Working minimum wage jobs are hard enough as it is. With many states aiming to raise the minimum wage to $16/hour in the coming year, is this sufficient for workers to have a living wage? Let’s look at the current state of minimum wage and whether these changes will bring a consistent standard of living for employees.

Minimum Wage Increases Scheduled for January

Twenty-two states are set to increase their minimum wage on January 1st, 2024. Later in the year, three more states also intend to increase their minimum wages. The increases range significantly, between 23 cents and $2. With these significant changes, minimum wage earners might see a major uptick in their salaries.

Aside from state increases, several metropolitan areas and counties will increase minimum hourly rates for workers within their boundaries. Fast-food workers in California may even be looking at an increase of up to $20 an hour after legislation was passed to allow the change late last year.

A Rising Tide Lifts All Boats?

Estimates put the number of workers in the system that will benefit from these minimum wage increases at around 9.9 million. Even those who aren’t directly affected by the minimum wage increase will see some change to their monthly paychecks. However, this is only true within those states that are increasing their rates.

The minimum wage will remain where it has been in approximately twenty states over the last few years. The mandated federal minimum wage of $7.25 per hour hasn’t increased since 2009. According to some sources, as many as three million workers earned less than $10 per hour in October 2023.

Cost Of Living Matters

Washington State’s new mandated minimum wage is $16.28 per hour. Yet, in other states, such as West Virginia, the minimum wage remains at $8.75 per hour. Why is there such a vast difference between these wages, given that they all belong to the same country?

The most convincing argument is that there are significant differences in the cost of living in different states. Washington State has pegged its minimum wage increases to keep pace with the cost of living there. Unfortunately, this might not be enough to guarantee a living wage.

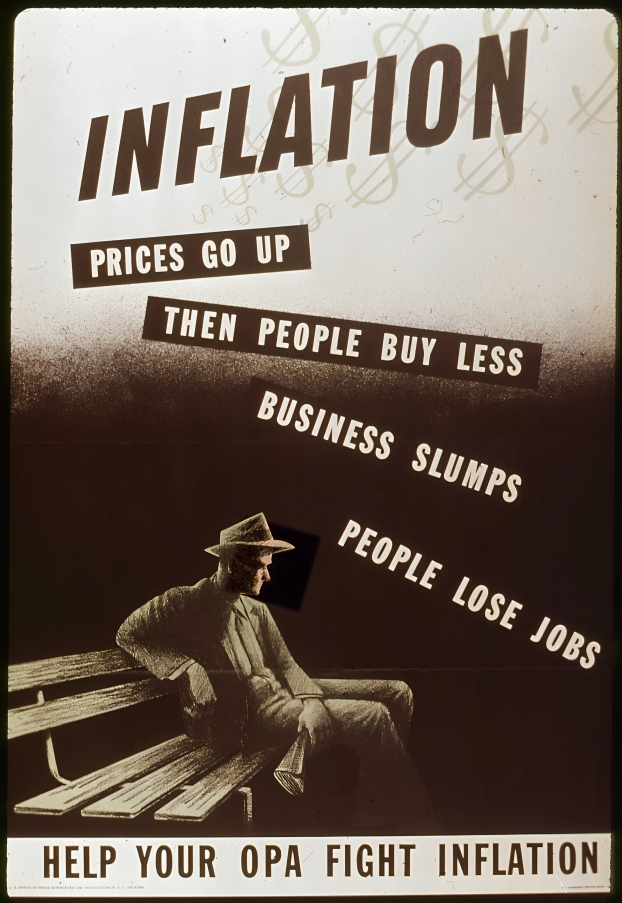

Inflation Strikes From the Shadows

The US inflation rate at the end of November was around 3.2%. However, between 2021 and 2023, the inflation rate rose to a massive 13%. As some experts have pointed out, even with the peg to the cost of living in certain states, inflation is already making those paychecks thin on the ground.

While the 2024 pay increases may demonstrate a significant amount of added income to workers, they may not be enough to stave off the rising tide of inflation. Some experts suggest that a $20 per hour minimum wage is a livable wage.

How Does Minimum Wage Impact Inflation?

Scientifically, economists are divided on the issue. Most of them believe that increasing the minimum wage will have a corresponding increase in inflation. However, empirical evidence shows that raising the minimum wage may not actually affect the inflation rate.

However, there’s a stat at play that doesn’t get much notice. As minimum wages increase, businesses cut expenditures to be leaner. This means that many workers who would have been employed at the lower minimum wage are instead sent home. It’s a no-win situation for those at the bottom of the earnings ladder.

The Choice Between Making Ends Meet and Having a Job

As minimum wage rises happen across the US, there will be a corresponding increase in unemployment. Those who remain employed might see their hours cut, and the increase may not even affect their take-home pay at the end of the month.

The reality of the situation is that a livable wage is an excellent political tool, but it’s also not a viable long-term position for a business. As wages increase, companies will cut back on their spending, leading to a negative feedback loop as fewer people buy products and less labor is needed to make those products.

The Labor Market Is Cooling Off

The post-pandemic world saw a surge in jobs, especially minimum-wage employment. With most positions vacated because of the pandemic, there was a surge in demand for employees and a rise in the wages offered as a result. Businesses needed these workers and offered a lot of benefits for them.

In many cases, employees saw their wages shoot up. Walmart raised its employee wages from $12 to $14 an hour to bring in more potential hires in a tight labor market. Amazon, Target, and Best Buy have also raised their lowest wages to $15 per hour – far better than many minimum wage requirements.

Why All The Increases?

As any economist will tell you, the supply and demand curve applies to everything, including labor. In a tight labor market, fewer people are willing to work for lower wages. As a result, businesses have to change their rates to attract more workers. Even unskilled workers benefit from this increase.

However, what goes up must come down. As more workers enter the job market looking for these jobs, the amount of labor surges. This means that the market shifts in favor of the employers as opposed to the employees. Eventually, this may result in less employment as employers fill their available slots.

The Pendulum Of The Market

Employment usually swings between better rates for employees and more labor for employers. As labor increases, wages tend to decrease and vice versa. Minimum wage legislation is supposed to ensure that even the earners at the bottom of the wage ladder can afford to live.

However, while it sounds good in theory, it rarely works in practice. Many economists see the minimum wage as installing an artificial floor in the wage market. They suggest that employers and employees would work out what work is worth without a minimum wage. This might not work out as elegantly as economists think.

More Money Doesn’t Mean Better Living

While the increases in minimum wage are something to look forward to, they should be taken with a grain of salt. Sure, employees (those who remain employed, anyway) will get more money, but will their purchasing power increase as a result? Chances are it won’t.

As inflation continues to rise and the economy contracts, more money for the lowest earners won’t mean a better quality of living. It may just mean an extra buffer between employment and going broke. This increase may not solve anything, but it’s necessary to ensure people can afford to live in a collapsing economy.