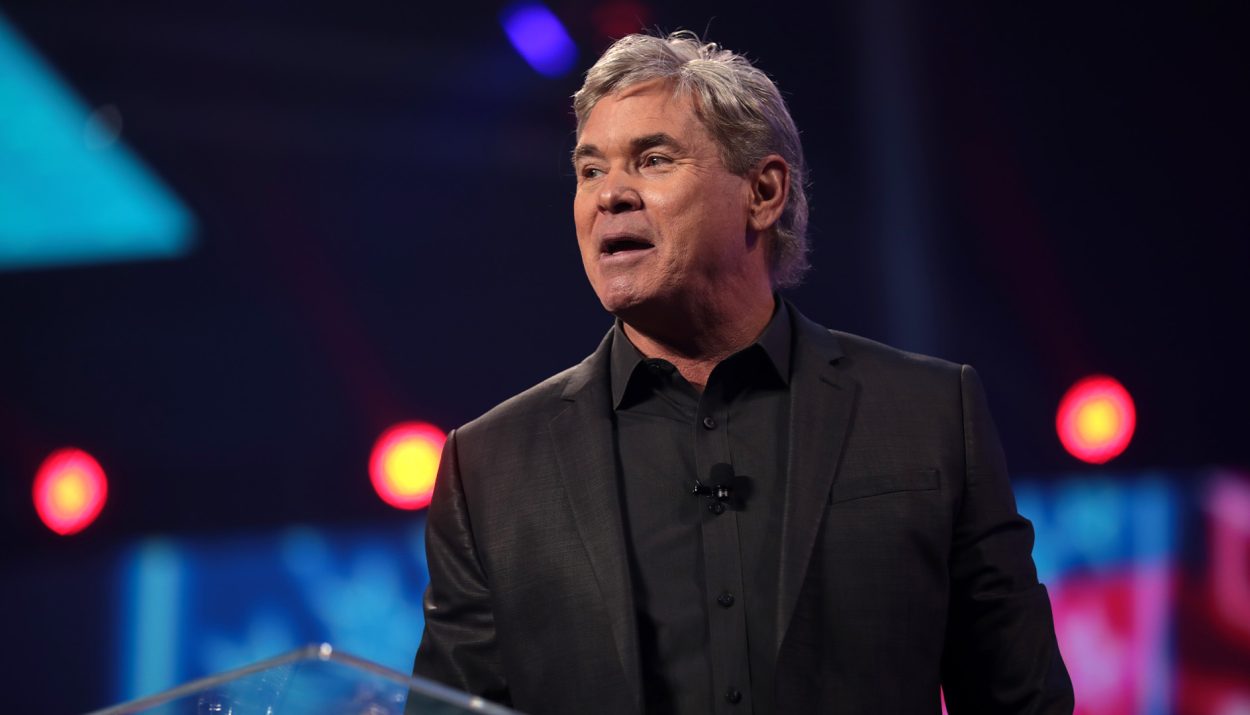

A recent statement by a prominent megachurch pastor has drawn scrutiny for potentially violating rules prohibiting religious leaders from making political endorsements. The pastor, who leads one of the largest congregations in the southeastern United States, acknowledged during a service last month that he publicly voiced support for a candidate in a competitive Senate race.

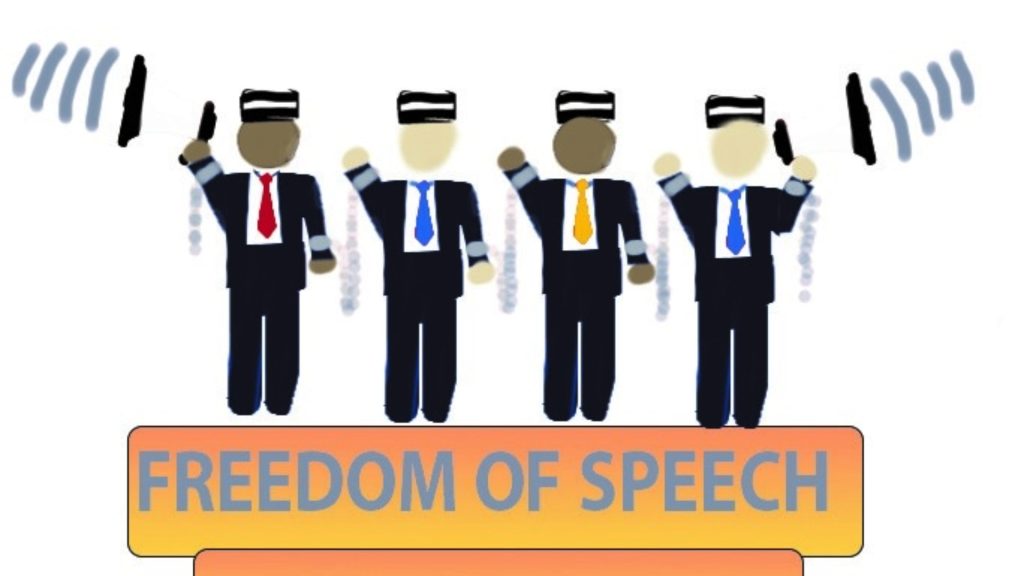

While churches are permitted to engage in nonpartisan civic engagement efforts, the tax-exempt status of religious organizations bars them from supporting or opposing political candidates.

Violation of Tax-Exempt Status

Pastor Jack Hibbs of Calvary Chapel Chino Hills urged his congregation during a sermon to vote for Republican Senate candidate Steve Garvey. Hibbs admitted that doing so violated laws prohibiting tax-exempt organizations like churches from endorsing political candidates.

The IRS explicitly prohibits 501(c)(3) tax-exempt organizations, including churches and other religious organizations, from directly or indirectly participating or intervening in any political campaign on behalf of or in opposition to any candidate for public office.

Competitive Primary

The primary election in March will use California’s jungle primary system, where all candidates run on the same ballot. The two candidates receiving the most votes advance to the general election in November. Polls show Schiff as the favorite, but Garvey and Porter are competing for the second spot to face Schiff.

Regardless of the outcome, the election is not considered competitive, given California’s strong Democratic leanings. In 2020, over 63% of Californians voted for Biden compared to 34% for Trump.

Violation of Tax-Exempt Status

As a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code, churches are prohibited from directly or indirectly participating in or intervening in any political campaign on behalf of (or in opposition to) any candidate for elective public office.

By endorsing Republican candidate Steve Garvey from the pulpit during a sermon, Pastor Jack Hibbs violated this statutory prohibition and put his church’s tax-exempt status at risk.

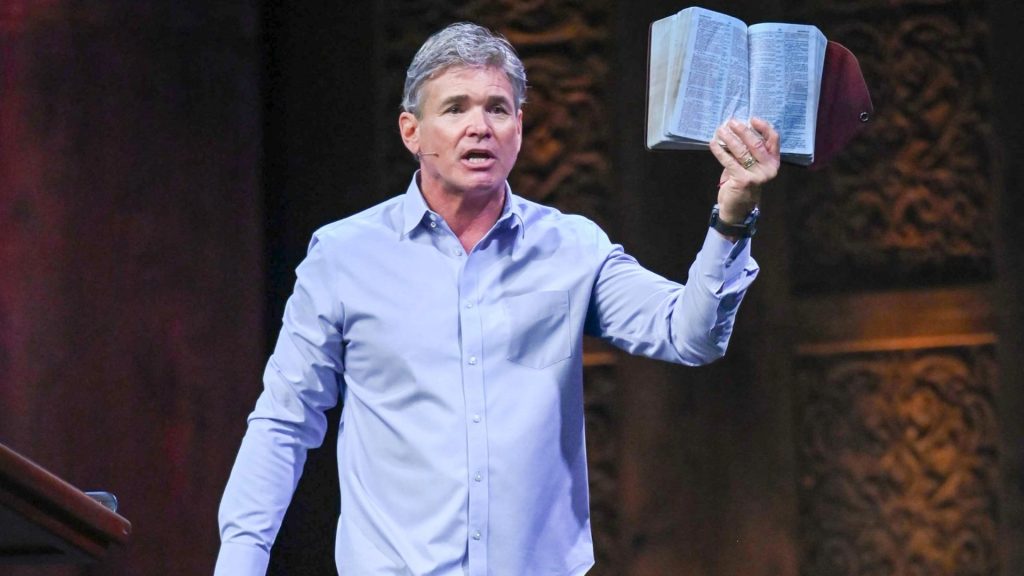

First Amendment Defense Unlikely to Succeed

While Pastor Hibbs cited his right to free speech as a private citizen in endorsing Garvey, the courts have upheld the ban on political campaign activity for tax-exempt organizations.

Given the clear violation of the statutory prohibition and legal precedent, Calvary Chapel is unlikely to succeed in defending Pastor Hibbs’ endorsement on First Amendment grounds.

Repercussions and Next Steps

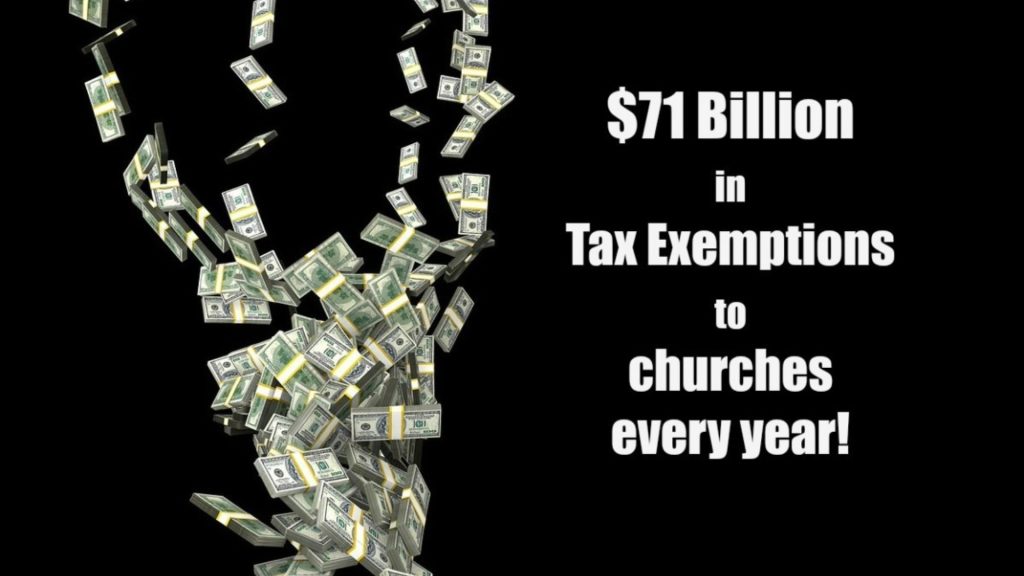

In addition to penalties from the IRS, Pastor Hibbs’ endorsement may damage the reputation and credibility of Calvary Chapel. Some critics argue that churches engaging in politics should lose their tax-exempt status.

To remedy this situation, Calvary Chapel should issue a statement clarifying that Pastor Hibbs’ endorsement was made in his capacity and not on behalf of the church.

Pastor Hibbs Remarks

“How are you voting, regarding our upcoming local vote? I want to publicly, right now today, encourage all of you to vote for Steve Garvey. You’ve got to vote for Steve Garvey. I just remembered, it’s against the law for me to say that in the pulpit,” Hibbs said.

“As a public citizen, Steve Garvey is not only one of the greatest baseball players of all time, but we want Steve Garvey to represent us in the Senate, and so Steve Garvey is the only guy on the ballot,” he said.

Criticism Mounts Against Pastor Hibbs

Pastor Hibbs’ remarks elicited a strong negative reaction, with many arguing that his church should lose its tax-exempt status for violating regulations prohibiting political campaign intervention.

The Freedom From Religion Foundation, a non-profit advocating for the separation of church and state, announced plans to report Calvary Chapel Chino Hills to the IRS.

Loss of Tax Exemption

As a 501(c)(3) organization, Pastor Hibbs’ megachurch currently enjoys tax-exempt status, meaning donations are tax-deductible, and the church pays no taxes on its income. However, the Internal Revenue Service (IRS) prohibits tax-exempt organizations from endorsing political candidates.

Now that Pastor Hibbs has openly endorsed Republican Senate candidate Steve Garvey during a sermon, the IRS may revoke the church’s tax exemption.

The Ethical Dilemma for Religious Leaders in Politics

Religious leaders face challenging decisions when it comes to engaging their congregations on political issues and endorsing candidates. On one hand, pastors and ministers feel a moral obligation to lead their flock on issues of ethics and values.

On the other, non-profit organizations like churches must follow laws prohibiting direct support of political candidates to maintain tax-exempt status.

Looking Back at Other High-Profile Pastor Endorsements

In 2008, Pastor John Hagee of Cornerstone Church in San Antonio, Texas, endorsed Republican presidential candidate John McCain. Hagee proclaimed that God willed McCain to be president. The McCain campaign later rejected Hagee’s endorsement after controversial past statements came to light.

Likewise, in 2012, Pastor Robert Jeffress of First Baptist Dallas endorsed Republican candidate Mitt Romney for president. Jeffress had previously said that Romney’s Mormon faith made him “not a Christian.”

How This Incident Could Impact Future Political Engagement by Clergy

The actions of Pastor Jack Hibbs in endorsing Senate candidate Steve Garvey during a sermon could have significant ramifications on how churches and clergy engage in political activities going forward.

As 501(c)(3) tax-exempt organizations, churches are prohibited from directly or indirectly participating in or intervening in, any political campaign on behalf of or in opposition to any candidate for elective public office.

Examining the Role of Religion in Political Campaigns

The non-profit status of religious organizations depends on following IRS regulations that prohibit endorsing political candidates. However, some religious leaders still choose to endorse candidates, raising questions about the role religion should play in politics.

Opponents argue these endorsements violate the separation of church and state and that tax-exempt organizations should not influence elections. Supporters counter that religious leaders have the right to free speech and that endorsements reflect leaders’ personal, not institutional, views.

The Ongoing Debate Over Church and Politics in America

The separation of church and state has long been a contentious issue in the U.S. There is an ongoing national debate over how much religious organizations should be allowed to engage in political discourse and campaigning.

Some argue that churches have a right to free speech and should be able to endorse candidates that align with their values, while others believe that allowing religious groups to campaign for specific candidates could undermine the division between church and state.

What This Means for the Relationship Between Church and State

The admission by Jack Hibbs, pastor of Calvary Chapel Chino Hills, that he violated laws prohibiting churches from endorsing political candidates threatens to further strain the relationship between religious institutions and the government.

The situation highlights the complex relationship between religion and government in the U.S. and the challenges of balancing First Amendment rights with regulations on political activity.