As the tax deadline of April 15 looms, Rep. Marjorie Taylor Greene has aimed at the federal government over its spending. Amidst the usual flurry of last-minute filings, a new voice has emerged in the debate over federal taxation: that of Rep. Marjorie Taylor Greene. The Georgia Republican has been vocal in her criticism of the federal government’s spending habits, sparking a heated discussion on the role of taxation in American society.

Greene’s Stance That Taxation Power Be Taken From Federal Government

The Georgia Republican has said taxation powers should be taken away from the federal government. She laments the trillions of dollars collected in 2023 to fund essential tenets of American society, such as healthcare, Social Security, and the military.

Greene’s stance on taxation is rooted in a belief in limited government and fiscal conservatism. She argues that the federal government’s current level of spending is unsustainable and that taxation powers should be returned to the states, where they can be managed more effectively.

Greene States that “Shameful” Collections By the US Government

On X (formerly Twitter), Greene wrote that “…The U.S. federal government collects an average of $4.7 trillion annually from Americans and this is the result of your hard-earned tax dollars. It’s shameful.”

By taking these issues onto social media platforms such as Facebook or Twitter, her main aim was to show her dissatisfaction with the American taxation system at present. She added that billions of dollars are collected by national governments but “most of this money does not go towards productive uses.”

Greene’s Proposal for Government Size

She further adds that she believes in cutting down half of what Washington spends today and giving more power in taxation back to individual states without mentioning how this can happen specifically.

However, Greene does not provide details on how this drastic reduction in government size would be achieved, leaving many questions unanswered.

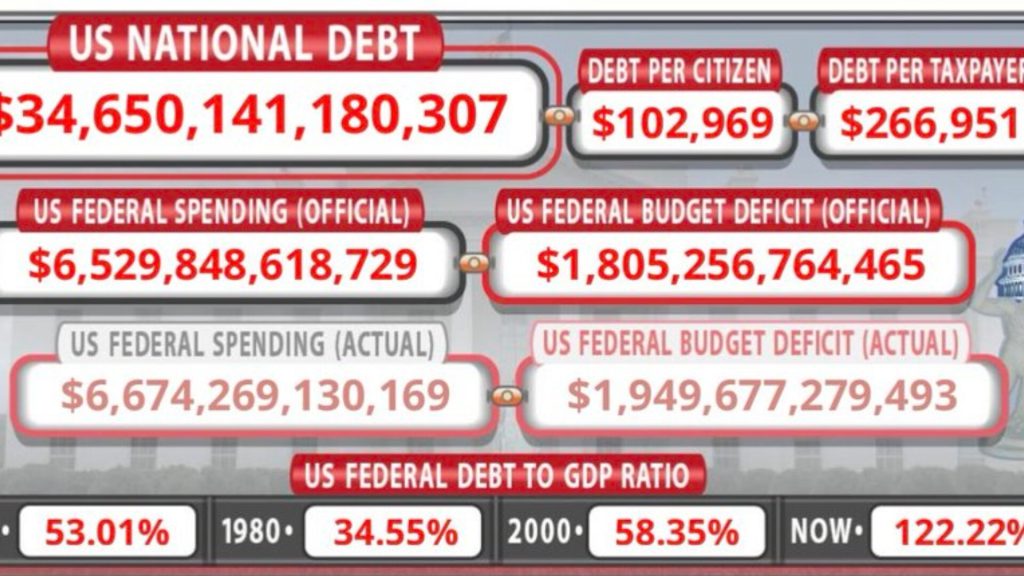

Greene’s Infographic on Government Spending and Taxation

Greene also posted an infographic of the Federal Government’s taxation, spending, and U.S. national debt. The image posted on her social media accounts is a representation of how America is financially run by the central government.

The amount of money that is received from tax collections, its disbursement, and the current state of the country’s indebtedness are all broken down in this infographic. Furthermore, Greene uses an infographic to make another point about government expenditure.

National Debt Burdens Americans According to Greene

The infographic claims the national debt, which it lists as $34.6 trillion, amounts to $102,969 per U.S. citizen and $266,951 per taxpayer. According to Greene, these figures show just how much individual Americans have been burdened with due to the national debt.

Thus, citizens are assuming their part in shouldering this enormous financial load as citizens and taxpayers; further highlighting her argument regarding fiscal responsibility in Washington.

Greene’s Claims Could Not Be Verified

These figures could not be verified independently at this point and there is no indication of where the infographic originated from. This raises some concerns about the accuracy of Greene’s assertions.

Although politicians tend to use data to back up their opinions, it must be correct and can be proved. The lack of independent verification for these numbers points out the necessity for open political discussions.

Government Spending in 2023 Amounts to $6.5tn

The infographic brings to light government spending statistics for the financial year 2023. It is shown in this infographic that last year the federal government spent $6.5tn.

This figure if accurate gives a glimpse into how big federal spending goes. It urges for less state expenditure and more fiscal responsibility, thus supporting Greene’s argument.

Greene’s Figures vs Official Government Figures

Greene lists the total amount of money spent as $6.6tn and that is not far from what actually has been recorded by the Treasury Department but still different. This indicates that Greene may have presented wrong information in his infographic as depicted by his figures and official treasury totals.

On a larger scale, it seems like an insignificant difference though it should be noted that even fractional inaccuracies carry major implications when dealing with amounts such as those.

Spending in the Current Fiscal Year Amounts To $3.25tn

The Biden administration has already spent approximately $3.25tn during the current fiscal year 2024 running from October 2023 up until September 2024 according to the Treasury Department.

In this fiscal year, it shows how much money the federal government has spent so far; providing an important yardstick for measuring further expenditures of future years along these lines. By using this number, Greene claims that the US federal government is out of control of its spending spree and must be restrained.

Increase in Government Spending by $103Bn

During this period, spending has increased by $103bn over last year’s same period. For instance, she says what we have done regarding defense budgeting within one year could also be improved.

She points to this increase as evidence of reckless government spending habits and uses it to back her argument for reduced government size and spending.

Greene Suggests That the Federal Government Should Be Halved

Marjorie Taylor Greene told reporters outside Capitol Hill ahead of the April 15 Tax day and suggested that the federal government should be halved. Greene has made a lot of public appearances and statements to both her supporters and foes.

Her proposals which she has always been controversial about, like halving the federal government are bringing up very heated debates on what should be the size of the federal government in the American society.

What Is The Public Response to Greene’s Proposals?

Public reactions have been mixed toward Greene’s suggestions. While some laud her for fighting against what they perceive as an overreach by the government others also lambast her for proposing extreme measures without giving any clear action plan on how they will be implemented.

Critics contend that such a move would lead to a considerable reduction in essential services, affecting everything from healthcare to national security. On the other hand, proponents believe that this is necessary to bring down national expenditure and eventually decrease national debt.

Implementing Green’s Proposals Would Be Challenging

However, it is unclear whether Greene’s proposals will succeed or not going forward. Her ideas may be thought-provoking but practically implementing them into policy would be a very challenging task ahead. It will need more than just support from her fellow legislators but also a shift in public opinion as well.

Overall, the debate on federal taxation and spending will continue as the tax deadline approaches. The only certainty arising from this is Marjorie Taylor Greene has successfully brought these matters for discussion at the national level.

Green’s Suggestions Sparks Debate Around Federal Spending

As the tax deadline approaches, Greene’s rage against the federal government’s spending and taxation powers has sparked a heated debate.

Whether her suggestions will lead to any changes remains to be seen.