfettered capitalism has led to significant striations in social and economic classes. The economic gap between the wealthiest Americans and the poorest Americans is at an all-time high, and many individuals are feeling the inequality keenly.

In recent years, the wealth gap between Americans has grown exponentially. Despite the idealized vision of America where anyone can become rich if they’re simply willing to work hard enough, the reality does not reflect the ideal.

An Understandable Attitude

In a country where the top 10% own 66% of the total wealth in the country, it’s understandable why there would be a good deal of discontent regarding income inequality and the wealth gap. The truth of the matter, though, is that this is not a one-sided attitude.

Recent studies show that the socioeconomic classes are mixing less and less as the years go on. With the rise of online shopping and remote work, individuals are finding fewer and fewer reasons to leave their homes and interact with people who are different from them.

Reflected in History

This is not the first time that there has been significant wealth inequality in the United States. Some would argue that the country’s history is steeped in it, in a way that makes it nearly impossible to escape.

These individuals point to the Civil War as an example of wealth inequality taken to the extreme. After all, the civil war was fought over the ability of Southern wealthy landowners to continue holding slaves, who were, by nature, the lowest possible of any human class.

Clear Economic Classes

If you don’t subscribe to this theory, it is still true that America has always had very clear economic classes, and the divide between them has only gotten more significant over time.

The Industrial Revolution, in particular, led to a boom of average Americans suddenly becoming exponentially wealthier due to their genius and innovation. Henry Ford leapt into prominence from his farming childhood with the advent of the Model T, taking cars from an expensive luxury to an affordable convenience for all Americans.

The Golden Age of the American Dream

There are dozens of stories like Ford’s from the early 20th century, showcasing individuals who were able to suddenly gain wealth through one industry or another. This was the golden age of the American Dream, where anyone could make anything happen for themselves, as long as they were willing to dig in and do a little bit of hard work.

This attitude continued on into the sixties and the seventies, when many major brands that have become staples of American life started. Sam Walton first conceived of the convenience store that would become Wal-Mart in 1962, and grew his empire to include Sam’s Club in 1983.

Economics Affected by Global Events

These success stories were not without their pitfalls, of course. Global events affected every industry, with wars and economic recessions don’t care how hard you work. Where there are many industries that permanently changed by new businesses that sprang up in the twentieth century, there are just as many that failed and faded to obscurity.

Multiple presidents took notice of different industries that boomed over the years, as well, leaving their mark on various economic sectors as the opportunity came up. For instance, President Lyndon B. Johnson imposed a 25% tariff on various imports during the height of Cold War tension that ultimately came to be known as the Chicken Tax – as it was in response to a tariff on imported chicken in Europe.

Let’s Talk About Reagan

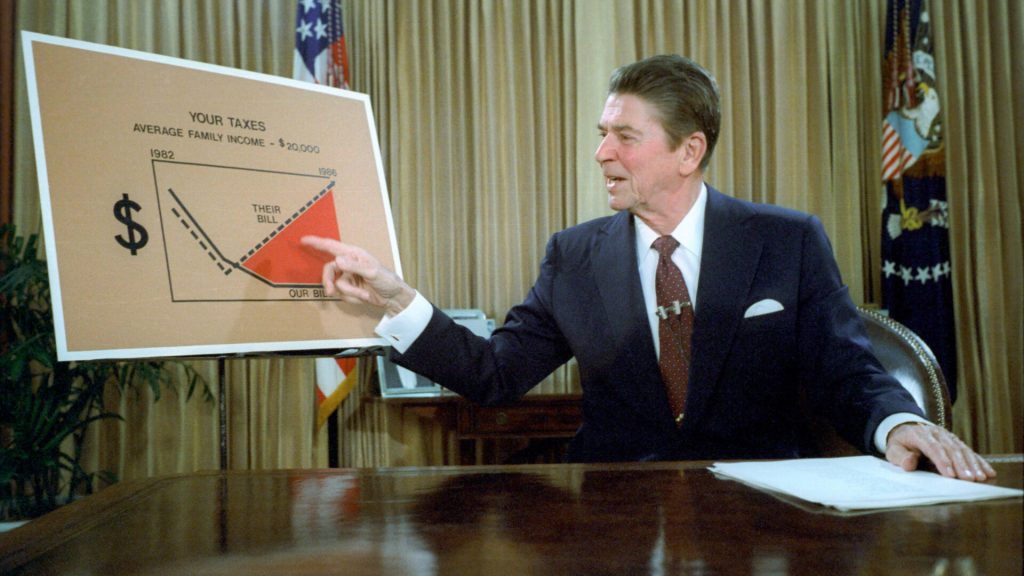

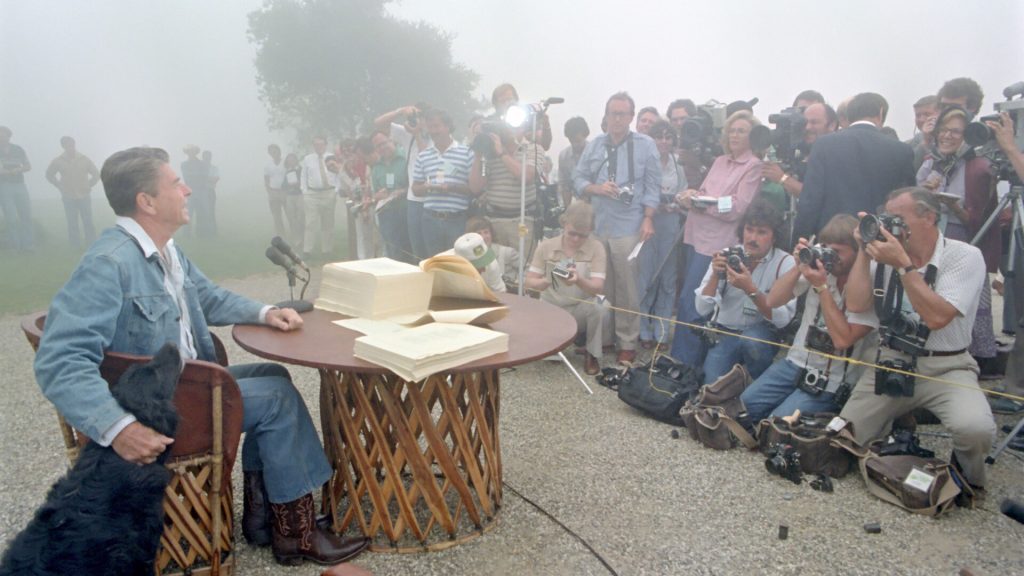

One president in particular has his hands in the economic and socioeconomic structure more than others, and the effects of his presidency are still being teased apart and dissected by economists today.

Part of Ronald Reagon’s campaign strategy when he ran for president in 1980 was to paint himself as a man who would be friendly to business, who would push for the boom of the middle class. As an actor, he had little experience in any of these matters, but he was charming and an excellent salesperson when the product was himself, and he won the presidency handily against Jimmy Carter.

Reagan’s Impact is Still Being Felt

During his eight-year term as president, Reagan coined the term “Reaganomics,” which was used as a shorthand to describe his economic policies. He’s easily one of the most prominent conservative presidents of the last one hundred years, and many contemporary Conservatives refer to his presidency fondly.

All is not perfect out of the Reagan era, though. Many of the issues of contemporary capitalism can be traced back to policies that were first instituted in the Reagan era, including the disappearing middle class and the megamonopolies that organizations such as Amazon and Wal-Mart have become.

“Trickle Down Economics”

Reagan presided over a period of “stagflation” in the United States, which is a period of time where the inflation rate is high, economic growth slows, and unemployment is also high. These facts led to some drastic economic measures, which have come to be known as Reaganomics.

Reaganomics, at its heart, is a series of policies centered around economic deregulation and tax cuts. Reagan made famous the term “trickle down economics,” wherein he stated that reducing the amount that businesses were taxed would ultimately “trickle down” to the middle class as businesses had more money to spend and invest.

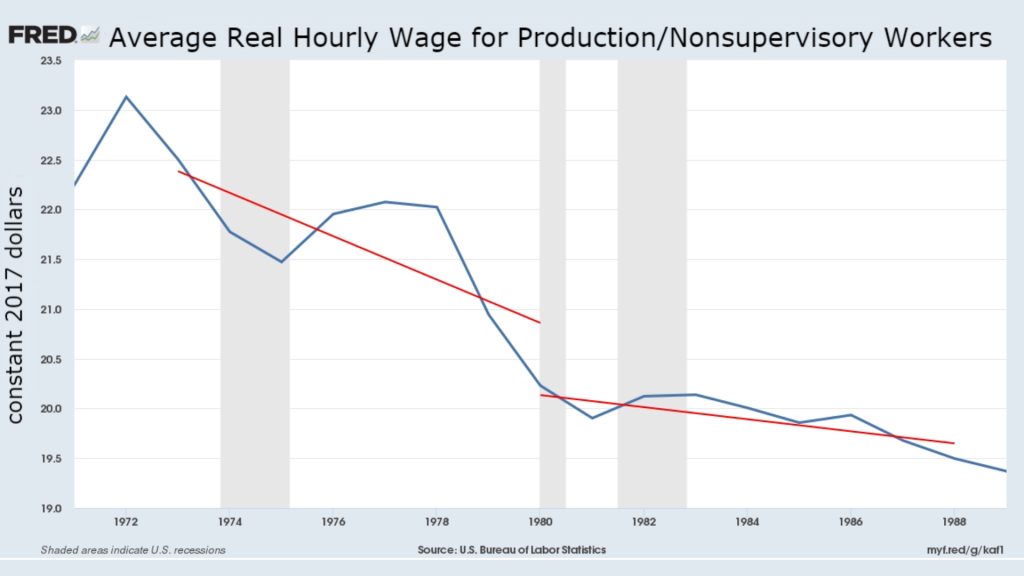

Which Didn’t Work

This is a noble idea that has not panned out in any realistic or reasonable way. Trickle-down economics relies on the idea that companies will reinvest extra funds into their businesses and employees in order to fund growth.

Reality does not reflect this idealistic concept, particularly in light of business’ reliance on the Stock Market and publicly available earnings statements. Companies are beholden to their investors, and it has resulted in a system where any extra money is hoarded in order to provide a return for said investors, rather than reinvested in the economy as Reagan believed.

Income Inequality has Increased Substantially

This adjustment in business and profit expectations for the economy is primarily what has driven such a substantial increase in economic inequality between the wealthiest Americans and the poorest Americans.

The wealthiest Americans are often seen in expensive restaurants with wait lists a mile long, where the poorest Americans are often working two and three jobs in order to afford their bills, meaning that they often don’t have the disposable income to be eating out at all.

Classes Don’t Mix

These coexisting realities often mean that the top 1% often does not mingle with the bottom 99%. This is not due to a snobbery or a better-than-thou attitude, in most cases. It’s simply a reality of the different ways of living.

However, recent data has shown that there are some places where the super wealthy and the poor mingle equally in society, and it’s a bit of a surprising revelation. Chain restaurants, like Olive Garden and IHOP, are officially the new hubbub of socioeconomic interaction, much to our surprise.

Some Post-Pandemic Numbers

This information comes to light in the wake of staggering figures post pandemic, which revealed that social interaction between the classes dropped as much as 30%, even after lockdowns and other situations were lifted.

Economists and sociologists point to the lower interaction between classes as a result of changing social attitudes towards the upper echelon of society, as well as the rise in socially isolating habits such as food delivery and online shopping.

A Predictor of Mobility

It’s a somewhat worrying pattern, though unfortunately one that has been seen before, though not quite as intensely. In general, classes tend to stick together; the wealthy often rub elbows with other wealthy people. Poor people tend to stick close to home, and therefore meet people in their own tax bracket.

Where this is concerning is that economic mingling is often one of the most stable predictors of economic upward mobility. For people who are in a lower socioeconomic class, having a friend or relative in a higher economic class can provide opportunities for them to socially move upwards.

A Great Space for Mingling

For those who don’t have that token rich friend, the statistics about full-service, low-cost restaurants can offer some comfort. Restaurants like Olive Garden and Chilis saw the greatest mingling of economic classes, compared to local businesses such as pharmacies or grocery stores.

The effect of social mixing wasn’t evenly spread across all restaurants, though. Poor people were much less likely to encounter the wealthy in restaurants like McDonalds, where wealthy people were less likely to meet poor people in restaurants like Panera.

Casual Restaurants Hiding the Truth

The sweet spot of inexpensive, full service restaurants seems to point to a desire to mingle felt by all classes. Olive Garden, Chilis, even IHOP. These restaurants might seem casual, but you’re just as likely to meet someone with a Bentley as you are someone with a secondhand Toyota.

In the wake of heightened outrage over economic inequality, this information is a welcome relief to many who feel that clawing their way out of the bottom 10% is impossible. It might not necessarily be where you are, but it could be who you’re dining with.

An Ongoing Conversation

While eating at restaurants like Chilis and Applebee’s won’t make a difference in economic class for many Americans, the information is fascinating. The conversation around “late stage capitalism” and the movement to “eat the rich” make these conversations ever more important to have.

It might not be the redistribution of wealth that a growing minority are asking for, but the knowledge that social elevation is possible through unlikely places is still comforting. Not everybody can be the CEO of a multinational corporation, but everyone can probably dine out at Olive Garden.