Recently, a lot of rich people have moved out of California. This change has brought the state’s population below 39 million, a historical all-time low since 2015.

These rich people are very important contributors to California’s tax revenue pool. Now that they are leaving, we can’t help but wonder – How will this exodus affect California’s money and its future?

Over 750,000 People Have Left California In The Last 3 Years

In the last three years, more than 750,000 people have left California. This isn’t just about fewer people living there; it’s about who is leaving. A lot of these people who moved away have good jobs and education. When they leave, they take their money with them.

This is important because they used to pay a lot of taxes, which typically fund public infrastructures like schools, roads, and hospitals. Now, with less money from taxes, California might have trouble paying for most if not all of these important things.

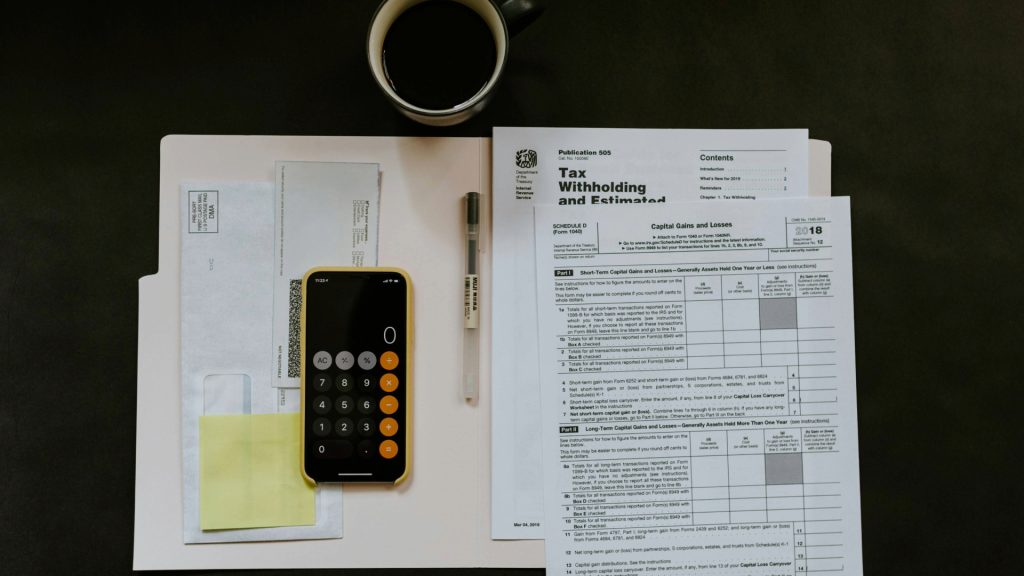

California’s Tax Rate Is One Of The Highest In The Country

It’s no surprise, but yeah, people are leaving California because the taxes are very high. It’s one of the places in the United States where you have to pay the most taxes. Rich people in California have to fork out even more – up to 15% of their income.

All things considered, not wanting to pay 15% in tax fees is a good enough reason to want to consider other favorable state policies. And now experts who help others plan their money, like estate planners, are swamped with heaps of calls from people who want to move to save on taxes.

Businesses Are Dipping

Now, it’s not just people leaving California, but also businesses. The reasons? You probably guessed right – California has high taxes, and strict rules, and it costs a lot to pay workers and for energy.

So, many businesses are choosing to go to other places which in case you haven’t caught on, is a big problem for California’s money situation.

Trouble In Paradise

When businesses leave, the state gets even less money from taxes. Also, people lose their jobs.

California is already in trouble because it needs to find $68 billion to balance its budget. With both people and businesses going away, and less tax money coming in, the state has to deal with even more money problems.

Growing Safety Concerns

California is also dealing with a lot of safety problems. And it’s getting worse. First, there’s more crime happening. Also, natural disasters like wildfires and earthquakes are happening more often.

These underlying issues pose significant risks to public safety and infrastructure. It goes without saying that California needs to think carefully and make good plans to address these issues.

Middle-Class Families Are In The Thick Of It

California’s middle-class netizens are in for troubled times. Necessities like food, clothes, and other basic needs you can think of are crazily very expensive.

As you can imagine, these high costs of well, everything is making everyday life hard for a lot of families.

Owning A Home Might As Well Be Fleeting Dreams

One of the biggest problems is how much it costs to buy a house. Statistically speaking, the state of California currently is one of the most expensive places in the U.S. to buy a home.

The price for an average house there is a lot higher than in most other states. The implication is that not many middle–class families can afford to own their own homes.

Life Is Tough Generally

Also, finding good jobs that pay well is tough. This adds to the difficulty for an average middle-class family trying to live comfortably and save money for the future.

Unsurprisingly, all these issues make people worry about the future of middle-class citizens of California. California really does have its work cut out for them, especially when it comes to ensuring that middle-class Californians can stay strong and successful in the long run.

Californians Are Exploring Reasonable Alternatives

States with lower taxes, like Texas, Florida, Arizona, Tennessee, and Nevada, are seeing a lot of people from California moving in. Many of these new residents are retirees.

Texas and Florida, in particular, were two hot zones for migrating Californians. These two states don’t levy any personal income tax. Talk about well-reasoned state policies!

Texas And Florida Are Favorites

Census data from 2023 shows that these states are really attractive to people who want to escape California’s high taxes and living costs.

The implications of these trends are far-reaching. It clearly shows the growing importance of tax policies and their influence on how and why people decide to migrate. This is especially so among retirees looking to make the most of their retirement savings.

Essentials Of Inter-State Migration

If you’re thinking about moving to a different state, it’s not just about the income tax. Some states, like Texas and Tennessee, don’t have state income taxes, but they make up for it in other ways.

For instance, Texas has high property taxes – about 1.7%, which is one of the highest in the U.S. Tennessee, on the other hand, has a high sales tax, which is around 9.5%, the highest in the country.

Look Before You Leap

If you’re planning to move, you need to look at all the different kinds of taxes, like property and sales taxes, not just income taxes. It’s important to understand the total cost of living in a state.

This means knowing how much taxes will really cost you and how much other additives like housing and food cost. Knowing all this helps you decide if moving to that state is a good choice for you, especially if you’re trying to save money.

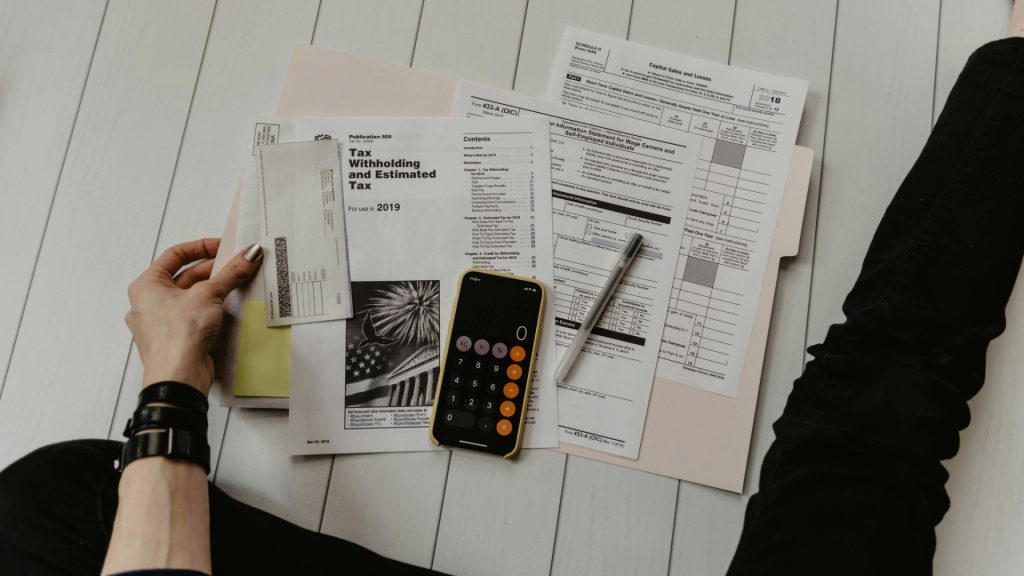

Californians Migrating Will Have A Long Reaching Impact

The ongoing departure of residents from California carries substantial implications, affecting various aspects of the state’s socioeconomic well-being.

One of the primary concerns is the potential loss in tax revenue, of which the importance can’t be overstated. As mentioned earlier, tax funds are crucial for maintaining public services and infrastructure. This decrease in revenue could lead to reductions in the quality and availability of essential services.

Housing And Job Opportunities

Then, there’s the housing market. As people move away, there might be less demand for houses. This would inevitably change house prices and how much rent costs, ultimately affecting everyone, whether they own homes or rent them.

The job market could also see some shifts. With skilled and educated people leaving, California is bound to face a shortage of workers in certain areas. It’s easy to see where this is headed – businesses won’t be able to find the right people for jobs, affecting the state’s economy.

Local Businesses And Public Services

Local businesses might feel the impact too. They might struggle because there are fewer customers, and if the types of customers change, businesses might need to adjust what they offer.

Public services, like buses, hospitals, and libraries, might also need to adjust. How they’ll do this is anyone’s guess at this point, but the fact remains that these services will have fewer resources or need to meet different needs of the population.

President’s Trump Tax Policy Overhaul

The 2017 federal tax cut – a monumental policy change championed by President Donald Trump – has also had a notable impact on the migration patterns of high-income Californians.

A key feature of this tax overhaul was the capping of state and local tax (SALT) deductions at $10,000. SALT stands for state and local tax deductions. These deductions used to help people save money on their taxes. But after the change, there’s a limit of $10,000 on how much people can deduct for SALT.

Zero Sums Gain

So, even though federal taxes were lowered, rich people in California didn’t really save much money. That’s because they still had to pay a lot in state taxes, and they couldn’t deduct as much as before.

This change in tax policy has been a motivating factor for some high-income Californians to relocate to states with lower tax burdens, where they can more fully benefit from the reduced federal tax rates.

The Moment Of Truth

California is at a really important point right now where it has to make big decisions about its future. The state is facing a choice: it can either change its tax rules to keep and attract more people and businesses, or it can look for other ways to keep its economy strong.

This decision is super important because it will quite literally shape California’s future. The choice California makes will affect not just how much money the state has, but also how big of a role it plays in the economy of the whole United States. We have our fingers crossed as we look to see how the brilliant people of California will tackle the issue.