California is facing a large budget deficit that is putting pressure on state leaders to find ways to raise revenue. One proposal being considered is a wealth tax on high-net-worth individuals, which has generated controversy.

Supporters argue that the tax is necessary to raise funds for critical state programs, while opponents claim it may prompt the wealthy to leave the state. The debate surrounding the wealth tax proposal highlights the state’s ongoing struggle to balance its budget while promoting inclusive economic growth.

California’s Budget Deficit and Need for New Revenue

California faces a projected budget deficit of $68 billion for the 2022 fiscal year. The state’s unfunded liabilities, including an estimated $150 billion in retiree healthcare costs and over $1 trillion in pension deficits, intensify the need for additional revenue.

In an attempt to address the budget crisis, California legislators proposed an unprecedented wealth tax targeting residents with a net worth exceeding $1 billion. The bill calls for an annual 1.5% excise tax on worldwide net assets over $1 billion, which would expand to a 1% tax on wealth over $50 million by 2026.

Wealth Tax Crossroads: For and Against

Opponents argue the wealth tax could drive affluent individuals and businesses from the state, damaging its economy. The tax also faces potential legal challenges regarding its constitutionality and enforcement. Furthermore, the legislations carve-out exempting personally owned real estate could encourage the wealthy to shift assets into property to avoid the tax.

Supporters counter that the tax targets only the ultra-wealthy and helps address income inequality while funding important programs and services. The implications of this tax reach far beyond its revenue potential, stirring debate around the state’s priorities and the consequences, intended or otherwise, of such sweeping policy changes.

Details of the Proposed Wealth Tax in California

In an effort to address California’s sizable budget deficit, estimated to be between $38 to $68 billion, state legislators have proposed imposing an annual excise tax on high-net-worth residents. The tax would apply to Californians with a net worth of $50 million or more, starting at 1% and increasing to 1.5% for those with assets over $1 billion.

The tax is projected to generate $22.5 billion in additional tax revenue for the state over the first three years. However, the implications of this tax reach beyond mere revenue generation, stirring a contentious debate on the state’s fiscal priorities, economic repercussions, and the potential departure of high-net-worth individuals.

Wealth Tax Cuts Across Everything But Residential Real Estate

The proposed wealth tax is a sweeping measure, encompassing both full-time and part-time residents of California. According to the bill, the tax would apply to worldwide assets, including cash, investments, and business interests.

Residential real estate would be exempt, a concession that critics argue primarily benefits wealthy donors and lobbyists. Supporters argue the wealth tax could provide much-needed funding for programs and services that benefit middle- and low-income Californians.

What Constitutes Wealth Under the New Tax Proposal?

Lawmakers designed the bill to encompass a broad range of assets that would be subject to taxation. The tax base includes:

Cash and cash equivalents: Cash, savings, CDs, money market accounts, etc.

Publicly traded securities: Stocks, bonds, mutual funds, ETFs, etc.

Closely held businesses: Ownership interests in private companies, partnerships, LLCs, etc.

Private equity and hedge fund interests: Investments in investment firms and funds

Real estate: Residential and commercial property, land, etc.

Jewelry, art, collectibles, and other valuable personal property

Cryptocurrency: Bitcoin, Ethereum and other digital assets

The bill grants exemptions for average household furnishings, clothing, and vehicles. Additionally, the first $15 million in residential real estate and $3 million in agricultural land would be shielded.

Potential Impact on the Wealthy if Passed

The wealth tax is a sweeping measure, encompassing both full-time and part-time residents of California. Levying a 1.5% excise tax on worldwide net worth exceeding $1 billion, the bill aims to generate substantial revenue to fill the state’s budget deficit.

By 2026, the tax net expands to wealth exceeding $50 million at a 1% yearly rate, with an additional 0.5% tax on assets exceeding $1 billion. The proposed legislation provides exemptions for personally owned real estate, encouraging the wealthy to shift more investments into property.

Arguments for and Against a Wealth Tax in California

Critics argue such a tax may exacerbate California’s precarious financial situation. The risk of driving away high-income residents and businesses could undermine the sustainability of such a tax. California’s increased reliance on its highest earners, with half of tax revenue derived from 1% of the population, yields revenues highly sensitive to economic fluctuations.

While proponents frame a wealth tax as an equitable solution targeting only the super-wealthy, opponents argue it may act as a disincentive for job creators and business leaders to remain in California. The tax coincides with other rate increases, including a wage tax with no income ceiling for certain employees.

Implementation and Enforcement

Questions remain regarding implementation and enforcement. Scrutinizing the net worth and assets of wealthy individuals would require disclosure of sensitive financial records, with privacy concerns and potential legal challenges.

The bill empowers lawyers to pursue perceived underpayment of taxes under the False Claims Act, potentially incentivizing predatory behavior. Valuing certain assets also poses difficulties. The implications of such a tax stir contentious debate regarding fiscal priorities, economic impact, and the sustainability of this approach.

How the Wealth Tax Would Address the Budget Shortfall

To remedy California’s substantial budget deficit, estimated to range from $38 billion to $68 billion, lawmakers have proposed a sweeping wealth tax targeting the state’s affluent residents. The tax aims to generate much-needed revenue to fund government programs and services.

However, the implications of this tax reach beyond mere revenue generation, stirring a contentious debate on the state’s fiscal priorities, economic repercussions, and the potential departure of high-net-worth individuals.

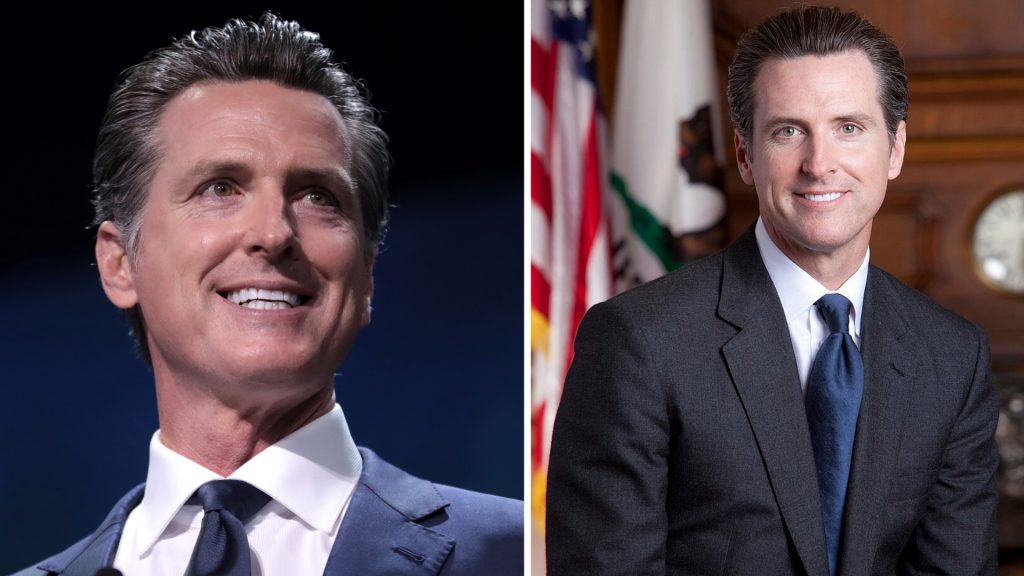

Newsom’s Stance and Fiscal Exigencies

Governor Gavin Newsom has acknowledged California’s substantial budget shortfall, attributed to COVID-19 disruptions, delayed revenue, and high existing tax rates. The state’s increased spending on Medicaid, healthcare for undocumented immigrants, and other programs has contributed to the budget crisis driving the wealth tax proposal.

The potential impacts of this controversial and untested measure remain to be seen. California’s consideration of a wealth tax in the face of gaping budget deficits highlights the complex interplay between raising revenue, incentivizing economic growth, and the risk of unintended consequences.

Other States Considering Similar Wealth Taxes

Several other states are contemplating wealth tax proposals similar to California’s. New York and New Jersey, also facing substantial budget shortfalls, are evaluating the implications and feasibility of wealth taxes to generate much-needed revenue.

Proponents argue that wealth taxes could provide states with a steady income stream to fund essential services and balance budgets. However, critics point out the risks of driving away affluent residents and discouraging business investment. The complex legal and practical challenges of valuing assets and ensuring compliance present additional obstacles.

California Is Hoping To Learn from Other’s Successes and Failures

New York State Assemblyman Phil Steck has proposed an annual wealth tax starting at 0.5% on net worth over $1 billion that could raise an estimated $23.3 billion in 2023. However, New York Governor Andrew Cuomo has expressed reservations, citing the difficulty of valuation and risks to New York’s economy

In New Jersey, two Democratic lawmakers proposed a wealth tax in 2020 on net worth above $1 billion to fund schools, transit, and property tax relief. The bill aims to tax assets like stocks, bonds, real estate, and art at a rate of 1% up to $5 billion. However, New Jersey’s relatively high taxes have already contributed to an exodus of residents in recent years, raising concerns about the impact of additional levies.

What Happens Next – Will the Wealth Tax Pass?

The controversial wealth tax proposal faces an uncertain future in California’s legislature. According to critics, the bill may exacerbate the state’s financial troubles and budget deficit by driving away wealthy residents and businesses. However, proponents argue it could generate substantial revenue to fund government programs and services.

The passage of the wealth tax is uncertain, given the potential unintended economic consequences, legal issues, and Newsom’s opposition. The revenue from the tax depends on the state’s ability to value assets and enforce compliance for residents’ worldwide holdings. The costs required to implement the tax may reduce or negate the projected revenue gains.

What Caused The Deficit in The First Place?

California’s budget deficit results from various factors, including policy decisions to expand healthcare to undocumented immigrants, minimum wage increases, and higher public employee salaries. The state’s spending has doubled over the past decade, straining resources.

California’s precarious financial situation and overreliance on income taxes from high earners underscore the need for sustainable solutions to balance the budget in a prudent, ethical manner without jeopardizing economic prosperity.

There is More To it Than Money.

As California grapples with significant budget shortfalls, a wealth tax seems an easy solution to raise much-needed revenue. However, the exodus of high-net-worth residents in response demonstrates why such desperate fiscal measures often fail to be implemented. Rather than quick fixes, California needs structural reforms that expand its tax base, control spending, and promote economic growth.

Leadership must balance short-term gaps with long-term fiscal health. There are no easy answers, but a wealth tax appears more likely to accelerate decline than reverse it. California’s policymakers face hard choices, but they must chart a sustainable path that works for all residents, not just the wealthy few.