Any casual scholar of economics knows that when taxes rise, businesses leave. However, the same is true for people. Several states have seen a wealth tax as a viable way to offset their debts, but this action will have consequences. Let’s look at which states are going to implement this tax and which citizens would be most affected.

California’s Budget Deficit Has Become a Chasm

California has expanded its spending and borrowing, and now someone has to pay the piper. Over the last decade, the state budget has ballooned, doubling to cope with inflation and population growth. This year, the deficit is supposed to reach $68 billion.

Most of the state’s income comes from taxing a tiny sliver of the population. These taxes and loans go towards funding massive retiree health insurance and pensions for residents. An alarming 2022 for the stock market also limited the state’s income from capital gains taxes.

Tax Payment Deadline Extensions Worsen the Problem

Aside from a bad financial year for the state itself, citizens also had to cope with a few massive winter storms that laid waste to property. Governor Gavin Newsom extended the date by which taxes could be paid for residents.

While residents are grateful for the relief the extended deadline to tax payment offers them, it’s a double-edged sword. The state can’t recover this revenue until these taxes are paid, adding more to the debt burden that the state is already shouldering.

New York City Also Feeling the Bite

The East Coast is having its own problems with mounting debt. The budget deficit in New York City is estimated to be around $13 billion. While nowhere near as massive as the debt that California has racked up, it’s still significant.

New York is seeing a slowly rising tide of debt, as the city’s income is far less than its expenditures. Over the years, it has managed its debt successfully, but inflation and other factors, such as its migrant crisis, may force expenses above manageable levels.

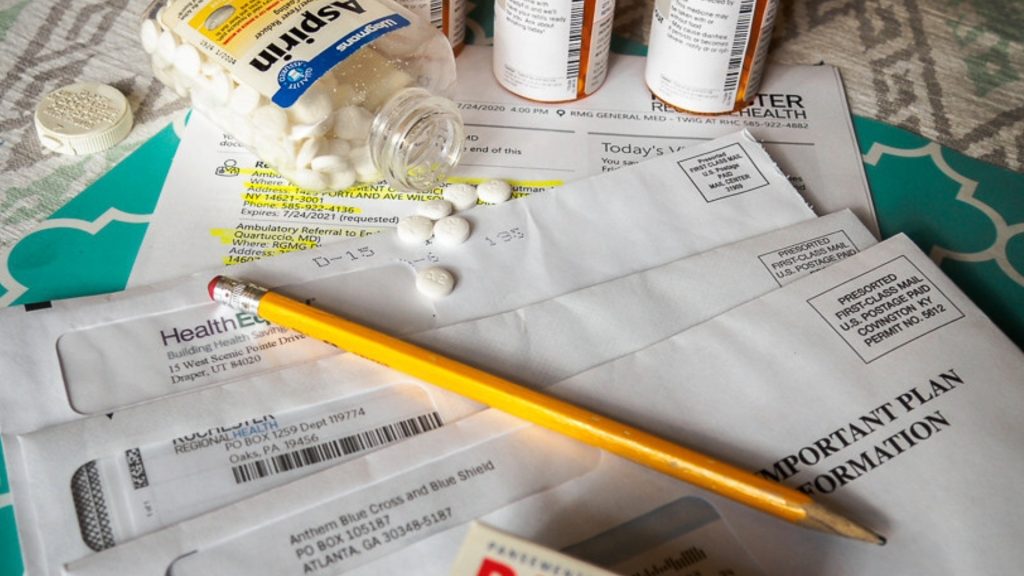

Paying Off Medical Debt Adds to the Problem

New York City has pledged to pay down $2 billion of residents’ medical debt recently, meaning it must find the money to meet these obligations. Up to 500,000 residents will have their medical debt erased completely.

While this benefits the medical companies that are still getting paid, it puts much more pressure on taxpaying citizens who may not benefit from this write-off. So, who’s going to fit the bill for this charitable payment? New York has an answer that wealthy citizens will not like.

The Proposed California Wealth Tax

California’s proposed wealth tax will likely levy taxes on anyone with over $1 billion worldwide assets. While implementing this tax may help to ease the tax burden on California, it will be difficult to enforce since tracking down assets will be extremely difficult.

Beyond that, the consideration is that many residents who are unhappy with the taxation are likely to just leave California. If these individuals take their businesses with them, the state could be in a much worse position financially than it is now.

Hitting Both Full-Time and Part-Time Residents

One of the loopholes lawmakers spotted early on was that some residents are seasonal, especially those of a higher economic class. Targeting permanent residents would earn them far less than going after the part-time residents of their most opulent neighborhoods.

Even part-time residents will be subject to the 1.5% excise on assets exceeding $1 billion worldwide. By 2026, the wealth tax is expected to expand to take up residents whose wealth is over $50 million. The state hopes it will offset most of its spending by that point.

Exemptions For Personal Real Estate

California’s Wealth Tax will likely impact many individuals, but some assets are exempt from the tax. Real estate assets won’t be included in the tax calculations, making it more likely that high-net-worth individuals would move their wealth into real estate investments to avoid taxation.

The idea is that putting more money into real estate would be offset by the high taxes on mansion sales in places like Los Angeles and San Francisco. However, for those interested in purchasing agricultural or commercial real estate, the exemption offers an easy way to avoid being taxed.

New York Aims For a Different Approach

New York also wants to tax its wealthiest citizens, but they don’t want to spend time working through a multitude of international assets to calculate taxable income. Instead, they intend to levy a tax on capital gains for all realized income that comes from stock and bond sales.

The tax mandate is slated to impact citizens with an income of over $400,000 from long-term capital gains. On these earnings, the state will levy an income tax between 7.5% and 15%, depending on the amount of earnings.

Capital Flight Occurring Because of Taxes

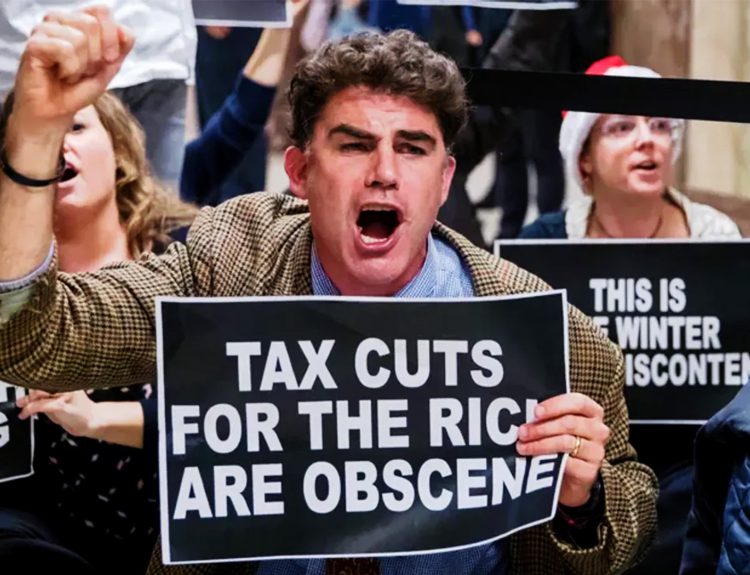

Taxing the wealthy has always been a significant point of contention in political circles. Many people have demanded that millionaires pay their fair share of the tax burden. These new taxes are supposed to address income inequality by taxing the wealthiest.

Most people believe the wealthiest in America don’t pay their fair share of the taxes. In implementing these, lawmakers in these states are enacting something that middle-income and low-income earners have been calling for for decades.

No Deep Ties To the State

However, the wealthy also have the means to move anywhere they want to, including places that don’t have wealth taxes. This could see a lot of New York’s and California’s high-earning residents leave the state because they can afford to live anywhere they want.

New York’s taxes on capital gains may be the most successful push in this direction. Traders can work remotely, of course, but the state can tax capital gains on stocks and bonds sold on the NYSE quickly enough.

Counting On Investment and Property Ties

Many wealthy individuals in both locations have businesses and investment properties within the state. It would be difficult to move while still owning those assets, and the states rely on the hassle of disposing of them to keep those citizens paying taxes.

However, with the proper financial management, disposing of these assets is relatively simple. Once the family no longer has anything that ties them to the state, they can leave, taking their wealth and whatever taxes they would have paid with them to greener pastures.

Lower Taxes From a Smaller Population

California and New York are still recovering from the population drop that occurred thanks to the pandemic. New York’s population decline is offset by an influx of migrants from the border.

Unfortunately, these migrants are not taxable entities, and the state doesn’t benefit from their presence. California has made some bad decisions to drive away workers. The cost of living in California is high, and taxes on freelancers have also seen a mass exodus from the state.

Smaller Taxable Entities Leave a Larger Burden

With these smaller taxable entities leaving, the state now has to look at the high-income earners as a source of revenue. This, of course, is where the wealth taxes stem from. High-income earners have to pay for bad political decisions.

New York’s approach targets people who may not be earning that much either. With many people now trading on the stock and bonds market, the “wealth” tax might target someone in the middle of the earning table.

Lots of Places to Go

Many wealthy people leave California and New York because it impacts their bottom line too much. Millennial millionaires are looking at places like Nevada, Texas, and Florida as where they want to spend their time (and money).

Texas and Florida, particularly, are attractive for these wealthy citizens because their effective tax rates are 0%. These locales are only those within US borders, and many more tax havens exist outside the US that would be glad to welcome more wealthy citizens to their shores.

State Taxation Is an Election Issue

The US Presidential Election is slated for later this year, and state taxation is a huge talking point that both sides must address. If re-elected, Biden intends to increase taxes on individual, corporate, and capital gains.

Conversely, while Donald Trump has not yet broached the state taxes issue, he has set a precedent for reducing taxes. If he continues on this road, we could see taxes being reduced again for a large portion of the wealthy and allowances for tax breaks for corporations.

Most People Are For Taxing the Wealthy

A YouGov poll noted that most of the population favors taxing the wealthy and making them pay their fair share. However, the poll only asked whether they supported the measure, not how it should be implemented.

Both Republicans and Democrats will have a hard time implementing and enforcing a wealth tax on the wealthiest citizens. Many of the financiers of these parties would be negatively affected by such a tax, and proposing it would not endear the incumbent to those financiers.

A Significant Tax Code Overhaul Expected

Legislation introduced under the Trump administration is set to expire in 2025. The Tax Cuts and Jobs Act shifted the boundaries for taxable income and changed personal taxation at every level.

The President in 2025 will be responsible for revamping much of the tax code. Whether it’s Biden, Trump, or someone else, they will have to balance the will of the people with what they want from the legislation.

Could We See More People Leave?

State wealth taxes will always be contentious since they risk forcing people who have money out of the places where they can spend that money. Unfortunately, a lot of people on the street advocating for higher taxes don’t see this angle.

If state taxes continue to rise or wealth taxes proliferate across more states, the ones without income taxes will see an influx of wealthy citizens. Only time will tell if wealth taxes will actually help ease the debt burden on the states that have implemented them.