The proposed $4 billion merger between the Trump Media and Technology Group and Digital World Acquisition Corp. has sparked debate and speculation regarding its viability and potential for success. Trump and his partners tout the deal as a means to challenge big tech and create a rival social media platform to reach millions. At the same time, critics question the former President’s ability to compete in a crowded marketplace.

As the deal progresses, many are watching closely to determine whether this represents Trump’s financial salvation or an elusive mirage built on shaky ground. The coming months will shed light on the strength of the business model and the partners’ capability to deliver on ambitious goals.

Trump’s Financial Troubles and Need for Capital

Recent reports claim that former President Trump’s financial troubles could be alleviated through a proposed merger between his Media and Technology Group and Digital World Acquisition Corp.

The $4 billion merger may provide the capital Trump desperately needs to settle his many legal disputes and pay off debts. While some experts believe the merger could save Trump’s finances, others argue that the valuation of his media company is unrealistic.

Questions Over Trump Media and Technology Group’s Valuation

According to Jay Ritter, a finance professor at the University of Florida, the merger could generate $270 million for Trump’s company. However, Ritter argues that the media company’s valuation is disconnected from its fundamental value.

He describes the valuation as “crazy,” given the company’s $26 million loss and $1 million in revenue last quarter. Although the merger would make Trump’s 79 million shares worth $4 billion on paper, Ritter says that amount would not immediately translate to “actual cash” for Trump.

Breaking Down the Key Players: Trump Media and Technology Group

Former President Donald Trump founded Trump Media and Technology Group (TMTG) to operate his social media platform, Truth Social. According to recent filings with the SEC, TMTG has struggled financially, posting a loss of $26 million in revenue over the last quarter while generating just over $1 million.

CNN spoke to a finance professor at the University of Florida, Jay Ritter, who stated that it could result in an estimated $270 million flowing into Trump’s Media and Technology Company. The injection of cash could then lead to the growth of Trump’s Truth Social platform, which has been struggling over recent years.

Breaking Down the Key Players: Digital World Acquisition Corp

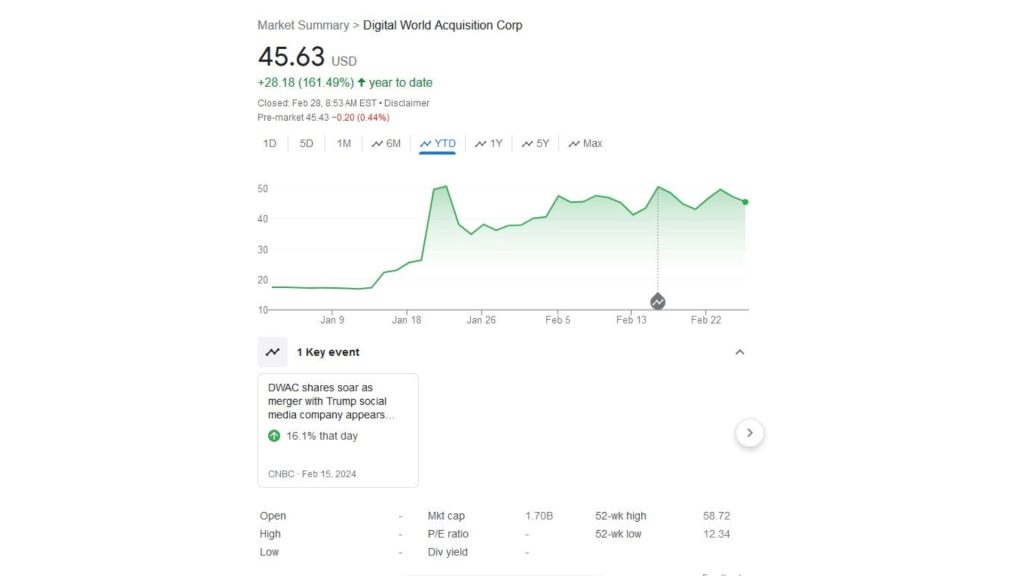

Digital World Acquisition Corp (DWAC) is a special purpose acquisition company (SPAC) that provides a means for private companies to become publicly traded without an initial public offering (IPO). DWAC announced plans to merge with TMTG, which would allow the media company to become publicly traded.

According to reports, the merger is valued at $4 billion. For the merger to be finalized, shareholders must now vote in favor, and due to the increase in share price, there is no question that shareholders will support the move. “Anyone who holds shares and votes against the merger is crazy,” explained Ritter, noting that they would lose money if they did not.

Potential Benefits of the Merger for Trump

The funds from the merger may provide Trump with the means to pay mounting legal costs and liabilities. Trump faces several pending lawsuits and legal issues that have already resulted in substantial financial penalties.

According to legal experts, the $4 billion that Trump stands to gain could be enough to pay for all current and pending legal liabilities. While Trump will not have immediate access to the full funds due to a lock-up period, the deal may help him avoid bankruptcy and continue to fight legal battles.

Regaining Public Company Status

The merger’s approval also allows Trump to return to Wall Street as the head of a publicly traded company. Trump previously took multiple companies public, though several ultimately filed for bankruptcy. Becoming CEO of a publicly traded company again could restore a measure of credibility and status for Trump in the business world.

However, some analysts argue the valuation of Trump’s new media company seems divorced from its fundamentals and revenue, describing it as a “meme stock.” The long-term viability of the new public company remains uncertain.

Risks and Skepticism Around the Deal

While the merger could provide an influx of capital to fuel the growth of Trump’s Truth Social platform, the funds may not translate into immediate cash for the former President. As the majority shareholder with 79 million shares, Trump’s stake was calculated at $4 billion based on a $50 share price.

However, Ritter noted this amounts to “paper wealth” that cannot be accessed for at least six months due to a lock-up period preventing the sale of shares. The merger still needs approval from shareholders, but given the rise in stock price, approval seems likely.

What This Means for the Future of Trump’s Media Presence

While Trump stands to gain a sizable stake in the new company, estimated to be worth $4 billion based on current share prices, finance experts caution that this amounts to “paper wealth” that may be difficult to convert into actual cash.

Nonetheless, the infusion of funds is poised to fuel the expansion of Truth Social, Trump’s social network that has struggled since launching earlier this year. Trump owns a majority of shares in Trump Media and Technology Group, holding approximately 79 million, according to SEC filings cited by CNN.

Implications for the Social Media and Political Landscapes

The implications of the merger for Truth Social and the political sphere are manifold. Trump’s social media venture has struggled since its launch, posting substantial losses despite the former President’s popularity and reach.

An infusion of $270 million could allow Truth Social to scale up rapidly, improve its offerings, and attract more users. With a larger platform and audience, Trump may gain more influence over public discourse and the political agenda once again.

Unanswered Questions Surrounding the Merger

There are still many unresolved questions surrounding the proposed merger between Trump’s Media and Technology Group and Digital World Acquisition Corp. While the SEC has approved the merger, shareholders must now vote to finalize it.

The valuation of Trump’s media company has been called into question, with Ritter describing it as “totally divorced from the fundamental value of the company.” He characterizes the valuation as “crazy,” highlighting the company’s poor financial performance.