Coming off of COVID, a period of time with some of the highest unemployment in recent American history, many economists were worried about a recession.

Most other pandemics in history have seen economic downturn while the country recovers, and the challenges that were faced by the country during the coronavirus pandemic didn’t suggest that the pattern would be any different this time.

The Job Market Suffering

Indeed, the United States job market suffered significant challenges for a while. Businesses furloughed and laid off significant numbers of their employees at the beginning of COVID in order to prevent the spread of illness, meaning that the unemployment rate in America skyrocketed.

At the same time, there was a hiring boom of sorts in the country. Tech companies were hiring qualified workers in spades, and some sectors boomed in profitability at a time when it seemed like there would be significant challenges.

Retail Industries Suffering More

This effect for COVID was not widespread. Many retail industries suffered due to widespread shut downs, and industries such as hospitality suffered even more. Individual states had different challenges; Nevada suffered from the lack of gaming and tourists. Utah struggled due to lack of tourists to their national parks.

In spite of the various challenges faced by different states, the country slowly made their way through the pandemic. GDP suffered, it’s true, and untold amounts of people suffered and ended up passing due to the novel virus that America’s social structure and infrastructure were not equipped to deal with.

Campaigning on the Economy

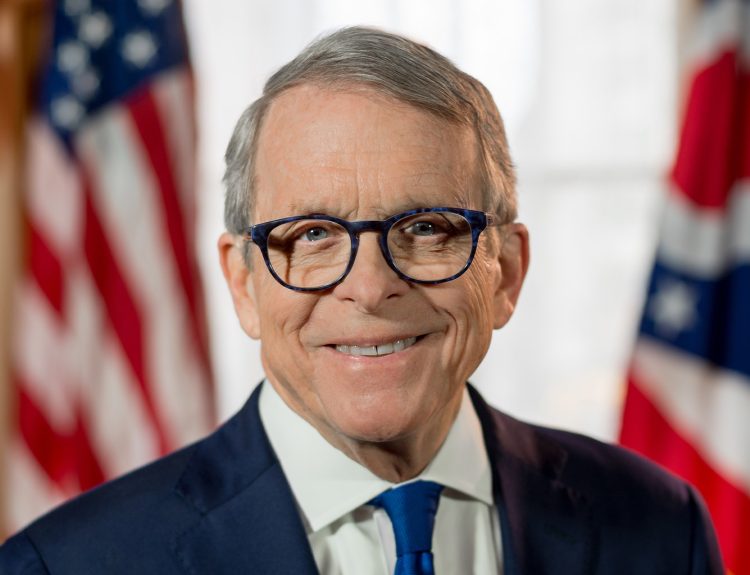

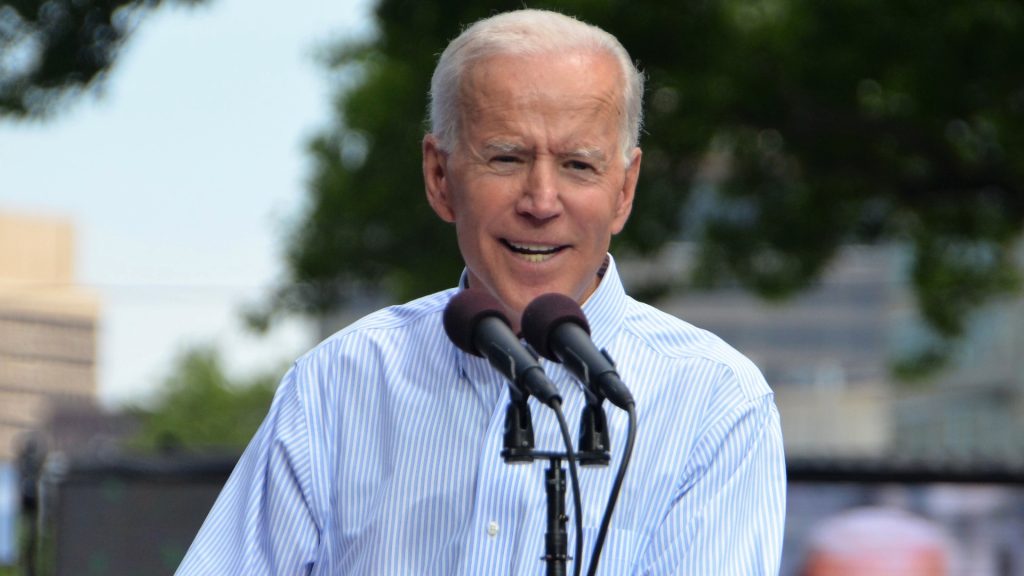

When Joe Biden campaigned for president in 2020, he ran on the platform that he was the only man who could steer the country through a potential recession. He used his experience as vice president during the 2008 economic downturn to sell himself to the American voters, and the play worked.

One of the first things that Biden began doing once he became president was put policies that encouraged job growth into place, and started advocating for greater investments in industries that were rapidly growing. Infrastructure, technology, green energy, and more were all on hand for Biden to push, and it worked.

Joe Biden Swinging – And Succeeding

Despite a significant amount of Republican backlash during his years as president, as well as unforeseen inflation and other economic challenges, the economy has rallied impressively under Joe Biden’s hand.

Tech sectors have boomed and GDP is up, and the economy has proceeded to add more jobs than expected every single month. Many believe that the jobs report could be inflated due to various factors, but it doesn’t change the fact that the reported numbers are better than any economic experts could have expected coming off of the pandemic.

Wages Increasing Too

On top of job growth, wages have continued to rise as employers have sought to make themselves more appealing in a competitive job market. Employers are vying for fewer workers than there are positions, meaning that they’re offering better wages and better benefits in order to try and capture workers that would be suited for the position.

While this is mostly a good thing, particularly in a country where the wage gap between the very wealthiest and the very poorest is the largest of any developed country, there are some unfortunate downsides. Higher wages and more money in the economy means higher inflation, which has sustained at uncomfortable levels for multiple quarters running now.

Inflation Levels Coming Down

While current levels of inflation are nowhere near the peak that the country saw in 2022, they’re still hovering higher than the Fed would like them to be. The highest levels of inflation were seen in 2022, at 9%, and aggressive efforts on the part of the Fed have brought them down to a much more reasonable 3% in recent months.

The Fed has few tools that it can use to combat inflation, just as the president has few tools that he can use. Joe Biden’s Inflation Reduction Act combined with aggressive interest rate raises on the part of the Fed have brought rates down, but they’re still above the desired 2% that’s generally seen for inflation in a healthy economy.

Americans Suffering From High Prices

This is a fact that is frustrating to many Americans, who are suffering from the high prices that come with inflation. Gas, groceries, rent, and many other necessities have reached astronomical levels in the past months, and the public perception is that the government is doing very little in order to help the little guy out when prices for everything are out of control.

What’s unfortunate about the entire situation is that many of the things that help average Americans, such as better benefits or better paying jobs, add to the issue of inflation in the economy. The Fed, who was hopeful that there would be three different interest rate deductions in 2024, have announced that they’re going to keep interest rates where they are in the hope of cooling the economy, meaning that Americans and employers are suffering more.

The Economy is Doing Very Well

Public opinion and perception don’t change the fact that, by all measurable markers, the economy is doing very well. The most recent jobs report supports that, with the Labor Department revealing that the economy added more than 300,000 jobs in the month of March. 303,000, to be exact.

Despite the significant increase in job numbers, wage growth remained contained, remaining at a steady pace. This fact supports many economists theory that the economy can sustain continued job growth without fanning inflation, a fear that many economists and average people have.

Better than Average Numbers

The jobs numbers are not the only positive to come out of this report, either. The jobs numbers were significantly higher than the 200,000 projected, showing that the economy is seeking greater growth in the coming year, in spite of investors fears about the lack of interest-rate cuts.

Additionally, all three United States stock indexes were up on Friday after a slow beginning to the week. Investors appear to be focusing on the strength of the economy, rather than what the jobs report might mean in terms of the Fed’s choices.

A Change in Opinion from the Fed

For most of 2022, senior Fed officials saw strong economic activity and hiring as a headwind to bring down inflation. They worried that tighter labor markets would keep pressure on wages to increase, and would prevent inflation from falling to the desired 2%.

In recent months, though, Fed Chair Jerome Powell has signaled that he no longer regards strong hiring as a concern. The labor force has been growing steadily, largely in part due to a rebound in immigration. Therefore, brisk hiring isn’t creating concern from Powell that the economy is at risk of overheating.

Data Informing Decisions from the Fed

“The economy actually isn’t becoming tighter, which it ordinarily would. It’s actually becoming a little looser, and you’re seeing inflation come down – very unusual situation,” Powell said in a statement on Wednesday.

Instead of focusing on hiring, Powell and other Fed officials have suggested that inflation data in the coming months will be much more important in determining whether the central bank can cut rates in June. The consumer-price index for March, which is set for release by the Labor Department next week, will be closely watched because inflation was higher than expected in January and February.

Immigration Assisting Positive Economic Growth

The positive numbers regarding jobs is, many economists believe, due to higher levels of immigration, which have helped to supply the job market with fresh workers. With the supply of available workers increasing, the number of jobs can grow more rapidly without risking overheating the economy.

Supply alone is not the only factor when it comes to job gains, though; there must also be demand. With layoff activity remaining low, and the number of unfilled jobs high, it appears that there’s still plenty of demand. All these factors point to a strong and healthy United States economy, which is something that everyone can get behind.

Good Numbers for the Democrats

Ahead of the election this fall, continued increases in strength for the economy can only be a good thing for the president. His low approval rate has stemmed, in part, due to a fear that Biden cannot support a strong economy, and all the numbers contradict those opinions.

The job of the Democrats, now, falls into two categories. One, to continue to push for a strong economy in all the ways that count, supporting policies that push for living wages and expansion of growing sectors such as technology and American manufacturing. And two, improve messaging so that Americans believe that Joe Biden is more than just talk, he’s a president that can continue to lead in an economy that is supporting not only the wealthy, but the little guy as well.