Social security, the government program intended to take care of the elderly and the vulnerable after they’re no longer able to contribute to the work force, is facing massive hurdles going forward. A heavily divided Congress can’t seem to make up their mind about how to fund the program going forward, and spoiler alert: addressing the problem is going to take compromise.

Social Security Explained

Social security, or Social Security Insurance (SSI), is a program that has existed in the United States for nearly one hundred years. It was first passed into law in 1935, and is meant to care for the elderly and the disabled in the United States.

Social security is a program that individuals can claim based on the number of years they worked and paid into the program. Individuals can start to claim their benefits at the formal retirement age of 65, or they can delay their payments and claim a larger amount later.

The Program Expanded Over the Years

Since those first years of social security, the program has expanded significantly. In 1940, there were 220,000 individuals who were claiming a monthly check from the social security program to assist with their lives after retirement.

In 2023, there are an average of 67 million Americans who claim a check from SSI every month. Now, that number has expanded beyond individuals who have reached the age of retirement. Disabled individuals can also claim SSI, though the process of qualifying for payments is lengthy and can be quite intensive.

A Funding Crisis Ahead

As mentioned before, the social security program is funded by the amount that individuals pay into the program through payroll taxes. Businesses pay into the social security program as well, with all entities paying various amounts based on their means.

For years, this has sufficiently funded the program and allowed individuals to retire and know that they would be taken care of by the government. With more individuals living longer lives, though, and more and more people claiming SSI for longer, the program is facing a serious funding crisis.

A Trust Fund Depleted

In the past, the social security fund has relied on a backup trust fund to make up for the amount of money that it was paying out versus the amount of money coming in via payroll taxes. This, among other reasons, is what has allowed the program to continue seamlessly for so long.

Projected output versus income over the coming decade paints a dire picture for the social security program, though. Financial experts predict that if serious adjustments aren’t made to the social security program, even the backup trust fund will soon be depleted.

A Bipartisan Issue

The social security problem is one of very few issues that bipartisan lawmakers can agree on. There may not be consensus on how the program needs to be funded, or the ways that it could be adjusted so that it depletes sooner, but everyone can generally agree that social security is an important program to fund.

Several lawmakers on both sides of the aisle have currently been working to make progress on this issue. Since the new Congress was sworn in in 2023, Republican Senator Bill Cassidy of Louisiana and Democratic Representative John Larson of Connecticut have been working in tandem on the issue.

A Liberal View

Larson has an understandably liberal view of the issue, and has proposed Social Security Bill 2100 in four separate sessions of Congress. In order to make the program more viable, he wants to make the benefits more generous, increasing the amount that individuals are paid out every month.

In order to fund these more generous benefits, Larson has proposed increasing the percentage of payroll taxes that are taken to fund the program. Additionally, he has proposed an additional net investment income tax for individuals who make more than $400,000 a year.

And a Conservative View

Cassidy has a different view on the issue. Rather than increasing the amount of money individuals and the wealthy are charged in order to fund the social security program, he has proposed a new Social Security Fund.

The new fund would be created through an investment of $1.5 trillion into the stock market, which would accumulate returns over the years, continually replenishing and helping to grow the fund. This would be separate from the current social security trust, which is invested in cash and Treasury bonds.

Deeply Divided Congress

These are two very different solutions proposed to the problem. Unfortunately, though everyone can agree that the program is untenable in its current state, nobody can come to a compromise as to the way out of the problem.

Though the problem becomes more and more dire with every year, it also doesn’t appear as if a working solution is on the horizon in the currently deeply divided Congress. Even within the two major parties, they can’t seem to come to agreements with each other, and any proposed solution would need 60 votes in the senate to pass to the President’s desk for signing.

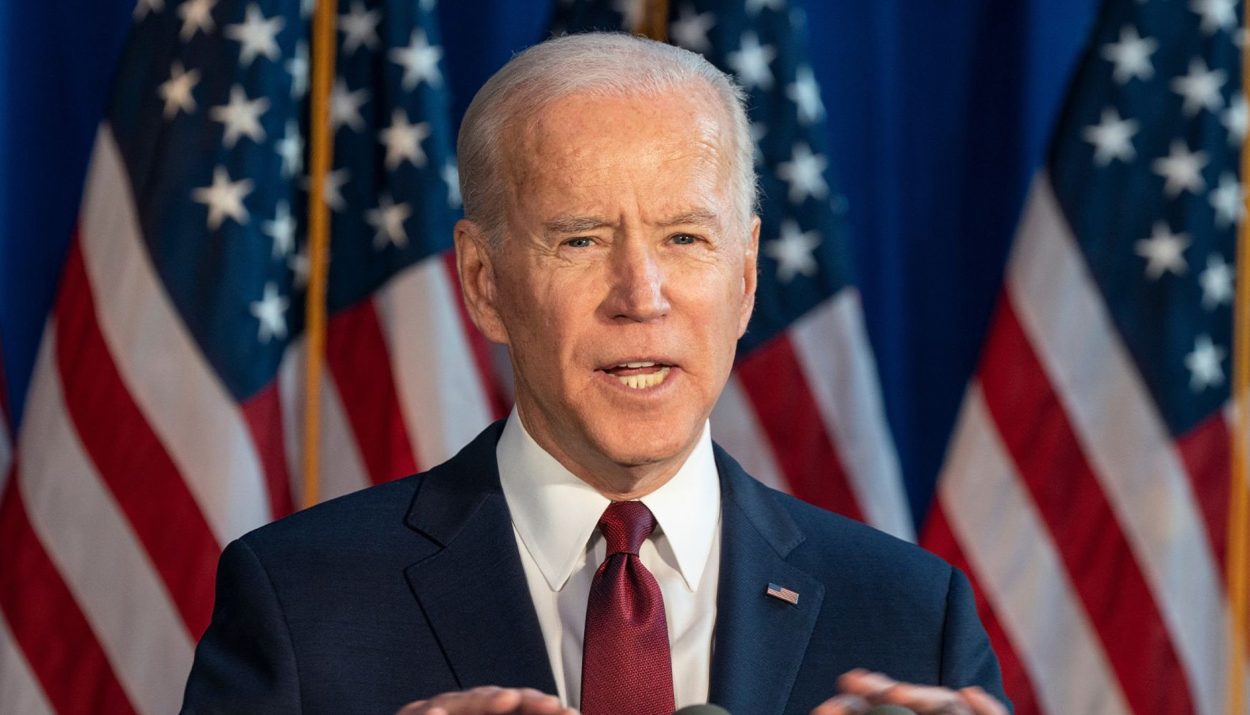

Biden Has His Work Cut Out For Him

President Biden has made it clear that the Social Security program is a priority of his administration, and his leadership will be crucial in getting a bill crafted with appropriate language for the United States moving forward.

His aspirations are steep, though. Bringing together Congress to create a working solution to this problem will require some political maneuvering and skill, and the fate of a program that has benefited Americans for more than 80 years hangs in the balance.

Republicans Have Different Priorities

Unfortunately for Biden, working with both sides of the aisle appears to be a steep ask. Especially in a deeply divided conservative conference, there doesn’t appear to be any effort to come to a compromise on many issues that require a solution, including the border and the budget deficit.

Republicans have made clear that reducing the national debt is a priority for them, especially ahead of the 2024 election, and they seem to be focusing on ways to make that happen. Some of the proposed solutions are financial cuts to programs such as Medicaid, but Republicans are always the first to reassure Americans that cuts to Social Security are “not on the table.”

Not Walking the Walk

Despite the lip service, Republicans have brought forward several budget proposals in the past two years that have, indeed, included cuts to Social Security.

In addition, the 2017 tax and jobs act signed into law by then-President Donald Trump has brought in less money to the system through the corporate tax cuts that are still being realized by the financial system. It has created a significant burden on the social security system, and has created an even more urgent need for a solution.

Social Security Is Not In Crisis…Yes

The Social Security program is not in dire crisis yet, but at the going rate, it will be soon. Other contemporary issues such as the increasing rates of significant disability caused by long COVID have put more pressure on the system as more and more people have applied for, and been granted SSI before the age of 65.

This has created a stressful give and take from the system. Young people who are disabled are claiming SSI benefits that are meant for the elderly, and not paying into the system for the years that it was initially planned. At the same time, Americans are living longer, taking more from the system; it’s a problem with an inevitable crash and burn.

Politicking on the Issue

It has become an issue ahead of the 2024 election as Republicans vie for the presidency and Democrats seek to take back the third branch of Congress. Nikki Haley even proposed a solution to the crisis that would raise the retirement age from the currently accepted 65 to 70, citing American’s longer lives as the reason.

There was significant backlash to this comment. Many Millennials and Gen Z-er’s who are just entering the workforce were appalled at the idea of working even longer, especially in the light of the affordability crisis in the United States. There might be many solutions to the issues with the social security program, but forcing young people to work more years for less payout does not appear to be a popular one.

The Crisis Looms

As more working Americans reach retirement age, the Social Security issue will become one that needs a solution. For now, Congress has gotten away with kicking the problem down the field to deal with at a later date, but that is a solution that will only work for so long.

Conversations about funding this issue are increasingly controversial in a deeply divided country, and it will be interesting to see where lawmakers ultimately end on the issue. Hopefully it will be a solution where everybody gets something, but nobody gets everything, and the program will be safe for elderly Americans for many years to come.