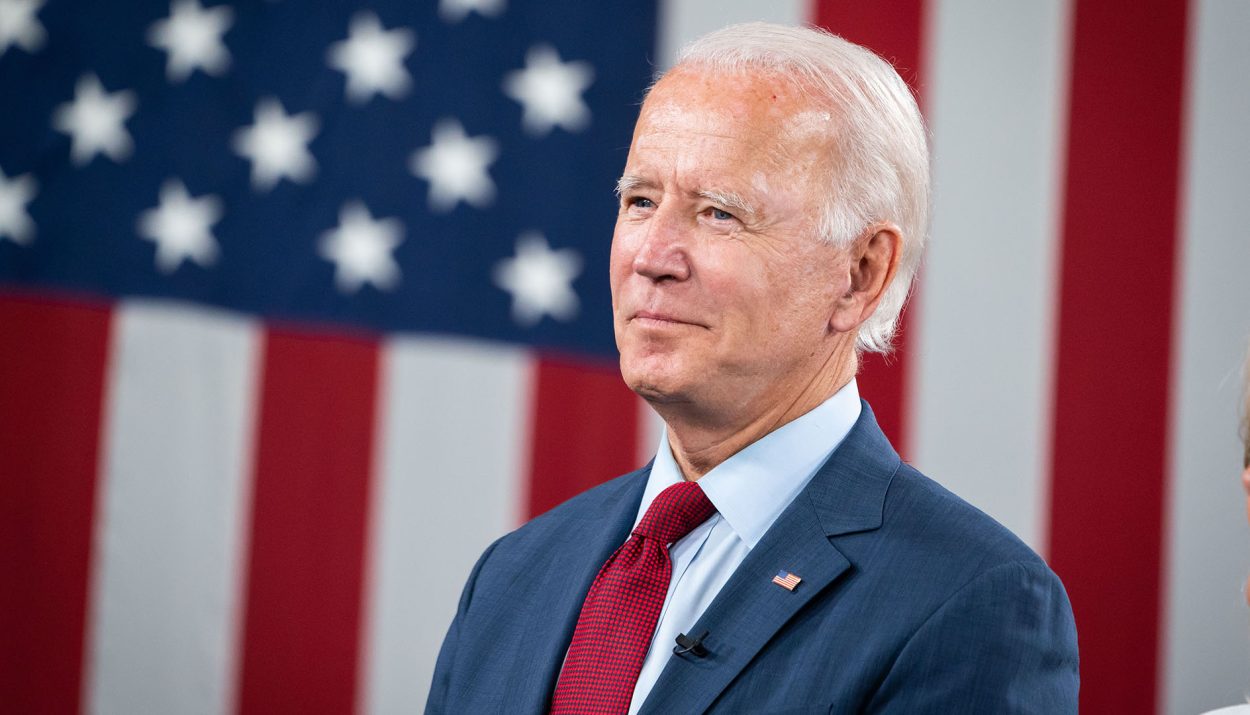

A federal judge in Texas has handed President Joe Biden a major victory by dismissing a lawsuit against his administration’s new Medicare drug pricing program. What does this ruling mean for efforts to lower sky-high prescription costs?

Texas Ruling Crucial First Step For Biden Medicare Drug Price Plan

The federal court decision in Texas dismissing the pharmaceutical industry lawsuit against President Biden’s Medicare drug pricing negotiation plan represents an important first legal and policy victory for the administration. Analysts called it the “starting gun” enabling the historic reforms.

While massive financial interests vow appeals, the administration notched a high-profile win by allowing activation of inflated reduction act mechanisms to leverage Medicare market power for discounts, estimated to ultimately save taxpayers and beneficiaries billions while advancing affordability aims.

Judge Clears Path For Medicare Talks Impacting Millions

Upholding the Inflation Reduction Act provisions over industry objections now opens the door for Medicare to engage pharmaceutical giants in reducing costs for medications used by millions of American seniors. Negotiations will prove a complex balancing act.

With the legal basis affirmed despite allegations of harm and threats to access, stakeholders predict talks kicking off could set sweeping precedents in broader efforts to rein in historically skyrocketing domestic prescription drug prices through competition and consumer consolidation power.

Big Pharma Vows to Keep Fighting Medicare Drug Price Negotiations

The Pharmaceutical Research and Manufacturers of America (PhRMA) expressed disappointment over the judge’s decision backing Medicare drug negotiations, pledging to weigh the next legal steps. Other plaintiffs like the Global Colon Cancer Association (GCCA) may also appeal.

Though the Biden administration secured an initial victory allowing the drug pricing initiative to advance, opponents remain defiant. With billions in revenue at stake, PhRMA and allied groups are expected to exhaust every option in trying to block or at least slow implementation.

CBO Projects Medicare Negotiations Could Cut Spending by $100 Billion

Independent fiscal experts at the Congressional Budget Office predict Biden’s Medicare drug negotiation policy could save up to $100 billion over the next decade. The forecast stems from projected discounts the government could obtain.

The pharmaceutical industry argues the potential fines for noncompliance are excessive, ranging from 185% to 1,900% of a drug’s total sales. However, the White House maintains bringing down costs is vital for both taxpayers and patients struggling with prescription expenses.

Florida Import Approval Foreshadows Drug Market Disruption

Beyond the Medicare reforms, the January FDA decision permitting Florida to import lower-cost prescription drugs from Canada signals seismic shifts on the horizon disrupting traditionally sheltered U.S. pharmaceutical sectors. More state applications are pending as legislators capitalize on swelling public outrage over domestically inflated patient expenses enriching corporate balance sheets. Experts forecast market globalization as trade barriers fall, especially if early state efforts succeed.

For American drug manufacturers, fierce defenders of existing frameworks guaranteeing profitability, the Florida precedent precipitates an existential crisis potentially catalyzing sweeping legislative and regulatory efforts to increase market competition through foreign access.

Democrats Advance Bills Capping Insulin, Hearing Aids

Parallel to the Medicare prescription drug negotiations, Congressional Democrats led by Sen. Majority Leader Chuck Schumer advanced popular legislation capping monthly insulin copays at $35 while allowing over-the-counter hearing aid sales to improve access and affordability.

The dual bills carry tangible impacts for patients if enacted but still face heavy special interest resistance despite strong polling numbers as medical trade groups and manufacturers mobilize lobbying efforts to dispute reform necessity and financial realities. For Democrats, the effort promises electorally potent messaging reinforcing commitments to challenge consolidated industry power through patient advocacy ahead of pivotal election cycles.

CBO Outlines Variables Impacting Medicare Negotiation Savings

According to analysis by nonpartisan Congressional Budget Office experts, realizing Biden’s envisioned $100 billion savings over a decade via Medicare drug negotiations depends partly on unknown variables related to implementation realities.

Firstly, the pace and scale of reforms hinge on bureaucratic efficiency in standing up complex new negotiating mechanisms alongside determining which medications to prioritize based on patient utilization rates and current pricing markers. Additionally, actual savings will derive from the pacing of negotiations, pharma concessions based on formulas determining financial risk tolerances for disrupted revenue streams, and other factors introducing uncertainties into fiscal impact scoring.

Court Fight Raises Concerns of Medical Shortages

After the Texas ruling, pharmaceutical interests continued utilizing arguments claiming penalties for failed Medicare negotiations could potentially bankrupt manufacturers, forcing the elimination of certain drug lines and reducing overall market diversity and access downstream.

Critics argue such warnings exaggerate hypotheticals but acknowledge legitimate factors if penalties over-scale, especially for narrow therapeutics without competitor alternatives. They also note companies forfeit negotiation power by avoiding collaborative cost solutions. Regardless of motivations, the medical shortage narratives represent likely industry talking points weaponizing patient fears to fuel legal appeals and legislative lobbying throughout the unfolding Medicare reform rollout.

Supreme Court Litigation Looms Over Policy Rollout

Legal experts anticipate litigation challenging Biden’s Medicare drug negotiation reforms will almost certainly reach the Supreme Court given the consolidated full-weight opposition of the multi-billion dollar pharmaceutical sector.

Various plaintiff arguments previewed in lower court battles frame pending appeals seeking injunctions on implementation procedures so far endorsed by district judges. Many anticipate long timelines as cases wind through circuits before final adjudication by SCOTUS. In 2013, the Court sided against drugmakers ruling that pay-for-delay deals are illegal. But the conservative 6-3 supermajority brings uncertainties over crystallized outlooks on the scope of Executive Branch price setting powers that may determine policy survival.

Biden Claims Mandate on Drug Costs Ahead of Election Season

Emerging victorious from the latest pharmaceutical industry court challenge fortifies Biden administration messaging about delivering much-awaited relief on skyrocketing prescription medicine prices as both parties angle for advantage entering the pivotal 2024 campaign cycles.

While more legal fights loom, the Texas ruling gifts a powerful talking point for Democrats to both solidify the progressive base and court independents skeptical of whether the government can overcome entrenched health sector interests to enact reform benefiting everyday Americans.