In recent times, there has been a noticeable shift in consumer behavior regarding Pepsi’s range of products. Customers are beginning to explore other options citing the price tags of Pepsi’s offerings as a primary concern. The company’s executives confirmed this last Friday stating that the company’s US sales are dropping as their prices keep rising.

“We’re seeing a bit of a slowdown in the US. Both in the food category and the beverage category in the fourth quarter,” CEO Ramon Laguarta said at the company’s earnings call.

PepsiCo’s Price Tweaks And Shifting Tastes

Recently, PepsiCo, the owner of brands like Mountain Dew, Lay’s, Cheetos, and Gatorade, has raised prices. This is supposedly to help offset the increasing costs of ingredients and disruptions in the supply chain.

“Part of that is a slowdown due to pricing and disposable income situation,” Laguarta said. “Part of that is also pivoting between in-home consumption and away-from-home consumption that we’re seeing in our business in the US.”

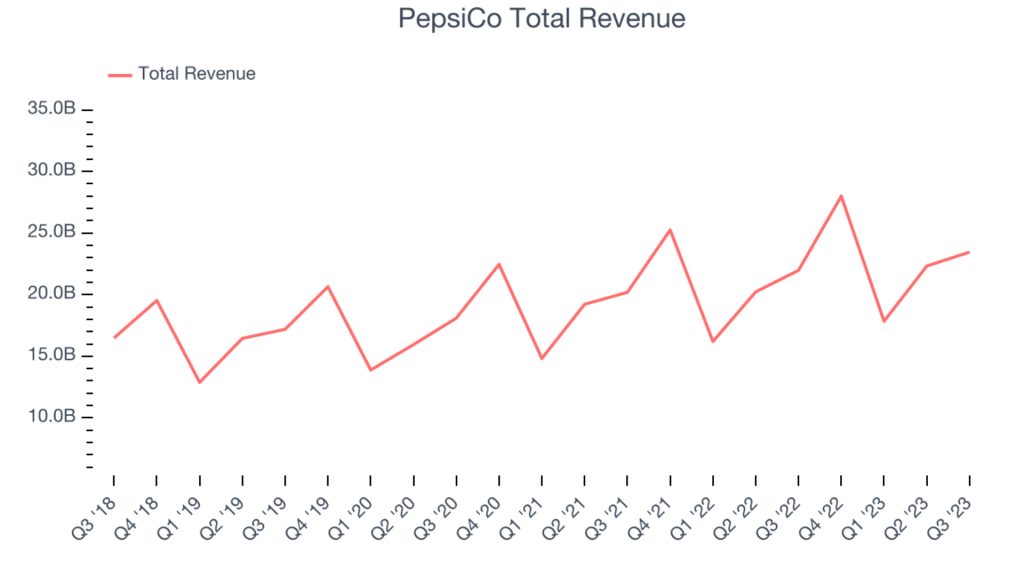

PepsiCo’s Fourth Quarter Revenue Trends

In the fourth quarter, PepsiCo’s worldwide revenues dipped by 0.5% compared to the previous year, totaling $27.85 billion.

In North America, sales declined by approximately 3.5%, reaching $16.28 billion. This drop was driven by a 3% decrease in Frito-Lay sales and a 2.4% decline in PepsiCo Beverages sales. And also, a significant 15.7% decrease in Quaker Foods sales, which is the smallest of the company’s three North American divisions.

Looking Ahead: Confidence And High Spirits

Laguarta mentioned that PepsiCo was adjusting its predictions because it believed the same pattern would carry on into 2024.

Despite this, PepsiCo is hopeful for this year. “We’re confident about consumers in “24 in the US,” Laguarta said. He noted the low unemployment rates and the expectation that wages would increase faster than inflation.

Summer Surprises: Lower Interest Rates And On-the-Go Snacking Trends!

“And we hope that by the summer interest rates will go down. That will create another source of oxygen for disposable income in households,” he continued.

Laguarta said that PepsiCo’s sales post-pandemic were shifting from in-home to away-from-home, such as at convenience stores. He mentioned that the size of the portions is “meaningfully different”. This is because people who buy food and drinks when they’re out usually prefer single-serving sizes that are easy to carry.

Refreshing Changes: Saying Goodbye To Some, Hello To Others

Laguarta mentioned that PepsiCo is set to make big changes. They plan to discontinue brands that don’t make as much money. He said they’ve stopped selling certain bottled water and larger bottles with multiple servings. They also recently announced they will no longer sell Mountain Dew Energy.

He also said that Pepsi will focus on its zero-calorie, no-sugar version called Pepsi Zero. He mentioned that this brand is presently attracting major sales. He also said that Mountain Dew is making its Baja Blast flavor available all year in stores across the US. The product has previously been sold only at Taco Bell and later expanded to other retailers during the summer.

Starry Shines, Sales Soar!

Starry, PepsiCo’s has been popular among Gen Z and has been attracting repeat customers, he also said. The lemon-lime drink without caffeine was introduced last January.

PepsiCo’s revenues in Latin America increased by around 18%. However, sales in its other regions – Europe; Africa, the Middle East, and South Asia; and Asia Pacific, Australia, New Zealand, and China Region – all experienced slight declines.

Pricing Woes: Carrefour Ditches PepsiCo, McDonald’s Suffers Backlash

In January, the French grocery store chain Carrefour announced that it would no longer sell PepsiCo’s products due to their high prices.

During the pandemic, prices at stores and restaurants went up a lot. This was because of labor shortages and problems with the supply chain, which made their costs higher. But now, customers are starting to react. Last week, McDonald’s said that price increases were turning customers away.

Carrefour’s Big Move: Shaking Up Grocery Shopping!

Carrefour’s move impacted more than 9,000 stores across four countries. This amounted to two-thirds of the retailer’s global footprint of 14,348 stores according to its 2022 annual report.

Retailers in various countries, such as Germany have also ended orders from consumer goods companies. This tactic is used in negotiations over prices, which have become more tense due to inflation.

PepsiCo Vs. Carrefour: The Battle Of The Supermarket Shelves!

“We’ve been in discussion with Carrefour for many months and we will continue to engage in good faith in order to try to ensure that our products are available,” PepsiCo said in a statement last month.

Certain PepsiCo items, like Cheetos and 7Up, were unavailable at a Carrefour supermarket in Paris’ upscale 16th district last month. However, other products, such as Pepsi, remained on the shelves alongside a sign.

Cheers In the Aisles: Shoppers React To Carrefour’s Pricing Standoff

Customers in the supermarket broadly cheered the move. “It doesn’t surprise me at all,” shopper Edith exclaimed. “I think there will be lots of products left on the shelves because they have become too expensive, and they are all things we can avoid buying.”

Carrefour has been among the most proactive retailers in challenging food companies on pricing. Last year, it launched a “shrinkflation” campaign by placing warnings on products that have reduced in size but increased in cost.

Carrefour’s Price Hike Battle: Going At It Alone

The group’s action was characterized as a “show of strength” by the chairman of Carrefour’s main competitor, E.Leclerc. However, their actions seem to have heightened tensions in what has become a politically charged topic amid the cost of living crisis.

They wouldn’t be joining Carrefour in taking such a bold move though. The company’s chairman Michel-Edouard Leclerc said his company wouldn’t be removing PepsiCo products from its shelves. Their preference instead is to engage in discussions with the fizzy drink giant.

Tried And Tested Blueprint To Follow

PepsiCo already has a blueprint to follow in its current standoff with a major retailer. Back in January 2022, Loblaw refused a price increase of less than 10%. As a result, PepsiCo stopped supplying its Frito-Lay potato chips to the Canadian grocery store.

In April of that year, Loblaw said the snack would be back on its shelves. This was after the two sides finally reached an agreement, according to the Financial Post.