Taxes. The bane of many Americans’ existence, and something that most people try not to think about until they ultimately have to when their tax bill comes on April 15. The United States tax code is convoluted and highly confusing, and every president for the last fifty years has attempted to make changes to the taxation system to make things simultaneously easier and more difficult for the average American.

A Conversation had Every Year

Taxes are a conversation that come up every year in the halls of Congress, simply by virtue of the fact that taxes are the way that many of the government’s needs are paid for. Congress salaries and roads and infrastructure and other requirements of the government are all paid for through taxes, which Americans have strong and differing opinions about.

It is a given that the American public will have to be taxed in some way, shape, or form. The United States deficit would be significantly worse were it not for tax income, but Americans differ in their opinions of how much they should be taxed, and what specifically those taxes should be going to.

A Party Line Issue

Unsurprisingly, these differences in opinion on taxes fall along party lines. Republicans believe that Americans should be taxed as little as humanly possible, and see government taxation as a theft of the hard-earned money of American citizens.

Democrats, on the other hand, see taxes as a public good. Many Democrats, particularly those of the younger generations, look at other countries who tax their citizens at similar rates to America, with a significantly better social safety net, and wonder why America doesn’t have many of those perks.

Allocating Tax Dollars to Serve the People

The perks in question, of course, are things like universal healthcare, free public university, subsidized housing, and more. Countries like Canada and the United Kingdom tax their citizens at a similar rate as America, but they appear to be allocating their dollars significantly differently.

This has created a frustrating system for many American citizens. Whether you believe that there should be more taxes or less, whether you believe that taxes should go to fund universal healthcare or the war in Israel, many Americans feel that their government is failing to provide for them in a number of basic ways.

Failing to Budget Appropriately

Not only do many people believe that the government is failing the public by not providing for its citizens with the money that they’re given, they also see the government failing spectacularly at allocating funds appropriately and staying within a reasonable budget.

This is seen in the deficit of the government, which has swelled to more than $34 trillion in the last five years. Some of the reasons behind that have been out of anyone’s control, such as the pandemic, but in general, it’s a clear and blatant example of the government’s mishandling of funds.

A Significant Impact on the Deficit

Critics have pointed out that the most recent adjustment in the tax code, the 2017 Tax Cuts and Jobs Act that was signed into law by former President Donald Trump, had a significant impact on the deficit. The bill cut tax revenue from corporations significantly, which many have pointed to as the reason behind the deficit swelling so significantly, so quickly.

Taxes and the deficit are a little more nuanced than that, of course. There’s rarely only one reason behind the deficit rising or falling, and while it’s likely that the tax cuts that were passed by Trump didn’t help matters, it’s unlikely that it’s the sole reason.

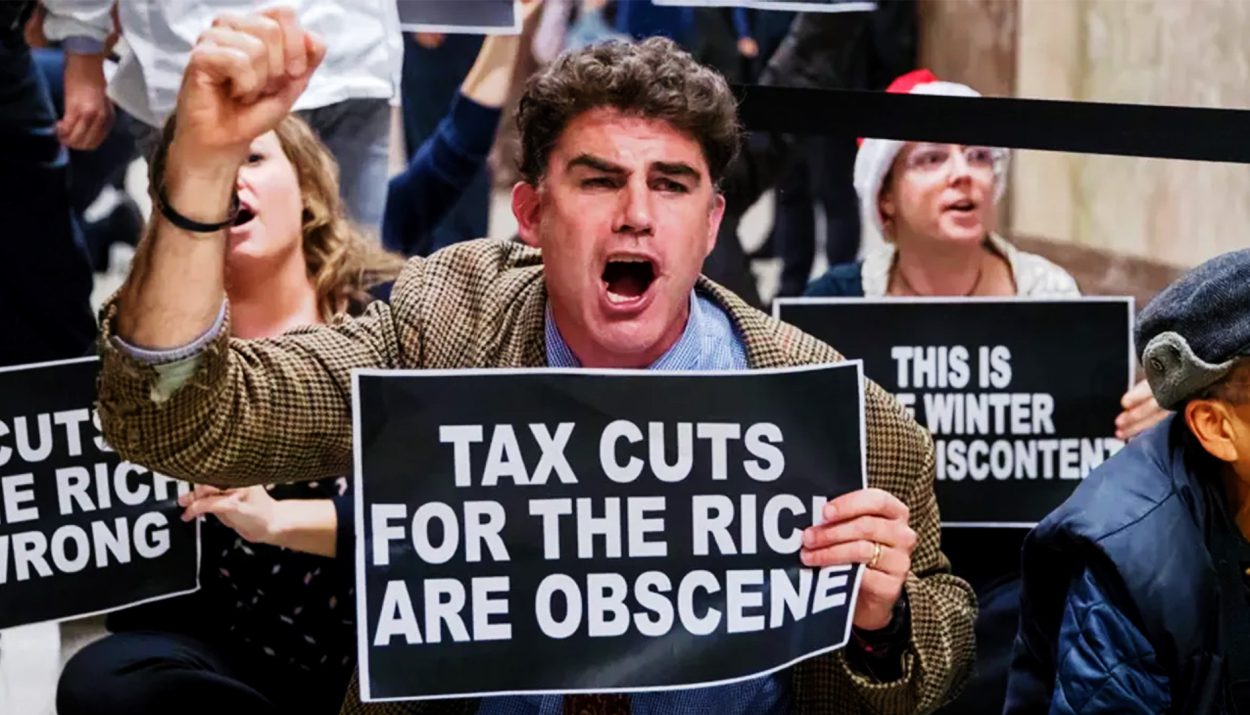

Deeply Unhappy Americans

However, this has left the current administration in a significant bind. Many Americans, Conservatives in particular, are not thrilled with the way that the American government is handling their tax funds, and are even less happy about the ever increasing deficit and debt.

Cutting expenses would be one of the first steps to helping cut the deficit, but bringing in more tax revenue would go a long way to reducing America’s debt. Unfortunately, raising taxes is a deeply unpopular idea, even if it is ultimately a public good.

Backlash Following the Fiscal Year Proposal

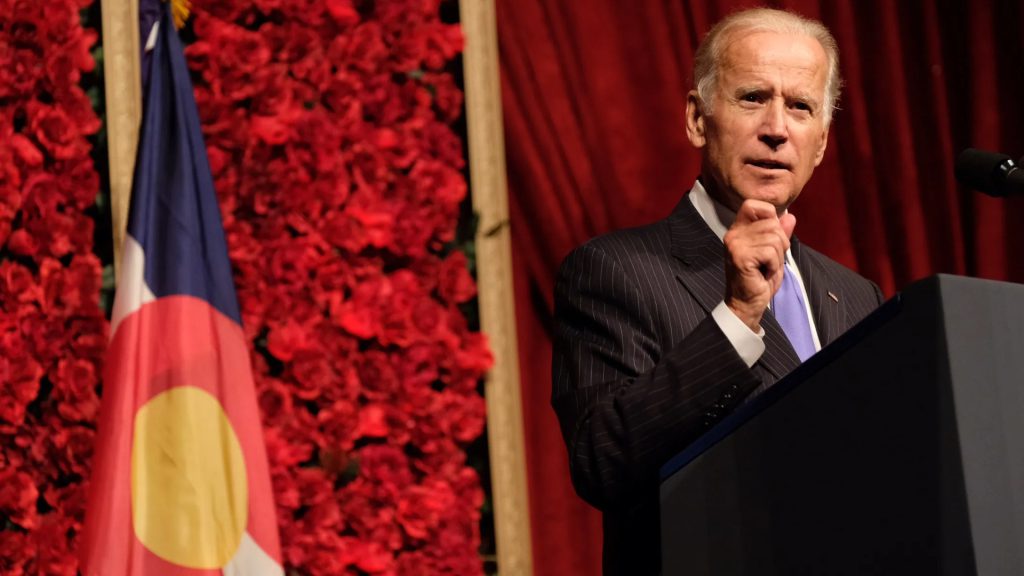

This can be seen in the backlash that has risen following an announcement from the Biden administration. Biden’s 2025 fiscal year proposal contained, among other things, a proposal to increase the capital gains tax rate up to the highest level it’s been in more than a century.

According to the proposal, the top marginal rate on long-term capital gains and qualified dividends would be raised to a staggering 44.6%. A capital gains tax hike of that level would take the rate to the highest it’s been since it was first introduced in the early 1920’s.

What are Capital Gains Taxes?

Capital gains taxes are taxes that are imposed on the sale of an asset. This only applies to capital assets, which include stocks, bonds, digital assets like cryptocurrencies and NFT’s, and jewelry, coin collections, and real estate.

Capital gains taxes are only paid once the asset is sold, so the tax doesn’t apply to unsold investments. Stock shares, for instance, will not incur taxes until they are sold, no matter how long the shares are held for or how much they increase in value.

A Devastating Effect on the Economy

Many financial experts have said that increasing the capital gains tax so significantly would have a devastating effect on the American economy.

“Investment is the real driver of economic growth,” said E.J. Antoni, an economist and research fellow at The Heritage Foundation. “Investment is what gives you productivity gains.”

Taxing Investment Means Less Investment

He went on, “Investment is where you get factories and machines – it’s where businesses are able to provide their workers with tools and equipment that allow them to increase their productivity, to increase wages, etc.”

“If you’re going to tax something, you get less of it. And that’s just as true for investment as it is for anything else. Taxing capital gains means less investment, it means less economic growth, and it means the rise of people’s standards of living is going to slow dramatically.”

Combining Multiple Proposals

The report from the Treasury department notes that the 44.6% rate is a combination of proposals. These include a measure that would increase the top ordinary capital gains rate from 20% to 37%. The majority of the tax hikes would impact Americans with taxable income greater than $1 million.

Antoni argued that a tax hike that significant would have broad economic impacts. He also noted that inflation impacts the price of equities like stocks, and that means that a tax on gains when equities are sold also, by proxy, taxes inflation.

An Incentive to Keep Inflation High

Increasing capital gains taxes, therefore, could create a larger incentive for lawmakers and policymakers to maintain high rates of inflation, to guarantee larger tax revenues for the government.

Mike Palicz, director of federal tax policy at Americans for Tax Reform, spoke to Fox on the matter, saying, “These are the really dangerous Biden proposals that a lot of people miss when it’s rolled out from the Treasury. They actually come out and say, ‘we’re advocating for a top capital gains rate of 44.6%.’”

An Ongoing Conversation Around the Tax Code

He finished, “This is people’s nest egg. This is them saving, them investing – it’s their American dream. And here is Biden coming out with the highest proposed capital gains tax in 100 years.”

It’s unlikely that this proposed tax rate hike will go into effect, particularly with how divided Congress is. Likely, this is Biden making clear what his legislative priorities are, should he be afforded a second term after the elections this November. However, it is an important concept to discuss. While tax hikes are widely unpopular with Americans, it’s clear the government cannot continue on this way. Something has to give, and if the government is going to continue spending the way that it is, then the government needs to start bringing in more revenue to make up for it.