The most recent announcement of the Biden administration indicates a thorough plan of shifting the student debt burden to taxpayers in order to help millions of Americans. Under this newly proposed scheme, the student debt of around 4 million Americans would be forgiven entirely, while accrued interest would be eliminated for another 23 million borrowers.

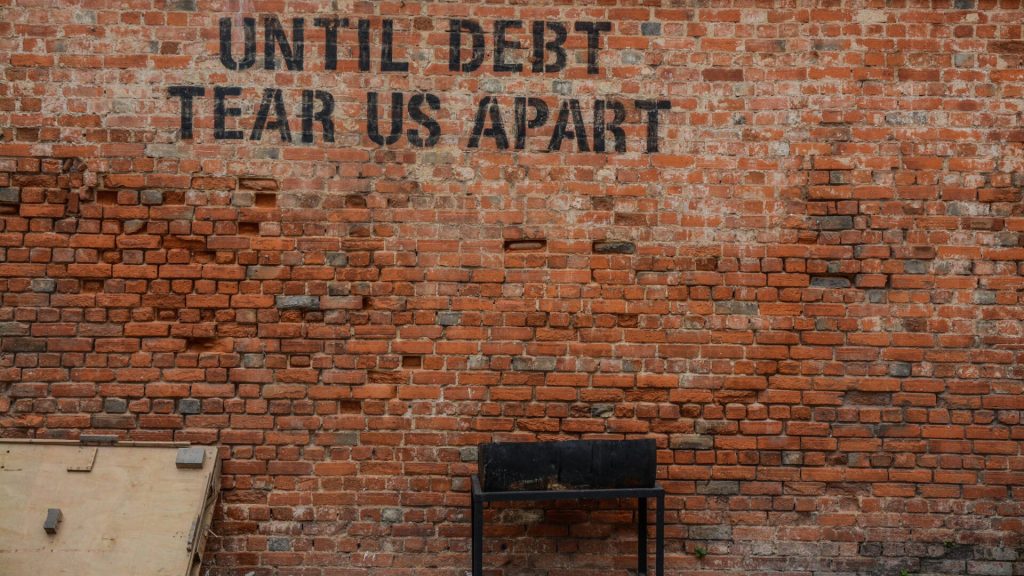

An additional 10 million debtors would also receive $5,000 or more relief. However, the plan faces criticism from the conservatives, who argue that this unfairly burdens the taxpayers while not addressing the underlying issues driving the college debt crisis.

Scope of Debt Forgiveness

Under the proposal launched by the Biden administration, debt forgives would extend to 4 million borrowers nationwide.

This relief would offer them significant financial respite. Further accrued interest would be eliminated for 23 million borrowers, and to further ease down the strain of student loans around $5,000 relief would benefit an additional 10 million borrowers. “This relief is long overdue for many Americans,” commented Senator Harris during a press conference.

What Is the Forgiveness Criteria?

As part of the proposal, people under debt would be eligible for several forms of debt forgiveness. What was more noticeable was the provision which forgave a whopping $20,000 of interest accrued with no distinction between the income groups.

Low—and middle-income borrowers who are enrolled in outcome-driven repayment plans would have the full amount of their balance increased since initiating loan repayment cancelled. This is to address the financial challenges the borrowers face across diverse socioeconomic backgrounds.

Why Is There Criticism from Conservatives?

Despite these benefits, the Biden administration’s student debt plan faces backlash from the conservatives. They argue that the plan attempts to shift the debt burden onto the taxpayers for political gain.

“We cannot afford to bail out debtors at the expense of hardworking taxpayers,” stated Representative Johnson. This proposal does not focus on the issues driving the college debt crisis in the first place. There are concerns raised regarding the legality and fiscal responsibility of the Saving on a Valuable Education (SAVE) plan, leading to anticipated legal challenges.

Expanding Eligibility for Debt Relief Programs

The administration plans to seek to expand eligibility for existing debt relief programs, including SAVE and the Public Service Loan Forgiveness (PSLF) program.

By including borrowers who are eligible for these programs, the aim is to streamline the process of identifying and providing debt relief to the ones who need it.

What Are SAVE and PSLF Programs?

The Saving on a Valuable Education (SAVE) plan was introduced by the Biden administration. It offers income-based repayment options and provides borrowers with greater flexibility in managing their student loan obligations.

The Public Service Loan Forgiveness (PSLF) program offers debt relief to public service workers who have served at least ten years. These programs are integral to the administration’s broader strategy to address the student loan crisis.

Republican Opposition and Legal Challenges

Republican lawmakers have openly opposed this new plan, criticizing it as an election ploy that disregards fiscal responsibility.

“We cannot support measures that shift the debt burden onto taxpayers,” Senator Thompson argued during a press briefing. Furthermore, legal challenges are anticipated concerning the constitutionality and cost of the proposed debt relief measures.

How Would This Impact the Borrowers?

The proposed debt forgiveness plan is poised to transform the lives of those facing financial hardships.

By offering debt relief, especially to those with high-value education but low earnings, the plan aims to address the disparities in loan repayment capabilities. This targeted relief would provide financial stability to millions of Americans struggling under the weight of student debt.

Cost and Implementation Timeline

The Biden administration successfully estimated the cost of the proposed plan and outlined a timeline for its implementation.

The public comment periods will precede the plan’s finalization, ensuring clarity and including stakeholder feedback. Once finalized, the plan is expected to take effect in the coming months, providing timely relief to those in debt and grappling with student debt burdens.

What Is the Administration’s Justification?

They have underscored the need to ease the burden of college debt on American households. By leveraging executive actions and target relief measures, the administration seeks to support those in debt and alleviate financial distress.

“We’re dedicated to ensuring that every American has access to affordable education,” President Biden affirmed during a town hall meeting. This initiative aligns with the administration’s broader goal of economic stability and opportunity for all citizens.

Response from Student Debt Relief Advocates

Student debt relief advocates have stated that this plan is a significant step towards addressing systemic issues in student loan repayment.

The advocates emphasize the importance of comprehensive reform to ensure fair access to higher education and financial security for all debtors.

What Are Some of the Political Implications?

Certain political implications exist as the president seeks reelection soon. By appealing to progressive and young voters, the administration aims to gain support for upcoming elections.

However, political tensions regarding student debt relief remain, which sheds light on the complexity of navigating electoral dynamics and policy priorities.

Comparison with Previous Debt Forgiveness Attempts

Compared to previous attempts at debt forgiveness, the Biden administration’s plan takes a more targeted approach, incorporating legal and procedural changes to enhance its viability.

“We’ve learned from past initiatives and adapted our approach to ensure effectiveness,” stated a White House official. The administration remains committed to providing relief despite the legal challenges and opposition.

What Is the Future of Student Loan Policy?

The proposed debt forgiveness plan does have significant implications for the future of student loan policy in the United States.

The sustainability and continuity of student debt relief efforts remain uncertain as administrations change and the country’s political landscape evolves. However, the current administration commits to addressing the issues, underscoring the importance of ongoing reform and support for borrowers.

Congressional Response and Public Opinion

The Congressional response to the administration’s plan has been mixed, with both support and opposition from lawmakers.

Public opinion on this relief varies as well, reflecting the ongoing debates over fiscal policy and government intervention. As the plan progresses, the administration will continue to engage with stakeholders and address concerns raised by these lawmakers and the public.