In recent years, California has faced unique challenges in the environment and weather that have created problems for residents in finding insurance. The climate crisis, drought, and fires have all combined to create a uniquely risky environment for insurers, and it appears that the situation is only getting worse.

Hartford Ceasing New Policies

A significant development in the California insurance market has recently come to pass. A large insurer, The Hartford Financial Services Group, has recently announced that they will no longer be providing new property insurance for homeowners.

In their statement, Hartford referenced, indirectly, some of the recent challenges that have faced Californians. They stated that these unique challenges have made them reconsider, as a company, the viability and risk of taking on new business in the state.

Not the Only Insurance Company to Make the Shift

Unfortunately for Californians, Hartford is not the first company who has recently changed their attitude towards providing service to residents of California. Prior to the Hartford announcement, both Allstate and State Farm had already ceased writing new policies in the state.

These companies, like Hartford, referenced recent environmental challenges as the reason for the policy change. Specifically, they cited the heightened risk for wildfires to California homes, considering the recent intensive drought and heat waves that appear to be getting more intense as time goes on.

Blaming Policy

Recent changes in California insurance regulation has also been cited as a reason behind the policy change. Proposition 103 was passed by the California state legislature in 1988, which requires approval for rate changes by insurers.

Insurers have stated that this regulation, which was meant to prevent price gouging on the parts of big corporations on premiums, has hampered their ability to respond appropriately to the heightened risks that have come with climate change.

A Strategic Shift

Hartford sees the change in policy as part of a strategic shift, meant to work with an ever-changing landscape of providing insurance.

Hartford did go on to clarify that, though they were not going to be offering or approving new policies for homeowners insurance in the state of California, they would continue to renew former policies that were approved before the policy change. This is consistent with the policies that were accepted during underwriting, according to the company.

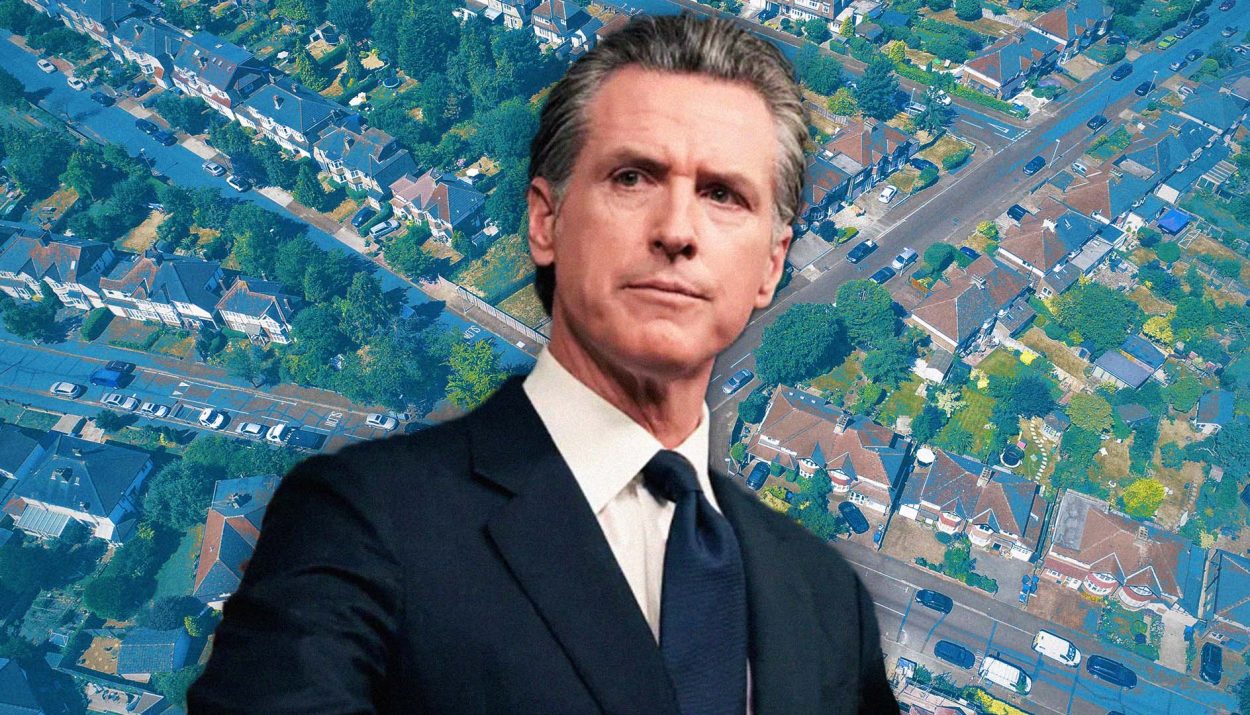

Californians Impacted Most of All

The announcement by Hartford changes the insurance landscape for Californians, and not for the better. In a state that is already significantly more expensive to live in than most of its neighbors, the difficult insurance landscape only makes things more difficult.

It also points to a concerning trend that was kicked off by Allstate and State Farm pulling out of the homeowners insurance market. Californians find themselves increasingly at risk for damage to their home by wildfires and other climate related emergencies, with fewer and fewer options for ensuring they are covered in the case of a devastating event.

Policy Changes to Adjust the Impact

This problem has not escaped the California government, and Commissioner Ricardo Lara has released several statements regarding the problem. His “sustainable insurance strategy” has been crafted with both consumers and insurers in mind, allowing Californians to get insurance while also allowing insurers to protect themselves.

Primarily, Lara has instituted policies that streamline the request process for insurers to be able to request, and have approved, insurance rate changes for consumers. He explains that this is a necessary adjustment to Proposition 103 in the an environment where climate changes make rapid and appropriate rate adjustments necessary.

Florida Facing Similar Issues

California is not the only state that is seeing rapid changes in the insurance market. Florida has also seen a swatch of rapid policy changes regarding homeowners insurance in light of more intense hurricanes and flood risk in the state.

Proposition 103 has allowed for Californians to have much more affordable rates than their sister coastal state, though. The average premium for homeowners insurance in Florida is a whopping $4,218 annually, compared to California’s average $1,380.

Following a Concerning Trend

The exodus of insurers from California also follows a trend seen in insurance companies across the country. Rates for homeowners insurance have been steadily rising in recent years, with companies largely citing changes in environment and climate change as the primary reason.

These patterns have prompted California’s governor, Gavin Newsom, to take executive action. In response to insurers pulling out of the state, he signed an executive order that requested the state’s insurance regulator to expand coverage options, as well as expedite the current approval process for rate changes.

The Results Remain to be Seen

Whether executive action and policy changes will result in relief for Californians seeking homeowners insurance remains to be seen. Insurers have responded to Commissioner Lara’s efforts with gratitude, but it hasn’t stopped them from making changes to policy that deeply impact Californians.

It may turn out that the only solution for those seeking homeowners insurance is to purchase homes outside of the Golden State. Cost of living has already made living in California difficult for many who choose to call it home, and the further exodus of insurers from the most populous state may make the environment completely inhospitable in the coming years.